When it comes to finances, we often think about how to get more money. However, not enough people focus on how to keep from having less money. Money problems are one of the leading causes of bankruptcy as well as stress and anxiety in general. According to recent research, around 46% of people will experience a financial crisis in their lifetime.

These stats show that most people do not have a firm grasp on their personal finance and are prone to falling into debt or insolvency at some point in their lives. Knowing your limits and staying within them is the best way to prevent insolvency and its associated problems. This blog post will give you tips on how you can prevent insolvency and manage your money better.

Plan for Financial Emergencies

Emergencies happen and it’s good to have a plan in place for them, but you also need to plan for the everyday financial pressures that occur in life. Having extra money on hand is a great way to prevent insolvency. Make an effort to put a little bit of money away each month. You can also set up an account where you regularly transfer a set amount of money that is earmarked as savings.

Set a goal for how much you would like to have saved. Having adequate funds in your savings account will help you avoid taking out a loan, which can lead to significant debt over time.

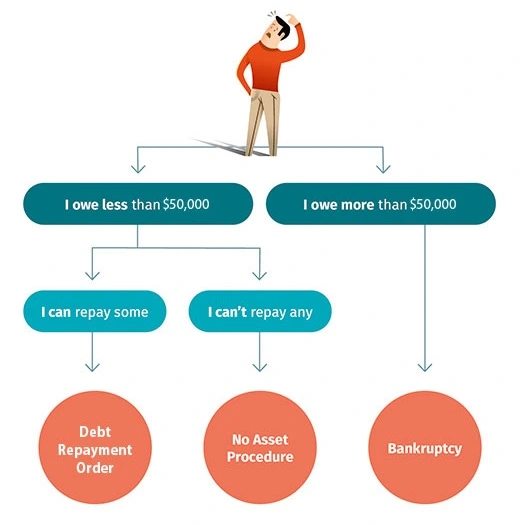

Photo Credit: https://www.insolvency.govt.nz/assets/Images/Diagrams/image-Your-Insolvency-Options-illustration-v2.jpg

Estimate Your Income and Expenses

Knowing where your money is going is the first step towards keeping it where it belongs — in your pocket. Keep a record of your income and expenses for a few months. This will provide you with a clear picture of where your money is coming from and how much of it goes towards your regular expenses.

Once you know where your money is going, it will be easier to start saving for what matters most to you. Now that you know how much money you have coming in and going out, you can make adjustments to your budget to account for higher-than-normal expenses that might come up. This will help you to avoid taking out a loan to pay for unexpected bills.

Track Your Spending

Another great way to keep track of your spending is to use a budgeting app. This will make it easier to track your expenses and transfer the data you record into a document to help you estimate your expenses more accurately. Budgeting apps are easy to use and can help you to take control of your finances even if you haven’t been keeping track of your expenses before.

Although keeping track of your spending is important, don’t let it become an obsession. We all have certain spending habits and it can be helpful to know what your tendencies are when it comes to money. However, don’t allow yourself to become so focused on your spending that you miss out on the joys of life and forget to enjoy the present.

Stop Incurring Credit Card Debt

Credit card debt is one of the biggest causes of insolvency. It often happens because people do not realize how quickly they are accumulating debt. A credit card may seem like a harmless way to get yourself out of a tight spot, but it can quickly lead to a debt that’s almost impossible to escape from.

Before you know it, one small debt can spiral into something much bigger. If you can’t pay off your credit card balance each month, then you’ll end up paying a lot more than you bargained for. One of the best ways to prevent credit card debt is to use cash for your regular purchases instead of using your credit card.

This will make it easier to track how quickly your debt is growing and stay on top of it. Using cash for regular purchases will also make it easier to budget for what you actually have coming in each month.

Set financial goals

How do you know if you’re on the right track towards financial stability? Set financial goals so that you can track your progress and get a better idea of where you stand in terms of your finances. These goals can be anything that is important to you and that relates to your financial situation.

For example, you may want to pay off your credit card debt as quickly as possible or put away a certain amount of money each month towards retirement. Having financial goals will help you to stay focused and motivated when it comes to your finances.

Don’t rely on only one source of income

Having only one source of income is risky and could put you at risk of insolvency if something happens to that particular income stream. One way to prevent this is to open a side hustle as a way to bring in extra cash. This could be anything from selling items you no longer need to freelance work.

Another option would be to start working towards a second job. However, before you start looking for another job, make sure that you are taking advantage of all the benefits you can receive from your current job. You may be able to receive benefits such as a reduction in your health insurance costs or a lower rate of taxes by applying for a loan.

Pay Off Debt and Avoid New Loans

If you are in debt, the best thing to do is to pay it off as quickly as possible. This will prevent you from having to pay a lot of extra money in interest and keep you from insolvency. If you can’t afford to pay off your debt in a short period of time, then you need to make a plan to do so and stick to it. You can make a budget that accounts for your monthly debt payments and stick to it.

However, don’t let your debt prevent you from making important investments in your future. For example, if you need to go back to school in order to advance your career, you may want to consider taking out a student loan. This can be a good idea as long as you have a plan to pay the loan off as quickly as possible.

Take care of the important stuff

Make sure you are taking care of the important stuff, such as making sure your car is running smoothly, your house is maintained, and you have health insurance. This can be done by setting up a budget for necessary expenses, like car repairs and insurance, and making sure that you stick to it.

These kinds of expenses often get overlooked and pushed off to the side. However, they are important and need to be accounted for in your budget.

Conclusion

When it comes to finances, the best way to keep from having less money is to prevent it from happening in the first place. This means taking care of your money by managing it, tracking it, and planning for financial emergencies.

It also means not relying on only one source of income, paying off debt, and taking care of the important stuff. Everyone has money problems from time to time, but by following these tips, you can avoid major money problems and keep from having less money.

188 thoughts on “How to Prevent Insolvency: Tips on Budgeting and Managing Your Money”

[…] comprehensive budget categories consist of several components, including income, expenses, savings, and […]

… [Trackback]

[…] There you can find 31744 additional Info to that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] Info on that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] Read More Info here on that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] Read More Info here on that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] Read More on that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] There you will find 57872 additional Information on that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] Find More Information here on that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] Find More here on that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] Find More here to that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] Find More on that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] Read More on to that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] Read More Info here on that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] Find More on on that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] Info on that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] Read More to that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] Read More on that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] There you will find 63398 additional Information on that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] Find More on that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] There you will find 81041 more Information to that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] Info to that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] Info on that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] Find More on that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] Read More on that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] Here you can find 66374 additional Information on that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] Find More Information here to that Topic: skillfine.com/how-to-prevent-insolvency/ […]

… [Trackback]

[…] Read More Information here on that Topic: skillfine.com/how-to-prevent-insolvency/ […]

Very nice post. I just stumbled upon your blog and wanted to say that I’ve really enjoyed browsing your blog posts. In any case I’ll be subscribing to your feed and I hope you write again soon!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

It’s perfect time to make some plans for the future and it is time to be happy.

I have read this post and if I could I wish to suggest you some interesting

things or advice. Perhaps you could write next articles referring to this article.

I want to read even more things about it!

Hey! This is my first comment here so I just wanted to give a

quick shout out and say I really enjoy reading through your articles.

Can you recommend any other blogs/websites/forums that cover the

same subjects? Thanks!

Howdy! I know this is somewhat off topic but I was wondering if you knew where I could locate a

captcha plugin for my comment form? I’m using the same blog platform

as yours and I’m having difficulty finding one?

Thanks a lot!

Hey! This is kind of off topic but I need some help from an established blog.

Is it hard to set up your own blog? I’m not very techincal but

I can figure things out pretty quick. I’m thinking about making my own but

I’m not sure where to start. Do you have any ideas or suggestions?

Appreciate it

Wonderful blog! I found it while surfing around on Yahoo News.

Do you have any suggestions on how to get listed in Yahoo News?

I’ve been trying for a while but I never seem to get there!

Thank you

Hi, after reading this remarkable paragraph i am too happy

to share my know-how here with colleagues.

I’m extremely impressed with your writing skills and also with the layout on your

weblog. Is this a paid theme or did you customize it yourself?

Either way keep up the nice quality writing, it is rare to see a nice blog like

this one today.

My family all the time say that I am wasting my time here at web,

except I know I am getting experience daily by reading

such nice articles or reviews.

Good way of explaining, and good piece of writing to get facts about my

presentation topic, which i am going to deliver in college.

Pretty nice post. I just stumbled upon your blog and wanted to mention that I’ve truly enjoyed surfing around

your blog posts. In any case I will be subscribing in your rss feed and I am

hoping you write again very soon!

Good post. I learn something new and challenging on sites I stumbleupon every day.

It’s always interesting to read articles from other writers and

practice a little something from other websites.

Fine way of telling, and nice piece of writing to take facts concerning my presentation focus, which i am going to convey in school.

Excellent blog here! Also your site rather a lot up very fast!

What host are you the use of? Can I am getting your affiliate hyperlink on your host?

I want my web site loaded up as quickly as yours lol

I’m really impressed with your writing skills as well as with the layout on your weblog.

Is this a paid theme or did you modify it

yourself? Anyway keep up the excellent quality writing, it is rare to see a nice blog like this one these days.

My spouse and I stumbled over here from a different web

page and thought I may as well check things out.

I like what I see so now i’m following you. Look forward

to looking at your web page for a second time.

It’s amazing to go to see this web site and reading the views of all mates concerning this paragraph, while I am also eager of getting familiarity.

Heya i am for the first time here. I came across this board and I in finding It truly helpful & it helped me

out much. I hope to present one thing back and help others such as you helped me.

Do you mind if I quote a couple of your posts as long

as I provide credit and sources back to your website? My

website is in the very same area of interest as yours and my users would definitely benefit from

some of the information you present here. Please let me know if this ok with you.

Many thanks!

Greetings! I’ve been following your weblog for a

long time now and finally got the bravery to go ahead and give you a

shout out from Atascocita Tx! Just wanted to say keep up the good

work!

This is very fascinating, You are a very professional blogger.

I’ve joined your rss feed and look ahead to in quest of extra of your wonderful post.

Additionally, I’ve shared your site in my social networks

Hello! This is my 1st comment here so I just wanted to give a quick shout

out and tell you I truly enjoy reading your posts. Can you suggest any other blogs/websites/forums that deal with the same subjects?

Appreciate it!

Tremendous things here. I’m very satisfied to look your post.

Thank you so much and I’m looking ahead to contact you.

Will you please drop me a mail?

Quality content is the main to invite the users to go to see

the web site, that’s what this site is providing.

We stumbled over here from a different page and thought I might as

well check things out. I like what I see so now

i am following you. Look forward to looking over

your web page for a second time.

Hi! This is kind of off topic but I need some help from

an established blog. Is it hard to set up your own blog?

I’m not very techincal but I can figure things out pretty quick.

I’m thinking about making my own but I’m not sure where to begin.

Do you have any points or suggestions? Cheers

Cool blog! Is your theme custom made or did you download it from somewhere?

A design like yours with a few simple adjustements would

really make my blog shine. Please let me know where you got your theme.

Appreciate it

Aw, this was an incredibly nice post. Finding

the time and actual effort to make a very good article… but what can I

say… I procrastinate a lot and don’t seem to get anything done.

Hey there, I think your website might be having browser compatibility issues.

When I look at your blog site in Safari, it looks fine

but when opening in Internet Explorer, it has some overlapping.

I just wanted to give you a quick heads up! Other then that, amazing blog!

Great web site. A lot of useful information here. I’m sending it to several pals ans also

sharing in delicious. And certainly, thanks on your sweat!

I’m excited to uncover this great site. I wanted to thank you for ones

time due to this fantastic read!! I definitely liked every part of it and I have you book

marked to check out new stuff in your blog.

Woah! I’m really digging the template/theme of

this site. It’s simple, yet effective. A lot of times it’s very difficult to get that “perfect balance”

between superb usability and appearance. I must say that you’ve done a very good job with this.

Also, the blog loads super quick for me

on Firefox. Excellent Blog!

Excellent post. I was checking continuously this blog and I am

impressed! Extremely helpful information specially the last part 🙂 I

care for such info much. I was looking for this particular info

for a long time. Thank you and best of luck.

you’re in reality a excellent webmaster. The website loading pace is

incredible. It seems that you’re doing any unique trick.

Moreover, The contents are masterpiece. you have done a excellent process on this topic!

Hey there! Quick question that’s completely off topic.

Do you know how to make your site mobile friendly?

My blog looks weird when browsing from my iphone 4. I’m trying to find a template or plugin that might be able to correct this problem.

If you have any suggestions, please share. With thanks!

Pretty! This was a really wonderful article. Thank you for providing

this info.

What a information of un-ambiguity and preserveness

of precious know-how regarding unexpected emotions.

If you are going for most excellent contents like I do, just visit this web page every day because it presents quality contents,

thanks

For most recent information you have to pay a quick visit web and on the web I found this web

site as a finest site for most up-to-date updates.

Thanks a bunch for sharing this with all folks you actually recognize what you’re talking approximately!

Bookmarked. Kindly also seek advice from my website =).

We may have a link exchange contract between us

Hi! I just want to offer you a big thumbs up for the great info you have

here on this post. I’ll be coming back to your site

for more soon.

Admiring the commitment you put into your blog and in depth information you offer.

It’s nice to come across a blog every once in a while that isn’t the same outdated rehashed material.

Great read! I’ve saved your site and I’m including your RSS

feeds to my Google account.

I like the helpful information you provide in your

articles. I’ll bookmark your blog and check again here frequently.

I am quite sure I will learn many new stuff right here! Good luck for the next!

Hey I know this is off topic but I was wondering

if you knew of any widgets I could add to my blog that automatically tweet

my newest twitter updates. I’ve been looking for a plug-in like

this for quite some time and was hoping maybe you would have some experience with something like this.

Please let me know if you run into anything.

I truly enjoy reading your blog and I look forward to

your new updates.

Thanks for ones marvelous posting! I certainly

enjoyed reading it, you are a great author.

I will always bookmark your blog and will often come back

later on. I want to encourage that you continue your great work, have a nice

weekend!

Greetings from Los angeles! I’m bored to death at work so I decided to check out your site on my iphone during lunch

break. I really like the information you present here and can’t wait to take a look when I get home.

I’m surprised at how fast your blog loaded on my cell phone ..

I’m not even using WIFI, just 3G .. Anyways, superb site!

Hi there, this weekend is pleasant in favor of me,

as this occasion i am reading this wonderful educational paragraph here at my house.

Hi, i think that i saw you visited my web site thus i came to return the want?.I am trying to to find

things to improve my web site!I assume its ok to make use of a few of your ideas!!

We stumbled over here different website and thought I may

as well check things out. I like what I see so now i’m following you.

Look forward to going over your web page repeatedly.

It’s the best time to make some plans for the

future and it is time to be happy. I’ve read this post and if

I could I desire to suggest you few interesting things or suggestions.

Maybe you can write next articles referring to this article.

I want to read more things about it!

I’m not that much of a online reader to be honest but your blogs

really nice, keep it up! I’ll go ahead and bookmark

your website to come back later on. Cheers

obviously like your web-site but you have to check the spelling on several of your posts.

Several of them are rife with spelling problems

and I to find it very troublesome to tell the reality

nevertheless I will surely come again again.

Hello! I know this is kinda off topic but I was wondering

if you knew where I could locate a captcha plugin for my

comment form? I’m using the same blog platform as yours and I’m having trouble finding one?

Thanks a lot!

Generally I do not read post on blogs, but I would like to

say that this write-up very pressured me to take a look at and do so!

Your writing style has been surprised me. Thank you, quite great article.

This post offers clear idea in favor of the new users of blogging,

that actually how to do running a blog.

Its such as you read my mind! You seem to know so much about this, like you wrote

the e book in it or something. I think that you can do with some % to

force the message house a bit, but instead of that, that is excellent blog.

An excellent read. I will certainly be back.

What’s up, after reading this awesome article i am as well

delighted to share my know-how here with friends.

Hi there, just became alert to your blog through Google, and found that it’s truly informative.

I’m gonna watch out for brussels. I will be

grateful if you continue this in future. Numerous people will be benefited from your writing.

Cheers!

Very good blog post. I definitely love this website.

Thanks!

Excellent blog post. I definitely appreciate this site.

Stick with it!

Appreciate the recommendation. Let me try it out.

My brother suggested I would possibly like this blog.

He was once entirely right. This post truly made my day.

You can not believe just how so much time I had spent for this info!

Thank you!

Very descriptive article, I loved that a lot. Will

there be a part 2?

Very nice post. I just stumbled upon your blog and wanted to mention that I have really enjoyed surfing around your blog posts.

After all I’ll be subscribing in your feed and I am hoping

you write once more soon!

What a data of un-ambiguity and preserveness of valuable experience regarding unexpected emotions.

If some one needs to be updated with hottest technologies afterward he must be pay a

quick visit this website and be up to date everyday.

Hi, I believe your blog might be having web browser compatibility problems.

When I look at your website in Safari, it looks fine however,

when opening in Internet Explorer, it’s got some overlapping issues.

I just wanted to provide you with a quick heads up!

Besides that, great site!

Yes! Finally something about 88BIG.

What a data of un-ambiguity and preserveness of valuable knowledge concerning unexpected feelings.

Because the admin of this site is working, no doubt very quickly it will be well-known,

due to its quality contents.

I am not sure where you are getting your information, but great topic.

I needs to spend some time learning much more or

understanding more. Thanks for wonderful info I was looking for this information for my

mission.

I blog often and I genuinely appreciate your content. This great article has really peaked my interest.

I will book mark your site and keep checking for

new information about once a week. I opted in for your RSS feed as well.

This paragraph is really a pleasant one it helps new internet

people, who are wishing for blogging.

Hi, I do believe this is an excellent web site. I stumbledupon it 😉 I

may return yet again since I saved as a favorite it.

Money and freedom is the greatest way to change,

may you be rich and continue to help other people.

constantly i used to read smaller articles which as well clear their motive, and that is also

happening with this article which I am reading at this place.

I blog quite often and I really thank you for your

information. Your article has really peaked my interest. I am going to bookmark your site and keep

checking for new details about once per week. I opted

in for your Feed too.

Hello to every body, it’s my first pay a quick visit of this weblog; this website contains awesome and in fact excellent data designed for readers.

Thanks to my father who informed me about this website, this webpage is in fact awesome.

Appreciating the persistence you put into your

site and in depth information you offer. It’s awesome to come across a blog every once in a

while that isn’t the same unwanted rehashed information. Great read!

I’ve bookmarked your site and I’m adding your RSS feeds to my Google account.

Howdy! This is kind of off topic but I need some guidance from

an established blog. Is it tough to set

up your own blog? I’m not very techincal but I can figure things out pretty fast.

I’m thinking about creating my own but I’m not sure where to begin. Do you

have any points or suggestions? Thank you

Have you ever considered publishing an e-book or guest

authoring on other blogs? I have a blog centered on the same subjects

you discuss and would love to have you share some stories/information. I know

my visitors would enjoy your work. If you are even remotely interested, feel free

to shoot me an email.

Hello! I just wanted to ask if you ever have any issues with

hackers? My last blog (wordpress) was hacked and I ended

up losing a few months of hard work due to no back up.

Do you have any methods to prevent hackers?

What i don’t realize is in truth how you are now not actually much

more neatly-favored than you might be right now.

You are very intelligent. You know therefore considerably with regards to this topic, produced me personally imagine it from numerous numerous angles.

Its like men and women don’t seem to be interested until it is one thing

to accomplish with Girl gaga! Your individual stuffs nice.

All the time deal with it up!

Attractive section of content. I just stumbled upon your site and in accession capital to assert that I acquire actually enjoyed account your blog posts.

Any way I will be subscribing to your feeds and even I achievement you access consistently quickly.

Thank you for the auspicious writeup. It if truth be told used to be

a leisure account it. Look advanced to more added agreeable from you!

By the way, how can we communicate?

My brother suggested I might like this web site. He was totally right.

This post truly made my day. You cann’t imagine just how

much time I had spent for this information! Thanks!

Wonderful blog! Do you have any tips and hints for aspiring writers?

I’m hoping to start my own site soon but I’m a little lost on everything.

Would you suggest starting with a free platform like Wordpress

or go for a paid option? There are so many options out there that I’m completely confused

.. Any ideas? Appreciate it!

I have read so many articles regarding the blogger lovers however this post is actually a nice piece of writing, keep it up.

Howdy exceptional website! Does running a blog such as this take a great deal of work?

I’ve very little expertise in programming but I had been hoping

to start my own blog in the near future. Anyhow, should you have any

suggestions or techniques for new blog owners please share.

I know this is off subject however I simply wanted

to ask. Many thanks!

You’ve made some really good points there.

I looked on the net to learn more about the issue

and found most people will go along with your

views on this site.

Pretty section of content. I just stumbled upon your website and in accession capital to claim that I get actually enjoyed account your weblog posts.

Anyway I will be subscribing to your augment or even I achievement you get entry to constantly quickly.

It’s really a great and helpful piece of info. I’m satisfied that you simply shared this

helpful info with us. Please keep us up to date like this.

Thank you for sharing.

Greetings from Carolina! I’m bored to tears at work so

I decided to check out your website on my iphone during lunch break.

I love the knowledge you provide here and can’t wait to take a look when I get home.

I’m shocked at how fast your blog loaded on my mobile ..

I’m not even using WIFI, just 3G .. Anyhow, awesome site!

I’m not sure where you’re getting your information, but great topic.

I needs to spend some time learning more or understanding more.

Thanks for great information I was looking for this info for my mission.

Aw, this was an exceptionally good post. Taking a few minutes and actual effort to produce

a good article… but what can I say… I put things off a whole lot and

never manage to get anything done.

Howdy are using Wordpress for your site platform? I’m new to the blog world but I’m trying to get started and set up my own. Do you require

any html coding knowledge to make your own blog?

Any help would be really appreciated!

It’s great that you are getting thoughts from this article as well as from our

dialogue made at this time.

Hmm is anyone else experiencing problems with the pictures on this blog loading?

I’m trying to determine if its a problem on my end or if it’s the blog.

Any suggestions would be greatly appreciated.

Hello, Neat post. There’s a problem together with your site in internet explorer, would check this?

IE still is the market chief and a huge element of other folks will

pass over your wonderful writing because of this problem.

I am really inspired along with your writing abilities and also with the structure for your weblog.

Is this a paid topic or did you modify it

yourself? Anyway keep up the nice quality writing, it is rare

to see a nice blog like this one today..

I think this is one of the most important information for me.

And i am glad reading your article. But should remark on some

general things, The website style is ideal, the articles is really excellent : D.

Good job, cheers

Hey I know this is off topic but I was wondering if you knew of

any widgets I could add to my blog that automatically tweet my newest twitter updates.

I’ve been looking for a plug-in like this for quite some time

and was hoping maybe you would have some experience with something like this.

Please let me know if you run into anything. I truly enjoy reading your blog and I look forward to your new

updates.

Attractive section of content. I just stumbled upon your web site and in accession capital to assert that I get in fact enjoyed account your blog posts.

Any way I will be subscribing to your feeds and even I achievement you access consistently quickly.

Howdy just wanted to give you a brief heads up and let you know a few of the pictures aren’t loading properly.

I’m not sure why but I think its a linking issue. I’ve tried

it in two different web browsers and both show the same results.

Wow that was unusual. I just wrote an really long comment but after

I clicked submit my comment didn’t show up. Grrrr… well I’m not writing all that over again. Anyhow,

just wanted to say wonderful blog!

Hi there to every , as I am genuinely eager of reading this webpage’s post to be updated daily.

It consists of fastidious data.

Hello it’s me, I am also visiting this web site on a regular basis, this web site is in fact pleasant and

the people are in fact sharing fastidious thoughts.

Today, I went to the beach with my kids. I found a sea shell and

gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She

put the shell to her ear and screamed. There was a hermit crab inside and it pinched her ear.

She never wants to go back! LoL I know this is entirely off topic but I had to tell someone!

Pretty portion of content. I just stumbled upon your

website and in accession capital to assert that I get in fact enjoyed account your weblog posts.

Anyway I’ll be subscribing on your augment or even I fulfillment you get entry to consistently fast.

Superb blog! Do you have any helpful hints for aspiring writers? I’m hoping to start my own blog soon but I’m a little lost on everything. Would you propose starting with a free platform like Wordpress or go for a paid option? There are so many choices out there that I’m totally confused .. Any suggestions? Kudos!

Spot on with this write-up, I actually think this website

needs a great deal more attention. I’ll probably be returning to

see more, thanks for the information!

My brother suggested I might like this website.

He was entirely right. This post truly made my day. You

cann’t imagine simply how much time I had spent for this information! Thanks!

It’s a shame you don’t have a donate button! I’d

most certainly donate to this excellent blog! I suppose for now

i’ll settle for bookmarking and adding your RSS feed to

my Google account. I look forward to brand new updates and will share

this website with my Facebook group. Talk soon!

It is appropriate time to make some plans for the future

and it’s time to be happy. I’ve read this

post and if I could I wish to suggest you some interesting things or advice.

Maybe you could write next articles referring to this

article. I want to read even more things about it!

Thank you for another wonderful post. The place else may

just anybody get that kind of info in such a perfect manner of writing?

I have a presentation subsequent week, and I’m at the look for such info.

Good respond in return of this query with solid arguments and explaining everything concerning that.

I’ll right away grasp your rss feed as I can’t in finding your e-mail subscription link or e-newsletter service.

Do you’ve any? Kindly permit me recognise in order that I could subscribe.

Thanks.

You have made some really good points there. I checked on the net to

learn more about the issue and found most people will go

along with your views on this website.

Woah! I’m really digging the template/theme of this blog.

It’s simple, yet effective. A lot of times it’s very hard

to get that “perfect balance” between superb usability and visual appeal.

I must say that you’ve done a very good job with this. Also, the blog

loads extremely fast for me on Internet explorer.

Outstanding Blog!

It’s hard to find well-informed people on this topic, but you seem like you know what you’re talking

about! Thanks

Way cool! Some very valid points! I appreciate you penning this write-up and also

the rest of the site is also very good.

Good post. I am going through some of these issues as well..

It’s an amazing article for all the web viewers; they

will get advantage from it I am sure.

What’s up, I wish for to subscribe for this web site to get

most recent updates, so where can i do it please help.

Awesome blog! Do you have any tips for aspiring writers?

I’m planning to start my own site soon but I’m a little lost on everything.

Would you propose starting with a free platform like Wordpress or go for a paid option? There are so many

choices out there that I’m completely confused ..

Any suggestions? Kudos!

It’s really a nice and helpful piece of info. I’m happy that

you just shared this useful information with us.

Please keep us up to date like this. Thank you for sharing.

I do consider all the ideas you’ve presented to your post.

They are really convincing and can definitely work.

Still, the posts are too short for novices. May just you please extend them a little from next time?

Thanks for the post.

After I originally commented I seem to have clicked on the -Notify

me when new comments are added- checkbox and from now on whenever a comment is added I receive 4

emails with the exact same comment. Is there an easy method

you can remove me from that service? Cheers!

This is really interesting, You’re a very skilled

blogger. I have joined your feed and look forward to seeking more of your excellent post.

Also, I’ve shared your site in my social networks!

Thanks , I’ve just been searching for info about this topic for a long time and yours is the best I have came upon so far.

But, what in regards to the conclusion? Are you certain in regards

to the source?

Greetings, I think your website might be having

browser compatibility problems. Whenever I look at your web site in Safari, it looks fine however,

if opening in I.E., it’s got some overlapping issues.

I just wanted to give you a quick heads up! Besides that,

wonderful website!

I like the helpful information you provide in your articles.

I’ll bookmark your weblog and check again right

here frequently. I am reasonably sure I’ll be told many new stuff right right here!

Best of luck for the next!

What’s up to all, the contents present at

this web site are genuinely amazing for people experience,

well, keep up the nice work fellows.

Hello, Neat post. There’s an issue together with your web

site in internet explorer, might test this? IE still is

the marketplace chief and a large section of other people

will miss your great writing due to this problem.

Nice blog right here! Additionally your site rather a lot up very fast!

What web host are you the usage of? Can I am getting your associate link to your

host? I desire my web site loaded up as quickly as

yours lol

Thanks for any other informative website. The place else could I

am getting that type of info written in such an ideal manner?

I have a mission that I am just now operating on, and I’ve been at the look out for such

info.

Can I simply just say what a relief to discover somebody that truly understands what they are discussing on the

internet. You definitely realize how to bring an issue to light and make it important.

A lot more people need to look at this and understand this side of the story.

I can’t believe you are not more popular since you definitely

have the gift.

Hello! I could have sworn I’ve been to this blog before but

after browsing through some of the post I realized it’s new to me.

Anyhow, I’m definitely delighted I found it and I’ll be book-marking and checking back often!

I enjoy reading through an article that will make people think.

Also, thank you for allowing for me to comment!

Good article. I definitely appreciate this website.

Keep it up!

Thanks for sharing such a pleasant thinking, paragraph is pleasant,

thats why i have read it fully

Keep this going please, great job!

Wow that was strange. I just wrote an very long comment

but after I clicked submit my comment didn’t show up.

Grrrr… well I’m not writing all that over again. Anyhow, just wanted

to say excellent blog!

What’s Happening i am new to this, I stumbled upon this I have found

It absolutely useful and it has helped me out loads. I hope to give a contribution &

help other users like its aided me. Good job.

Just want to say your article is as astounding. The clearness in your publish is simply great and that i can think you are an expert on this subject.

Fine with your permission let me to snatch your feed to keep up to date with

forthcoming post. Thank you 1,000,000 and please carry

on the rewarding work.

Hello to every , because I am really eager of reading this webpage’s post to be updated regularly.

It includes pleasant information.

Very nice post. I just stumbled upon your weblog and wanted to say that

I have truly enjoyed surfing around your blog posts. In any

case I’ll be subscribing to your feed and I hope you write again soon!

Hello there! This post could not be written any better!

Reading through this post reminds me of my good old room mate!

He always kept chatting about this. I will forward this page to him.

Fairly certain he will have a good read. Thanks for sharing!

I’ve been browsing online more than three hours today, but

I never found any attention-grabbing article like yours.

It’s beautiful price sufficient for me. Personally, if all webmasters and bloggers made

just right content material as you probably did, the

net will probably be a lot more useful than ever before.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

114781 543933There couple of fascinating points at some point in this posting but I dont determine if these people center to heart. There is some validity but Let me take hold opinion until I check into it further. Great write-up , thanks and then we want more! Combined with FeedBurner in addition 417158

806671 772101Hello, Neat post. There is an concern along along with your web site in internet explorer, could test thisK IE still may be the marketplace leader and a huge portion of other people will miss your magnificent writing because of this issue. 865676

343142 897714Yay google is my world beater assisted me to locate this excellent web site ! . 955313

509130 857488Hello! I just would like to give a huge thumbs up for the fantastic information youve here on this post. I may possibly be coming back to your weblog for more soon. 653065

943999 535553Wow What wonderful info. Thank you for the time you spent on this post. 378456

First off I want to say fantastic blog! I had a quick question in which I’d like to ask if you do not mind.

I was interested to know how you center yourself and clear

your thoughts before writing. I’ve had difficulty clearing

my thoughts in getting my thoughts out. I truly do enjoy writing however it just seems

like the first 10 to 15 minutes are generally lost simply just trying to figure out how to begin. Any recommendations or tips?

Kudos!

Excellent blog here! Also your web site loads up very fast!

What host are you using? Can I get your affiliate link to

your host? I wish my site loaded up as fast as yours lol

With havin so much content and articles do you ever run into any problems of plagorism or copyright infringement? My website has a lot of completely unique content I’ve either created myself or outsourced but it looks like a lot of it is popping it up all over the internet without my authorization. Do you know any techniques to help stop content from being ripped off? I’d definitely appreciate it.