In business, it’s important to track your numbers so that you know when you’re making a profit and when you’re losing money. The break even point is the quantity of units of product or services that must be sold in order for the company to neither lose nor gain money. It is also known as the point of neutral cash flow, since at this point, the cash coming in from sales equals the costs going out for production and selling. In other words, how many units of a product can we sell to break even? This article breaks down everything you need to know about calculating breakeven point as an entrepreneur. Read on to get started right away!

What is the Break Even Point?

The break even point is the point at which sales of goods or services exactly equal the costs of producing and selling those goods. In this scenario, the business neither makes a profit nor incurs a loss. The breakeven point provides a measure of risk in business operations. For example, a business may want to establish a minimum acceptable level of sales that should be achieved each month.

If sales for the month are expected to be below the breakeven point, the business will incur a loss for the month. The breakeven point can be expressed as the number of units sold or the amount of sales required to cover production costs. The amount of money that needs to be generated in order for a company to “break even” is calculated using this formula: COGS / (1-Revenue %). This formula divides the combined costs of materials and labor by the amount of sales needed to cover those costs. The result is the number of units that need to be sold to break even.

Finding your breakeven point

The first step in calculating the breakeven point is finding your cost of goods sold (COGS). COGS is the cost of the materials that go into creating your product. If you’re selling a product, this will be the cost of the raw materials used and the cost of labor associated with producing the product.

If you’re providing a service, the COGS will be the cost of labor plus any overhead costs associated with operating your business (electricity, rent, etc.). If you are calculating the break-even point for a service-based business, you may need to estimate the number of hours needed to complete each project and your hourly rate.

Next, divide the COGS by the expected percentage of sales you’ll receive from each sale. This expected percentage is also known as your gross profit margin. The resulting number is the number of units you need to sell to break even.

How to Calculate Breakeven Point

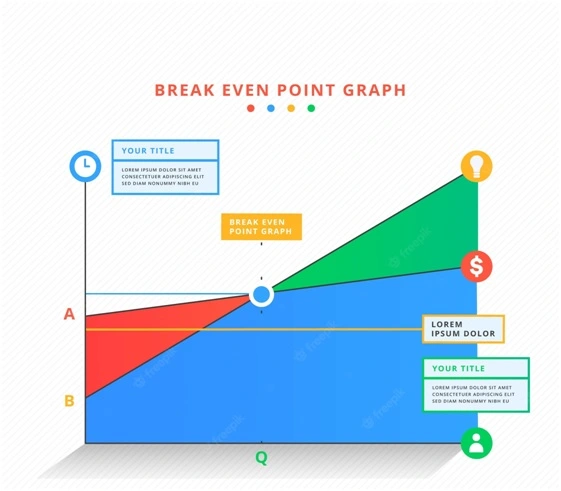

The break-even point is the sales volume at which profit is zero. It is calculated as the total fixed costs divided by the contribution margin. The contribution margin is the difference between the selling price and the variable costs per unit. The break-even point can also be calculated as the fixed costs divided by the difference between the unit sales volume and the break-even quantity.

The break-even quantity is the number of units of the product that must be sold to cover the fixed costs. The break-even point can also be calculated as the fixed costs divided by the difference between the unit sales volume and the break-even quantity.

When Should You Care About Breakeven Point?

The breakeven point is an important metric for any type of business, but it’s especially important for startups. If you’re launching a new company, you’ll need this number so that you know how much you need to sell in order to break even. The breakeven point is essential to know because it can help you determine if your business idea is viable.

If you don’t know how many units you need to sell to break even and you’re trying to get funding, you won’t be able to provide investors with an accurate sales projection. This could mean that you won’t be able to secure funding from investors and your business idea could go up in smoke before it even has a chance to take off!

Alternatives to the Breakeven Point Calculation

The breakeven point is the most common way to calculate how many units a business needs to sell in order to break even and stay in the black. But there are other methods to calculate your sales goals as well. The first is the sales target method. This method involves calculating your true fixed costs and then determining how many sales you need to make in order to cover those costs.

However, you should be aware that this method is more subjective than the breakeven point calculation. The sales target method is less accurate because it relies on forecasting of the sales volume and variable costs of the business. The break-rate method is the third method you can use to calculate your sales goals. Using this method, you multiply your break-even point by the gross profit percentage. This will give you the sales targets necessary to make a profit.

Limitations of the Breakeven Point Calculation

Most businesses operate on a profit and loss (P&L) statement where they track their sales and expenses on a monthly basis. The breakeven point is a single metric that provides an overview of the entire business. However, it can be misleading if used to track your progress over time. There are two main limitations to the breakeven point calculation. The first is that it does not account for expenses other than variable costs.

This means that it does not include the cost of interest for any debt or rent for a fixed cost. To calculate accurate sales projections, you’ll need to use additional metrics such as break-rate or sales target. The second limitation of the breakeven point is that it does not account for the time it takes to sell products. For example, if a business expects to sell 100 products but they all need to be made, designed, and then shipped to each customer, the business would not break even until all of the products are sold. This means that the breakeven point is not a good metric for businesses that have high upfront costs.

Key Takeaways

The break even point is the quantity of units of product that must be sold in order for the company to neither lose nor gain money. It is also known as the point of neutral cash flow, since at this point, the cash coming in from sales equals the costs going out for production and selling. The first step in calculating the breakeven point is finding the cost of goods sold (COGS). COGS is the cost of the materials that go into creating your product. If you’re selling a product, this will be the cost of the raw materials used and the cost of labor associated with producing the product.

If you’re providing a service, the COGS will be the cost of labor plus any overhead costs associated with operating your business (electricity, rent, etc.). You can calculate the breakeven point using the breakeven formula, which divides the combined costs of materials and labor by the amount of sales needed to cover those costs. The result is the number of units that need to be sold to break even.

24 thoughts on “How to Calculate the Break-Even Point for Your Business”

… [Trackback]

[…] Read More Info here on that Topic: skillfine.com/how-to-calculate-the-break-even-point-for-your-business/ […]

… [Trackback]

[…] Find More here to that Topic: skillfine.com/how-to-calculate-the-break-even-point-for-your-business/ […]

… [Trackback]

[…] Information on that Topic: skillfine.com/how-to-calculate-the-break-even-point-for-your-business/ […]

… [Trackback]

[…] Find More on on that Topic: skillfine.com/how-to-calculate-the-break-even-point-for-your-business/ […]

… [Trackback]

[…] Read More Information here on that Topic: skillfine.com/how-to-calculate-the-break-even-point-for-your-business/ […]

… [Trackback]

[…] Information on that Topic: skillfine.com/how-to-calculate-the-break-even-point-for-your-business/ […]

… [Trackback]

[…] Find More to that Topic: skillfine.com/how-to-calculate-the-break-even-point-for-your-business/ […]

… [Trackback]

[…] Read More here to that Topic: skillfine.com/how-to-calculate-the-break-even-point-for-your-business/ […]

… [Trackback]

[…] Info on that Topic: skillfine.com/how-to-calculate-the-break-even-point-for-your-business/ […]

… [Trackback]

[…] Read More Information here to that Topic: skillfine.com/how-to-calculate-the-break-even-point-for-your-business/ […]

… [Trackback]

[…] Find More Information here on that Topic: skillfine.com/how-to-calculate-the-break-even-point-for-your-business/ […]

… [Trackback]

[…] There you can find 20237 more Info on that Topic: skillfine.com/how-to-calculate-the-break-even-point-for-your-business/ […]

… [Trackback]

[…] Here you can find 19142 more Information on that Topic: skillfine.com/how-to-calculate-the-break-even-point-for-your-business/ […]

… [Trackback]

[…] Find More to that Topic: skillfine.com/how-to-calculate-the-break-even-point-for-your-business/ […]

… [Trackback]

[…] Find More Information here on that Topic: skillfine.com/how-to-calculate-the-break-even-point-for-your-business/ […]

… [Trackback]

[…] Info on that Topic: skillfine.com/how-to-calculate-the-break-even-point-for-your-business/ […]

… [Trackback]

[…] Read More here to that Topic: skillfine.com/how-to-calculate-the-break-even-point-for-your-business/ […]

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

901805 238505You made some respectable points there. I looked on the internet for the problem and located a lot of people will go along with together with your site. 564466

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.