INTRODUCTION

Staying ahead in today’s competitive business environment requires constant innovation and strategic growth. One of the most effective financial tools for achieving these goals are the financing leases. This powerful arrangement enables companies to acquire essential assets without the strain of a large upfront cost. Picture the ability to expand your operations, invest in cutting-edge technology, or enhance your product offerings, all while maintaining healthy cash flow. This is the transformative potential of financing leases. This article provides a detailed overview of financing leases, their benefits, accounting treatment, and how they differ from other leases.

WHAT ARE FINANCING LEASES?

A financing lease, also referred to as a capital lease, differs from an operating lease because it essentially serves as a method for a company to finance the purchase of an asset. A finance lease, also known as a capital lease, is a type of lease agreement in which the lessee (the party leasing the asset) obtains significant control over the asset for most of its useful life, and the risks and rewards of ownership are transferred from the lessor (the owner of the asset) to the lessee.

Under a finance lease, the lessee records the leased asset on their balance sheet as if they own it, along with a corresponding liability for the lease payments. The lease is typically non-cancellable and often includes an option for the lessee to purchase the asset at the end of the lease term.

KEY FEATURES OF FINANCING LEASES

Several defining characteristics make financing leases an attractive option for businesses:

- Ownership Transfer: In many cases, the asset’s ownership transfers to the lessee at the end of the lease term. This can happen automatically or through a bargain purchase option, where the lessee can buy the asset at a reduced price.

- Extended Lease Terms: Financing leases typically cover most of the asset’s useful life, ensuring that the lessee has long-term access to the asset. This arrangement often requires the lessee to handle maintenance and insurance, similar to owning the asset outright.

- Cost Allocation: The total amount of lease payments typically equals or exceeds the asset’s fair market value. This effectively allows the lessee to finance the asset through periodic payments, much like a loan.

- Risk and Reward: The lessee assumes most of the risks and rewards associated with ownership, including responsibility for any wear and tear, as well as the potential for asset obsolescence.

PRACTICAL EXAMPLES

- Aircraft: Airlines often lease aircraft, allowing them to use the planes throughout their operational life while making regular payments and assuming maintenance and insurance responsibilities.

- Heavy Construction Equipment: Construction companies lease expensive machinery like excavators and cranes, enabling them to use these essential tools over long-term projects while spreading the cost.

- Server Infrastructure: Technology companies lease high-performance servers and networking equipment, allowing them to manage significant data center needs without an upfront purchase.

- Vehicles for Fleets: Delivery companies lease vehicles like trucks and vans for their operations, maintaining the vehicles and recording them as assets on their balance sheets.

- Retail Store Fixtures: Retailers lease fixtures such as shelving and display units, using them in their stores while spreading the cost over several years.

FINANCE LEASE VS OPERATING LEASE

Here’s a detailed comparison between operating leases and capital leases (also known as finance leases) under US GAAP, presented in a tabular format:

| Feature | Operating Lease | Finance Lease (Capital Lease) |

| Definition | A lease in which the lessor retains ownership and associated risks of the asset. The lessee uses the asset for a specified period. | A lease that effectively transfers most of the risks and rewards of ownership to the lessee. The lessee has the option to purchase the asset or automatically gain ownership at the lease end. |

| Ownership | Ownership remains with the lessor. | Ownership transfers to the lessee either during or at the end of the lease term. |

| Lease Term | Typically shorter, often less than the useful life of the asset. | Generally covers most or all of the useful life of the asset. |

| Balance Sheet Treatment (ASC 842) | Both right-of-use asset and lease liability are recognized on the balance sheet for leases longer than 12 months. | Right-of-use assets and lease liability are recognized on the balance sheet. |

| Lease Expense | Lease payments are expensed on a straight-line basis over the lease term. | Lease payments are split into interest expense and amortization of the right-of-use asset. |

| Criteria for Classification | If none of the finance lease criteria are met (see below)*. | Meets one or more of the following: 1. Transfer of ownership by end of lease term 2. Bargain purchase option 3. The lease term is 75% or more of the asset’s economic life 4. The present value of lease payments is 90% or more of the asset’s fair value 5. The asset is of a specialized nature with no alternative use to the lessor after the lease ends. |

| Risk and Reward | Retained by the lessor. | Transferred to the lessee. |

| Depreciation | It is not recognized by the lessee. The lessor depreciates the asset. | It is recognized by the lessee, as the asset is treated similarly to owned assets. |

| Maintenance and Insurance | Typically the responsibility of the lessor. | Typically the responsibility of the lessee. |

| End-of-term Options | The asset is returned to the lessor. | Lessee may purchase the asset or continue leasing at a nominal rate. |

| Impact on Financial Ratios | Traditionally, less impact on debt ratios (though ASC 842 now requires balance sheet recognition). | Increases both assets and liabilities, affecting debt ratios. |

*Criteria for Classification of Finance Lease (Under ASC 842)

- Transfer of Ownership: The lease agreement specifies that ownership of the asset transfers to the lessee upon the lease term’s completion.

- Bargain Purchase Option: The lessee in the lease agreement has an option to buy the asset at a price considerably below its anticipated fair market value when the option can be exercised.

- Lease Term: The lease term is for the major part of the remaining economic life of the asset (generally 75% or more).

- Present Value: The present value of the lease payments amounts to at least substantially all of the fair value of the leased asset (generally 90% or more).

- Specialized Nature: The asset is specialized in a way that the lessor anticipates no other viable use for it at the lease term’s conclusion.

These criteria help in determining a finance lease. If none of these criteria is met, then the lease is classified as an operating lease. This classification between finance and operating lease is important as it influences the financial reporting and treatment of the leased asset.

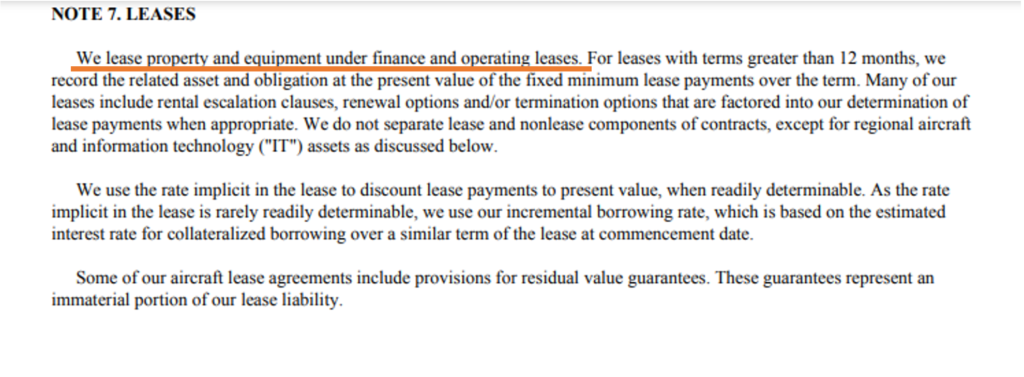

REAL-LIFE EXAMPLE- DELTA AIRLINES

Delta Airlines discloses that it leases property and equipment both under operating and finance leases. Mainly the aircraft is taken by Delta Airlines under both the finance and operating lease arrangement. The company discloses all the important information relating to the leased property and equipment. These disclosures enhance the operating transparency of the company and make it easier for analysts, investors, and financial institutions to compare the costs and benefits involved with companies’ leasing decisions.

Source: Note 7 of Form 10K https://s2.q4cdn.com/181345880/files/doc_financials/2023/q4/02/dal-12-31-2023-10k-2-12-24-filed.pdf

FINANCING LEASES – IMPACT ON THE COMPANY FINANCIALS

A financing lease can have several impacts on a company’s financial statements and overall financial health:

1. Balance Sheet Impact

- Asset Recognition: The leased asset is recorded on the balance sheet as a right-of-use asset or leased asset, increasing the total assets reported.

- Liability Recognition: The related lease liability is listed on the balance sheet, reflecting the company’s obligation to make future lease payments. This increases the company’s total liabilities.

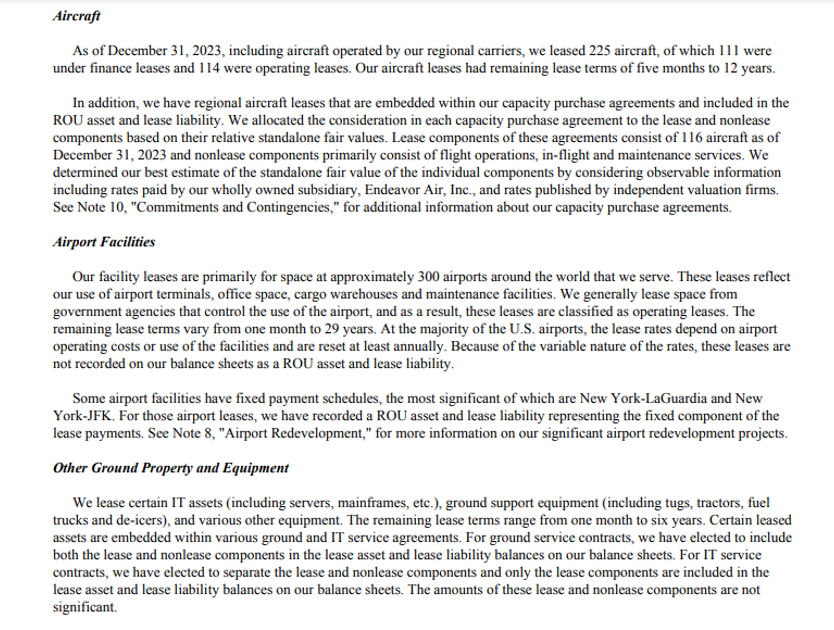

Below is the Balance Sheet position for Lease asset and liability category wise for Delta Airlines.

Source: Annual Report https://s2.q4cdn.com/181345880/files/doc_financials/2023/q4/02/dal-12-31-2023-10k-2-12-24-filed.pdf

From the above disclosure related to the balance sheet amount of finance lease assets and liability of the company, we find that the company has grouped Finance lease assets classified under Non-current assets as property and equipment and finance lease liabilities under Current and Non-current liabilities. The finance lease asset total is $1,338 million while the total finance lease liabilities are $1,444 million. We must note here that the amounts for finance lease assets and finance lease liabilities on a company’s balance sheet may differ slightly due to several reasons related to the accounting treatment of these items under the relevant accounting standards, such as IFRS 16 or ASC 842. Understanding these factors helps in accurately interpreting a company’s balance sheet and financial health.

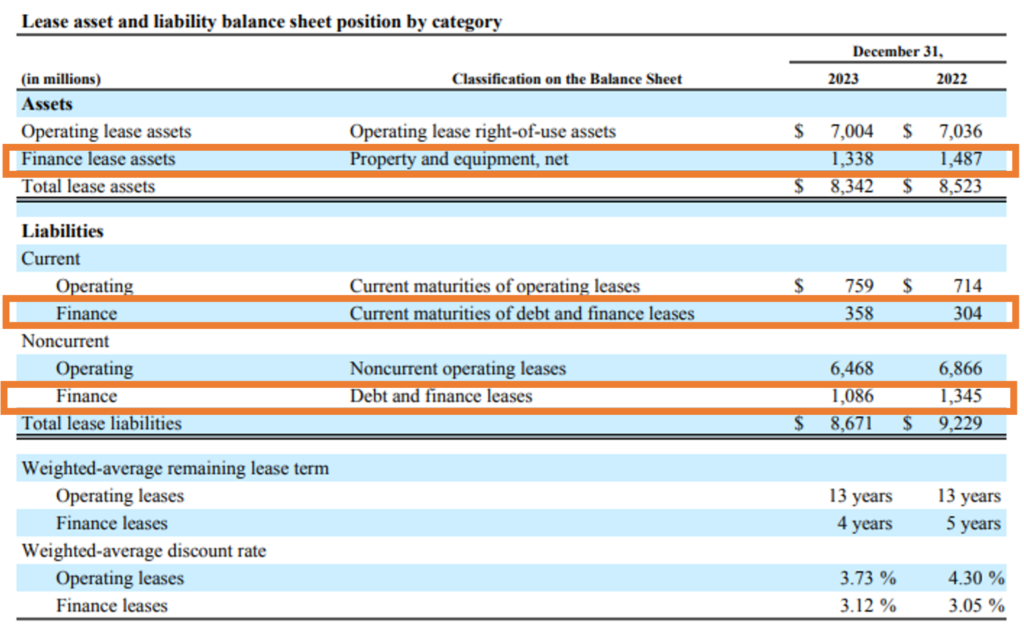

In the case of Delta Airlines Finance lease amounts to $1,338 million in the year 2023. The finance lease is classified in the Balance Sheet of the company as a Noncurrent Asset under the heading Property and equipment. The breakup of the Property and equipment as found in the annual reports of the company as under where the Gross amount of finance leased asset is $1,862 million and the accumulated depreciation is $525 million leading to net finance lease asset of $1,338 million.

Source: Annual Report https://s2.q4cdn.com/181345880/files/doc_financials/2023/q4/02/dal-12-31-2023-10k-2-12-24-filed.pdf

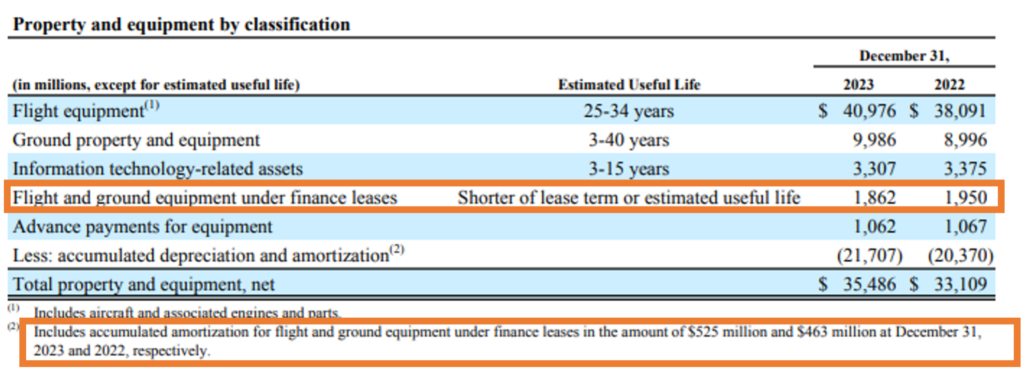

Let’s see where these Finance lease assets and liability fall in the Balance Sheet of the company below.

Source: Annual Report https://s2.q4cdn.com/181345880/files/doc_financials/2023/q4/02/dal-12-31-2023-10k-2-12-24-filed.pdf

2. Income Statement Impact

- Depreciation Expense: The leased asset is depreciated over its useful life, which appears as a depreciation expense on the income statement.

- Interest Expense: Lease payments are split into principal and interest components. The interest portion of the lease payments is recorded as an interest expense on the income statement.

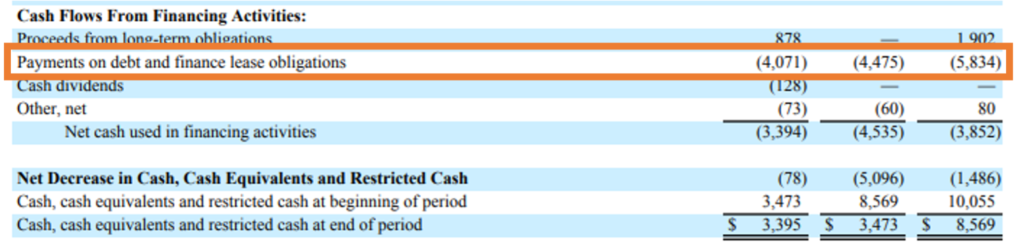

3. Cash Flow Impact

- Operating Cash Flow: The interest portion of the payment is included in the Cash Flows from Operating Activities section as a cash outflow.

- Financing Cash Flow: The principal portion of the payment is included in the Cash Flows from Financing Activities section as a cash outflow.

Let’s see how the finance lease appears on the cash flow statement of Delta Airlines.

Source: Annual Report https://s2.q4cdn.com/181345880/files/doc_financials/2023/q4/02/dal-12-31-2023-10k-2-12-24-filed.pdf

4. Financial Ratios Impact

- Debt-to-Equity Ratio: The increase in liabilities from the lease can impact the company’s debt-to-equity ratio, potentially making the company appear more leveraged.

- Return on Assets (ROA): The increase in total assets due to the leased asset might dilute the ROA if the asset does not generate proportionate income.

5. Tax Impact

- Tax Deductions: The interest expense and depreciation related to the finance lease is tax-deductible, potentially reducing the company’s taxable income and tax liability.

6. Impact on Notes to Accounts

- Disclosure Requirements: Companies must provide detailed disclosures about finance leases in the notes to the financial statements. This includes information on the nature of the leases, future lease payment obligations, and the terms of the lease agreements.

- Lease Classification: The notes must specify the classification of leases, distinguishing between finance and operating leases, and detailing the financial impact of each.

- Interest and Depreciation: Companies must report the total interest expense and depreciation expense associated with finance leases.

- Commitments: Future minimum lease payments and any contingencies or options to purchase the asset at the end of the lease term must be disclosed, providing transparency into the company’s lease obligations.

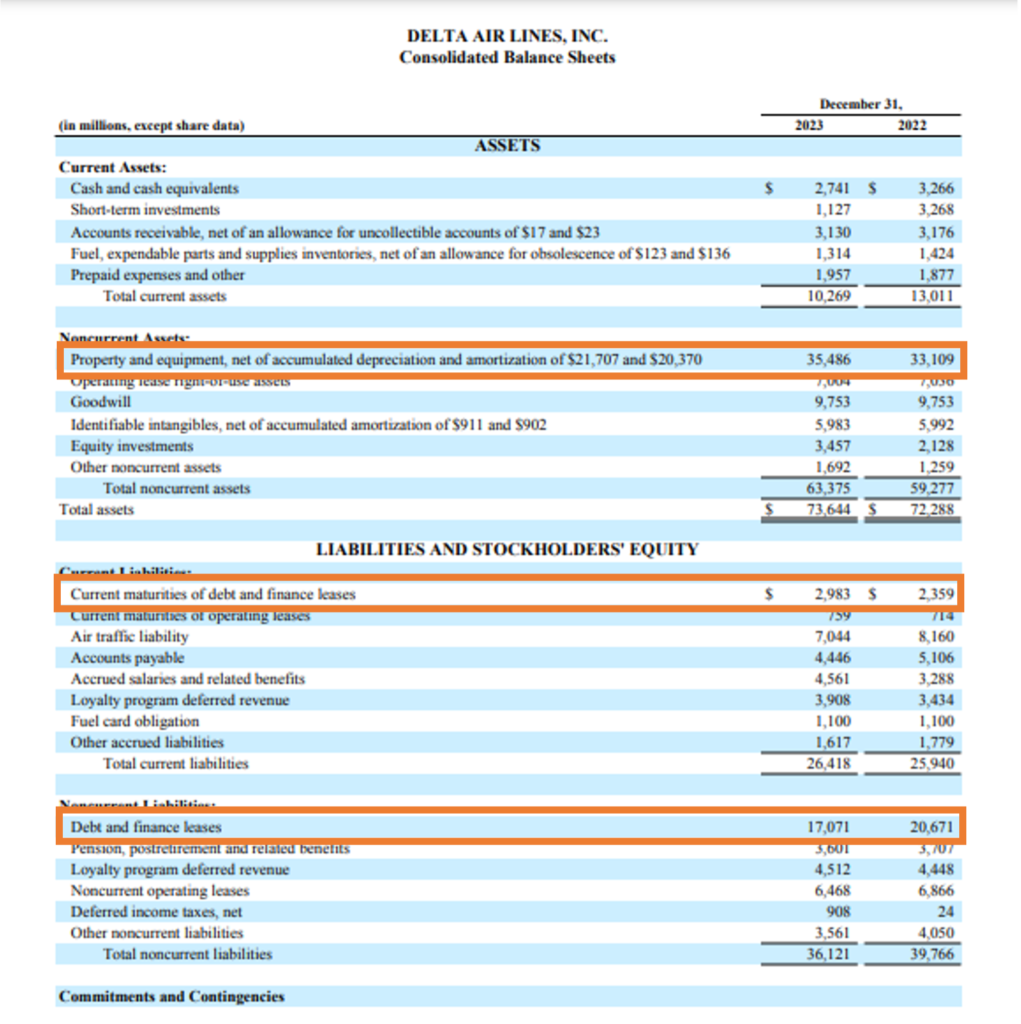

To understand the disclosure of lease information better let us look at the example of DELTA AIR LINES, INC. The notes section of Form 10-K for Delta Airlines Inc. shows the following information.

Source: Note 7 of Form 10-K

https://s2.q4cdn.com/181345880/files/doc_financials/2023/q4/02/dal-12-31-2023-10k-2-12-24-filed.pdf

ACCOUNTING FOR FINANCING LEASES

Under accounting standards, such as the International Financial Reporting Standards (IFRS 16) and the Financial Accounting Standards Board (FASB) ASC 842, financing leases must be recognized on the balance sheet. The lessee records both an asset, representing the right to use the leased item, and a liability, representing the obligation to make lease payments.

The asset is typically depreciated over its useful life, while the liability is reduced as lease payments are made. Interest expenses are also recognized in the income statement, reflecting the cost of financing the lease.

THE BENEFITS OF FINANCING LEASES

- Cash Flow Management: Financing leases allow companies to acquire assets without a large initial cash outlay. This can be particularly beneficial for cash flow management, as it enables companies to spread the cost of the asset over its useful life.

- Asset Acquisition: Companies can access high-cost assets, such as machinery, vehicles, or real estate, that they might not otherwise be able to afford. Financing leases can provide a way to acquire these assets and use them for revenue generation.

- Tax Advantages: In some cases, financing leases can offer tax benefits, such as deductions for depreciation and interest expenses. This can lower the company’s overall tax burden.

- Improved Balance Sheet: By using a financing lease, companies can acquire assets while keeping their debt-to-equity ratio lower compared to taking on traditional debt, which can be advantageous for maintaining favorable financial ratios.

DISADVANTAGES OF FINANCING LEASES

- Higher Total Cost: Over the lease term, the total cost of leasing, including interest, can exceed the asset’s purchase price.

- Limited Flexibility: Finance leases are long-term commitments compared to operating lease, which can be problematic if the asset becomes obsolete or the company’s needs change.

- Maintenance and Additional Costs: Lessees often bear the costs of maintenance, insurance, and other operational expenses, increasing the overall cost of the asset.

- Complex Accounting: Managing and reporting finance leases involves complex accounting requirements and may require additional resources.

- Potential for Obsolescence: Leased assets might become outdated before the lease ends, leading to issues with using or upgrading technology.

- Impact on Financial Ratios: The addition of leased assets and liabilities can affect financial ratios, influencing investor perceptions and future financing options.

- End-of-Lease Considerations: At lease end, companies may face challenges related to asset residual value or costs associated with returning the asset.

CONCLUSION

Financing leases are a game-changer for businesses eager to acquire essential assets while keeping cash flow robust and financial flexibility intact. By mastering the intricacies of finance leases, companies can strategically align their asset acquisition with their financial goals and growth ambitions. Whether it’s upgrading to state-of-the-art machinery, expanding fleets, or investing in prime real estate, finance leases offer a compelling alternative to outright purchases. This financial approach not only meets immediate operational requirements but also drives long-term growth and strengthens competitive advantage. Embracing finance leases empowers companies to seize new opportunities and excel in a dynamic marketplace.