WHAT IS EBITDA?

The term EBITDA stands for Earnings(E) before(B) Interest(I), Taxes(T), Depreciation(D) and Amortization(A). At many places we may see EBITDA categorized as one of the profitability financial ratios, but the fact is that EBITDA should be categorized as a performance metric. It is used to evaluate the operating performance of a company. A business may have a positive EBITDA but when we deep drill deep down into the financial statements we find that the bottom line is in fact negative. EBITDA is one of the most useful performance metric since it is it is used for financial performance comparison of companies in different industries, with different capitalization structures and operating in different tax jurisdictions.

EBITDA was developed by the former president and CEO of Tele-Communications Inc., giant of media and cable named John C. Malone in the 1970’s. EBITDA is formulated in such a way that it eliminates the effect of capital structures, Interest payments by companies and effects of taxes making performance comparison more uniform and meaningful. However, EBITDA can also be a warning signal that a company may be in a financial stress when it has high EBITDA but low or negative net income. This may be a sign that company may be highly leveraged (use of high debt to finance its operations), poor tax management by the company or high or unnecessary spending on capital assets.

EBITDA FORMULA

EBITDA can be calculated in two ways:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

or,

EBITDA = Operating Profit (EBIT) + Depreciation + Amortization

All the information required to compute the EBITDA can be found from the company’s financial statements, i.e., the Income Statement and cash flow statement. This means that at all times our financial statements should remain up to date and accurate, because any mistake in the accounting can lead to inaccurate EBITDA which could in turn overvalue or undervalue the company’s profitability.

COMPONENTS OF EBITDA

- Interest: Since the interest expense depends on the companies financing structure and arises from the money borrowed by the company to fund its business activities it is excluded from EBITDA. By adding back interest expense (or minus the interest income) from the Net Income and ignoring the impact the capital structure has on the business, it becomes simpler to compare the operating performance of companies in the same or different industry. The interest expense of companies varies according to its size and the funding requirement and hence adding interest expense to EBITDA brings the performance of different companies on the same ground for comparability.

- Taxes: Taxes that a company pays is not under the control of the management of the company and neither is a reflection of the managements performance. Taxes are in fact varies depending upon the region in which the company is situated or operating. Taxes may vary from one year to another as it is the function of jurisdiction tax rules which keeps on amending from time to time. Thus, Taxes are added back to Net profit to eliminate the effect of taxes on the operating income when comparing different business.

- Depreciation and Amortization: Depreciation is a result of the company’s historical investments and depend heavily on assumptions like the asset base, salvage value, method of depreciation adopted and the assumptions used to test any intangible asset like goodwill for impairment or amortization. Moreover, capital investment may vary hugely from one company to another, as a result of which one company which is heavily dependent on capital investment may record huge depreciation expenses resulting in lower Net Income and the other company which is less dependent on capital investment may record relatively lower depreciation and higher Net Income. Since it is not directly related to the current operating performance of the company, it is added back to Net Income to make comparison more meaningful.

Let us understand why should we use EBITDA as a performance metric to compare performance of any two companies.

We will compare the performance of two Fast food stalls with similar Revenues, Plant and equipment, Cost of production and taxes. However, the capital structure of two stalls vary which make their net income different.

| Fast Food Stall A | Amount (in $) | Amount ( in $) |

| Revenue | 1000 | 1000 |

| Cost of Goods Sold | 300 | 300 |

| Interest Expense | 0 | 200 |

| Depreciation of Fast Food stall | 50 | 50 |

| Income Before Taxes | 650 | 450 |

| Taxes (35%) | 227.5 | 157.5 |

| Net Income | 422.5 | 292.5 |

| EBITDA (Net Income+ Interest+ Taxes + Depreciation and Amortization) | 700 | 700 |

Since, Fast Food Stall A has no debt it has higher Net Income of $422.5, while Food Stall B which has a Debt resulting in Interest Expense of $50 it has lower Net Income of $292.5. The presence of Debt in the capital structure makes comparison between the two Food Stall’s difficult. Hence, EBITDA makes the comparison easier. When we calculate the EBITDA we find that both the company’s performance is on the same page. However, once we get the EBITDA figures we should dig deep into other factors like capital expenditure, Debt or equity financing, and taxes paid by the company to make comparison more relevant as these factors have impact on company’s actual profits and cash flows.

HOW CAN EBITDA BE USED IN BUSNIESS?

The concept of EBITDA though introduced in 1970’s, its use became more popular in the 1980’s which was the era of leveraged buyout. It was common for investors during this time to restructure financially distressed companies. To access whether a company could pay back interest cost associated with its re-structuring, EBITDA was used as an essential tool by the investors.

Even today EBITDA is used widely in business for a variety of reasons some of which are being listed below:

- Used to determine the Debt service coverage ratio (DSCR): This ratio is often used by Bankers to determine whether the borrower will be able to meet their contractual debt service obligation. It is a Debt to Income ratio, that measure that how much Operating Income before taxes a company generates to meet its contractual interest and principal payment obligations. A debt service coverage ratio of one or above indicates that a company is generating enough operating income to cover its debt obligation.

Formula for DSCR= Net operating income/ total debt service or EBITDA/ (Interest + Principle payments)

- Give a true overall view of company’s performance: EBITDA gives a clearer picture of a company’s operating efficiency and performance. It is specially a useful metric for Tech start-ups as EBITDA excludes the impact of huge upfront initial capital investment in the form of depreciation and amortization. Since the depreciation on initial capital investment is added back to the net profit, it helps the promoters to explain the long term viability of the start-up to the investors.

- Helps to compare companies: Since EBITDA removes the impact of factors not in the control of the management, it helps make investors and business make better comparison with peer companies in the same industry.

- It helps in the Budgeting process: EBITDA is used by company’s when preparing their budget for the next year to estimate how much of cost can be absorbed by the EBITDA due to extra machinery added or any upgrade undertaken. It also gives company an idea when to incur major expenses not impacting its overall financial health. EBITDA is a profitability figure before depreciation, interest and taxes and hence it gives the company a better picture of the company’s cash flow position and how much cost pressure it will be able to handle in future.

- It helps the investors to invest in the company: EBITDA is commonly used by investors to compare different companies in the same industry and understand which company is delivering strong operating results.

- It helps in forming an exit plan: If one is planning to sell its business in the market, EBITDA analysis helps to prove the buyers that the business they have put out in the market is a smart purchase and helps one set the correct sell price.

- EBITDA is used in Financial Modelling: For calculating unlevered cash flows EBITDA is used as the starting point in the financial modelling.

- EBITDA is used for cost cutting- When a company is considering cutting down its unnecessary cost calculating EBITDA can be useful. A company with higher EBITDA margin means the operating cost is lower in relation to the total revenue. However, if the EBITDA margin is lower, the operating cost is high in relation to the total revenue and company should consider minimising its cost or unnecessary spending.

ADJUSTED EBITDA

There is a thin line of difference between EBITDA and Adjusted EBITDA. Though EBITDA by eliminating the impact of depreciation, taxes and interest from Net Income, standardises the income and cash flows of different companies, there is still huge differences in the EBITDA of these companies because of the presence of various abnormalities. Adjusted EBITDA, eliminates any such abnormalities like price paid above the market price or arms-length price, redundant assets, one time gain or losses etc., thereby standardising the income and cash flows further to make comparison between companies easier irrespective of its industry, location, size or any abnormalities.

Common abnormal items excluded while calculating the Adjusted EBITDA:

- Non-operating income

- Non-cash expenses like depreciation

- Onetime/Windfall gain or loss

- Unrealized gains or losses

- One-time litigation expenses

- Payment over and above arms-length price

- Goodwill Impairments

- Write-down of assets

- Foreign exchange gains or losses

- Payment of bonuses to owners

- Special Donations

VARIATIONS OF EBITDA

Sometimes instead of EBITDA, companies may calculate alternative metric similar to EBITDA to justify its nature of business. We have listed down some of these variation metrics of EBITDA:

- EBITA: It stand for Earnings before interest, taxes and amortization. If we exclude depreciation from EBITDA we get EBITA. This variation takes into account the effect of the asset base to access the profitability of the company.

- EBITDAR: It stands for Earnings before interest, taxes, depreciation, amortization and rent cost. If we add rent cost to EBITDA we get EBITDAR. This metric is used when we compare two companies with different capital structure in the same industry. For example, one manufacturing company may have acquired its factory space on rent while the other company may have its owned space to manufacture goods. The EBITDA of the first company includes the rental expenses hence lowering the EBITDA. However, the second company has more of capital expenditure whose impact is not reflected in EBITDA figure, in turn making EBITDA higher. EBITDAR solves this problem by adding back rental expense to net income. This metric is commonly used by trucking business or hotel industry. Another alternative of EBITDAR is EBITDAL replacing rental cost with lease cost. The EBITDAR can also be used by restructuring companies by replacing “R for Rental” with “R for Restructuring”.

- EBITDAC: It stands for Earnings before interest, taxes, depreciation, amortization, and coronavirus and has been introduced as a result of the global pandemic COVID-19. Many companies started reporting EBITDAC figure during pandemic. This metric allows adding up of the profits to net income which would otherwise be earned by the company had it operations not been hit by the pandemic.

- EBIDAX: It stand for Earnings Before Interest, Depreciation, Amortization and Exploration. This metric is used to evaluate the performance of companies associated with exploration activities like mineral, oil and gas exploration companies.

EBITDA IS NOT CASH FLOWS:

One of the most common mistakes analysts make is to assume EBITDA is a metric of cash flows generation of a company. The reason they do that is because depreciation and amortization expense is not included in EBITDA as it is a non-cash expense. However, there are other cash adjustments that needs to be done to arrive at cash flows from EBITDA.

Specifically, we need to make adjustments for working capital changes like change in accounts receivables, inventories and accounts payables to the EBITDA number in order to get to a operating cash flows number. Again, we also need to deduct the capital expenditures from therein to arrive at a free cash flows calculation.

We may use the calculation below:

FCFF (Free Cash Flows to Firm) = EBITDA – Operating Taxes +/– Working Capital Changes – Capital Expenditures.

As you can see, EBITDA is a good starting point but not close to the cash flows calculation.

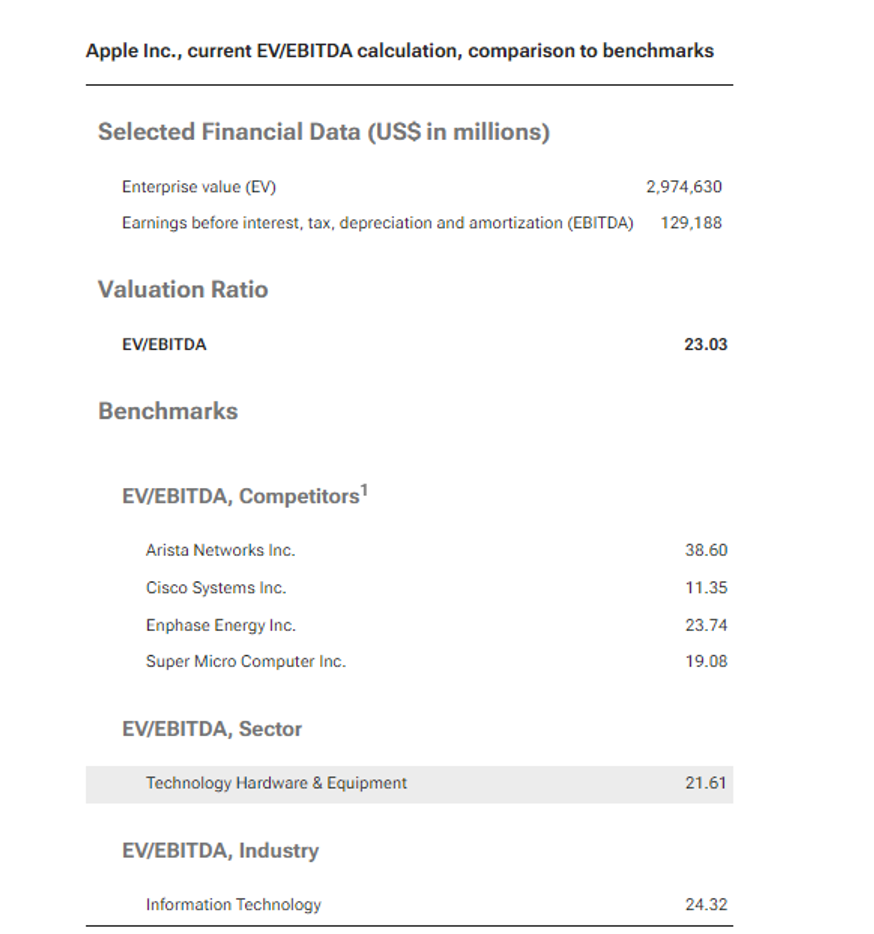

WHAT IS EBITDA MULTIPLE AND WHY IT IS IMPORTANT?

EBITDA multiple helps analysts, Merger and acquisition professionals and financial advisors access whether the company in consideration is overvalued or undervalued. If the EBITDA multiple is high it means that the company may be overvalued and if the ratio is low, it may indicate that the company is undervalued. One benefit that EBITDA has over other multiples like Price to Earnings(P/E) ratio is that, EBITDA unlike P/E ratio takes company’s debt into account.

How to Calculate EBITDA Multiple?

EBITDA Multiple= Enterprise Value/EBITDA

where, Enterprise value = Market Capitalization+ Value of Debt + Minority Interest+ Preferred Shares – Cash and Cash Equivalents (Marketable securities, Treasury Bills, Bank Accounts, Petty Cash etc.)

WHAT IS GOOD EBITDA?

To find out whether the EBITDA of a company is good or not, we have to calculate EBITDA Multiple or EBITDA Coverage Ratio. EBITDA is merely just a number and alone cannot demonstrate whether it’s good or bad. So let’s see how can we calculate EBITDA Multiple and EBITDA Coverage Ratio below:

- EBITDA Margin: EBITDA Margin shows how much Operating profit is generated by a company against each rupee of revenue generated. If the company has higher margin, it indicates it has higher potential for growth and vice versa for the company with lower margin.

EBITDA Margin= EBITDA/ Total Revenue

Example:

| Particulars | Company A | Company B |

| EBITDA | 500,000 | 700,000 |

| Total Revenue | 50,00,000 | 95,00,000 |

| EBITDA Margin | 10% | 7.36% |

From the above example we can see that though Company A has lower EBITDA compared to Company B, it has a higher EBITDA Margin when compared to Company B. For an investor Company A might be a better investment alternative than Company B.

- EBITDA Coverage Ratio: This ratio shows for each unit or rupee of debt, interest and other liability of the company how much of EBITDA is available to repay of the debts. If the ratio is 1 or greater than 1, it indicates that the company is in better off position to pay off debts than company with a ratio less than 1.

EBITDA Coverage Ratio= (EBITDA+ Lease payments) /

(Interest payments+ Principle payments+ Lease Payments)

DIFFERENCE BETWEEN EBITDA AND OPERATING MARGIN

EBITDA and Operating Margin are both profitability metrics but varies only slightly. While Operating margin measures a company’s operating profit before paying taxes, EBITDA on the other hand measures a company’s operating profitability but does not take into account depreciation and amortization.

DIFFERENCE BETWEEN EBITDA AND NET INCOME

EBITDA is an indication of company’s operating performance while net profit is an indication of company’s total earnings.

EBITDA = Net Income+ Interest+ Taxes+ Depreciation+ Amortization

Net Income = Revenue- Business Expenses

LIMITATIONS OF EBITDA

- EBITDA can give a deceptive view of company’s overall performance: EBITDA does not take into account some factors like depreciation, interest and taxes into account. Due to this reason it can give a deceptive view of the company’s performance and companies can use EBITDA to hide any warning signals such as high debt and interest liability, lack of overall profitability, unnecessary spending on fixed assets etc.

- EBITDA can be manipulated to give a higher profitability figure: In order to present a good picture in front of the investors companies can change their depreciation schedules to inflate a company’s projected results. In EBITDA depreciation is added back due to which the company’s earnings often appear greater than they actually are.

- It does not account for changes in the working capital: A company’s liquidity changes along with depreciation, interest and taxes. A negative EBITDA signals towards any problem with the profitability of the company. However, a positive EBITDA does not necessarily indicate towards a healthy company because taxes and interest expense on debt are actual expenses for the company which the company has to ultimately take into account to determine the overall profitability.

- EBITDA is not recognized by GAAP or IFRS: EBITDA does not fall under Generally Accepted Accounting Principles (GAAP). This implies that the companies can tweak the formula and its component in different ways. The famous Warren Buffett was also sceptical of using EBITDA because it presents the companies financials in such a way that it has never paid any interest on debt or taxes to the government or its assets have the same value as it was purchased with no lose over time. For example, a fast growing sales and EBITDA may be reported year on year by a fast growing manufacturing company. To achieve this high sales and EBITDA, the company spends huge amount on purchasing fixed assets, plant and machinery and to finance this expenditure it may borrow money from the banks and financial institutions. From the EBITDA one can see the company has strong top line growth, however the investors should dig deep in the financial statements and consider capital expenditures, cash flow other metrics to consider the overall profitability.

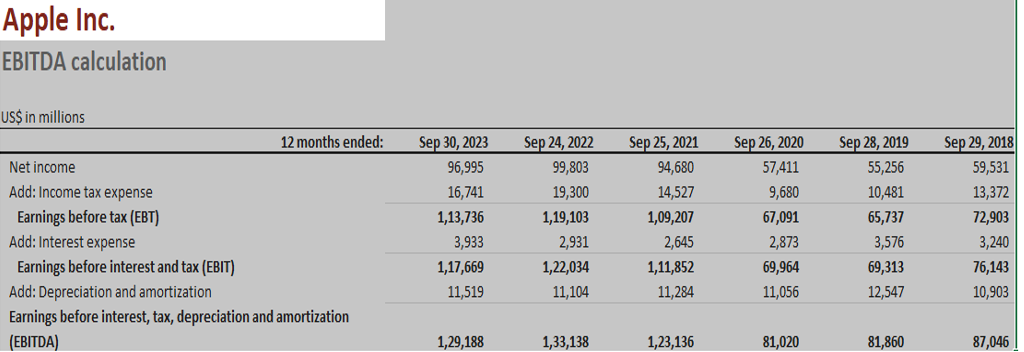

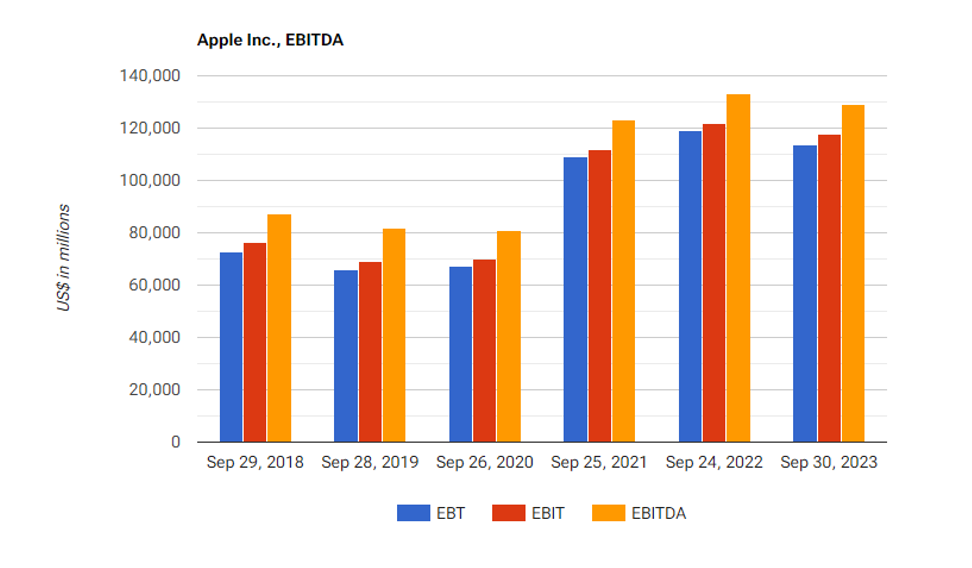

REAL LIFE EXAMPLE ON HOW TO CALCULATE EBITDA

Let’s see EBITDA calculation for Apple Inc. for 6 years

Source: https://www.stock-analysis-on.net/NASDAQ/Company/Apple-Inc/Valuation/EV-to-EBITDA

Source: https://www.stock-analysis-on.net/NASDAQ/Company/Apple-Inc/Valuation/EV-to-EBITDA

Source: https://www.stock-analysis-on.net/NASDAQ/Company/Apple-Inc/Valuation/EV-to-EBITDA

CONCLUSION

EBITDA is one of the best metric to evaluate a company’s financial performance. However, it should not be the sole metric on basis of which any decision should be taken by an investor since it removes the impact of elements not directly impacting the operating performance of the company. EBITDA should be used along with other factors to take an informed decision.

31 thoughts on “EBITDA is not the same as Cash Flows”

[…] Income of the company and add any other the company generates. We may alternatively also take EBITDA and remove depreciation and amortization expenses from […]

[…] margin:- EBITDA is Earnings before interest tax depreciation and amortization. It may be referred to as operating […]

[…] EBITA is an operating profitability metric that lies between other two very commonly used profitability metrics EBIT and EBITDA. […]

[…] it. This ratio tells us that if anyone wants to acquire the entire business then how many times EBITDA they have to pay for the […]

[…] financial metric. This metric could be anything reasonable and measurable like the annual sales, EBITDA, Interest, Taxes, EBIT, etc. EBITDA is the most commonly used financial metric. It is important to […]

… [Trackback]

[…] Find More on on that Topic: skillfine.com/ebitda/ […]

… [Trackback]

[…] Find More here on that Topic: skillfine.com/ebitda/ […]

… [Trackback]

[…] Here you can find 53804 more Information to that Topic: skillfine.com/ebitda/ […]

… [Trackback]

[…] Info on that Topic: skillfine.com/ebitda/ […]

… [Trackback]

[…] Here you will find 56328 additional Information to that Topic: skillfine.com/ebitda/ […]

… [Trackback]

[…] Find More to that Topic: skillfine.com/ebitda/ […]

… [Trackback]

[…] There you can find 40763 more Information to that Topic: skillfine.com/ebitda/ […]

… [Trackback]

[…] Find More to that Topic: skillfine.com/ebitda/ […]

… [Trackback]

[…] Find More to that Topic: skillfine.com/ebitda/ […]

… [Trackback]

[…] Find More to that Topic: skillfine.com/ebitda/ […]

… [Trackback]

[…] Here you will find 58684 more Information to that Topic: skillfine.com/ebitda/ […]

… [Trackback]

[…] Find More Info here on that Topic: skillfine.com/ebitda/ […]

… [Trackback]

[…] Information on that Topic: skillfine.com/ebitda/ […]

… [Trackback]

[…] Information on that Topic: skillfine.com/ebitda/ […]

… [Trackback]

[…] Info on that Topic: skillfine.com/ebitda/ […]

… [Trackback]

[…] Read More to that Topic: skillfine.com/ebitda/ […]

… [Trackback]

[…] Read More Information here on that Topic: skillfine.com/ebitda/ […]

… [Trackback]

[…] Find More on that Topic: skillfine.com/ebitda/ […]

… [Trackback]

[…] Read More to that Topic: skillfine.com/ebitda/ […]

Very well presented. Every quote was awesome and thanks for sharing the content. Keep sharing and keep motivating others.

I’ve read several just right stuff here. Certainly price bookmarking for revisiting. I wonder how a lot effort you place to create this kind of great informative website.

There is definately a lot to find out about this subject. I like all the points you made

Wow! This could be one particular of the most helpful blogs We have ever arrive across on this subject. Basically Great. I’m also an expert in this topic so I can understand your effort.

Pornstar

We’re a gaggle of volunteers and starting a brand new scheme in our community. Your site provided us with valuable info to work on. You have performed a formidable process and our whole community shall be thankful to you.

Someone essentially help to make seriously articles I would state. This is the very first time I frequented your web page and thus far? I surprised with the research you made to make this particular publish amazing. Excellent job!