INTRODUCTION

One of the fundamental aspects of corporate accounting is the Deferred taxes and it plays a crucial role in how a company manages its financial reporting and tax obligations. It becomes important to understand the concept of deferred taxes as it helps companies to do their financial and tax planning and improve investor relations. In this article we are going to delve into details on what is deferred taxes, reasons for the creation of deferred tax, types of deferred tax with examples, strategic considerations, and its impact on the financial statements.

WHAT ARE DEFERRED TAXES?

Financial accounting practices in the United States are guided by US GAAP (generally accepted accounting principles) and for most of the other countries in the world by IFRS. These accounting practices require the companies to calculate and disclose the transactions and events in a specific manner in the books of accounts. The Income as per books of accounts is used to calculate the Income tax expense. On the other hand, special rules are set by tax authorities like the Internal Revenue Service (IRS) for the treatment of certain events. The Net income calculated as per tax hence differs from the Net income calculated as per GAAP resulting in the difference in Income tax calculated. Due to differences in rules set by the financial and tax reporting, deferred tax assets and deferred tax liabilities come into existence. Deferred taxes refer to the prepayment or postponement of tax payments to future periods, as opposed to paying them immediately. These differences result in temporary variances, known as temporary differences, between taxable income and pretax financial income.

REASONS FOR DEFERRED TAXES

The following differences give rise to Deferred Taxes:

- Timing Differences: These occur when revenues or expenses are recognized in different periods for tax and accounting purposes. For example, the accelerated depreciation method used for tax purposes might differ from the straight-line depreciation method used in financial statements.

- Temporary Differences: These arise when an item is recognized in different periods for tax and accounting purposes, but it will eventually reverse. For example, a company may recognize revenue for tax purposes when received but defer it for financial reporting until it is earned.

DEFERRED TAX LIABILITY

What is Deferred Tax Liability?

Deferred Tax Liabilities are the taxes that will be payable in future periods due to taxable temporary differences. It arises when taxable income is lower under tax rules than under accounting rules in the current period, resulting in lower taxes now but higher taxes in the future.

When is deferred tax liability created?

Deferred tax liability is created when taxable income under tax rules is lower than under accounting rules (US GAAP or IFRS) in the current period, resulting in lower taxes now but higher taxes in the future.

Deferred tax liability is found on the Balance sheet under the “Non-current liabilities” section. A journal entry for deferred tax liability signifies a tax payment that can be postponed to a future date due to timing differences in accounting processes. Depending upon the situation deferred tax liability can be either advantageous or neutral. It signifies an obligation to pay taxes in the future, providing flexibility by delaying immediate payments. However, it necessitates setting aside funds to settle this obligation when it matures.

Examples of deferred tax liabilities include:

- Depreciation: A deferred tax liability is created when a company uses accelerated depreciation methods for tax purposes but straight-line depreciation for financial reporting. Under the accelerated depreciation method, depreciation expense is higher in initial years and lower in subsequent years. This results in lower taxable income than the book income in initial years and the creation of deferred tax liability.

- Revenue Recognition: Revenue recognition policy differs under taxation and financial standards. In the case of credit sales, revenue is recognized when sales are made in books of accounts whereas under taxation rules revenue is recognized only when money is received. This leads to lower taxable income initially than book income. This means the company pays lower taxes initially but has to pay higher taxes when credit sales made in the past are received in the future.

- Inventory Valuation: Differences in the methods (LIFO vs FIFO) used to value inventory can lead to deferred tax liabilities. For example, if tax rules allow for the use of the last-in, first-out (LIFO) method while financial reporting uses the first-in, first-out (FIFO) method, taxable income may be lower initially, resulting in higher taxes payable in future periods when FIFO inventory valuation results in higher taxable income.

- Accelerated Expense Recognition: Expenses that are deductible for tax purposes in one period but recognized in a different period for financial reporting can create deferred tax liabilities. For instance, prepaid expenses or certain types of provisions may be deductible immediately for tax purposes but recognized over time for financial reporting, leading to temporary differences and deferred tax liabilities.

- Business Combinations: When one company acquires another, it often has to adjust the values of the acquired company’s assets and liabilities to match their current market value. This adjustment can lead to differences between the accounting values (book values) and the tax values (tax bases) of these assets and liabilities. For example, during the acquisition, some assets of the acquired company might be valued higher than their tax basis (the value used for tax purposes). Suppose a piece of equipment has a book value of $100,000, but its fair market value is assessed at $150,000 during the acquisition. The tax basis, however, remains at $100,000. This difference between the fair market value ($150,000) and the tax basis ($100,000) creates a temporary difference of $50,000. Over time, the company will recognize depreciation on the $150,000 value in its financial statements, but it will only be able to deduct depreciation based on the $100,000 tax basis when filing taxes. This difference means the company will report higher profits for tax purposes in the future, leading to higher tax payments. Hence, this leads to the creation of deferred tax liability.

These examples illustrate how differences between tax rules and financial reporting standards can create temporary differences that result in deferred tax liabilities, impacting a company’s financial statements and tax planning strategies.

Understanding Deferred Tax Liability through an example:

A company, XYZ Corp., purchases equipment for $100,000. For tax purposes, the equipment is depreciated using an accelerated method over 5 years, while for accounting purposes, the equipment is depreciated using the straight-line method over 10 years. The corporate tax rate is 30%.

Calculations:

For the first 5 years, the DTL calculations will look like below:

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Depreciation Expense | |||||

| Tax Purpose | 40000 | 24000 | 15000 | 11000 | 10000 |

| Accounting Purpose | 10000 | 10000 | 10000 | 10000 | 10000 |

| Taxable Income Difference | 30000 | 14000 | 5000 | 1000 | 0 |

| Deferred Tax Liability | 9000 | 4200 | 1500 | 300 | 0 |

| Cumulative Deferred Tax Liability | 9000 | 13200 | 14700 | 15000 | 15000 |

As you can see, DTL increases cumulatively every year since the tax payable under tax purposes is lower than accounting calculations. However, over the next 5 years, this difference will reverse itself as seen in the calculations below:

| Year 6 | Year 7 | Year 8 | Year 9 | Year 10 | |

| Depreciation Expense | |||||

| Tax Purpose | 0 | 0 | 0 | 0 | 0 |

| Accounting Purpose | 10000 | 10000 | 10000 | 10000 | 10000 |

| Taxable Income Difference | -10000 | -10000 | -10000 | -10000 | -10000 |

| Deferred Tax Liability | -3000 | -3000 | -3000 | -3000 | -3000 |

| Cumulative Deferred Tax Liability | 12000 | 9000 | 6000 | 3000 | 0 |

Deferred tax liability is created because the company is paying less tax in the initial years due to the higher tax depreciation, which will reverse in later years.

The deferred tax liability is calculated as the difference in depreciation expense multiplied by the tax rate (30%).

This deferred tax liability reflects the taxes that the company will owe in the future when the depreciation expense for tax purposes becomes lower than for accounting purposes.

DEFERRED TAX ASSET

What is a Deferred Tax Asset?

This represents taxes that will be recoverable in future periods due to deductible temporary differences. It arises when taxable income is higher under tax rules than under accounting rules in the current period, resulting in higher taxes now but lower taxes in the future.

When is a deferred tax asset created?

A deferred tax asset is created when taxable income under tax rules is higher than under accounting rules (US GAAP or IFRS) in the current period, resulting in higher taxes now but lower taxes in the future.

Deferred Tax Assets are found under Non-Current Assets in the Balance Sheet. A deferred tax asset is classified as an intangible asset because it is not a physical item like equipment or buildings; it exists solely on the balance sheet. A deferred tax asset (DTA) is a financial asset because it represents an overpayment of taxes that can be used to reduce future tax liabilities. Deferred tax assets do not expire and can be utilized whenever it is most advantageous for the business. Deferred tax assets can always be carried forward to future tax filings, but they cannot be applied to past tax filings.

Examples of deferred tax assets include:

- Net Operating Loss (NOL) Carryforwards: If a company incurs a net operating loss in a given year, it can carry forward that loss to offset taxable income in future years, thus creating a deferred tax asset.

- Tax Credit Carryforwards: Tax credits that cannot be fully utilized in the current tax year can be carried forward to offset taxes in future years, resulting in a deferred tax asset.

- Warranty Reserves: Deferred Tax Asset is created when a company sets aside money for future warranty claims since the expense is recognized on the financial statements, but it is not deductible for tax purposes until the claims are actually paid.

- Bad Debt Reserves: Deferred Tax Asset is created when a company recognizes an expense for estimated uncollectible accounts receivable (bad debts) on its financial statements, but this expense may not be deductible for tax purposes until the specific accounts are written off. This is a timing difference resulting in a deferred tax asset.

- Deferred Revenue: If a company receives payment in advance for goods or services, it may recognize the deferred revenue on the tax return when the payment is received, but defer recognizing it on the financial statements until the goods or services are provided. This creates a deferred tax asset.

- Stock-Based Compensation: A deferred Tax Asset is created when the company recognizes the expense for stock based compensation for financial reporting purposes over the vesting period of the stock options, but the tax deduction is not recognized until the options are exercised. This timing difference leads to the creation of a deferred tax asset.

- Depreciation Differences: When a company uses different methods of depreciation for tax and accounting purposes, it can lead to a deferred tax asset. For instance, if tax depreciation is slower than accounting depreciation, it results in higher taxable income in the early years, creating a deferred tax asset.

These are common examples where the timing of recognizing income and expenses for financial reporting differs from tax reporting, resulting in the creation of deferred tax assets.

Understanding Deferred Tax Assets through an example:

ABC Corp. has a net operating loss (NOL) of $50,000 in the current year. The corporate tax rate is 30%. This NOL can be carried forward to offset future taxable income.

Calculations:

- Net Operating Loss (NOL):

Current Year NOL: $50,000

- Tax Benefit:

- The tax benefit from the NOL is calculated by multiplying the NOL by the tax rate

- Tax Benefit: $50,000 * 30% = $15,000

- Deferred Tax Asset:

The tax benefit from the NOL creates a deferred tax asset of $15,000. This means ABC Corp. can use this $15,000 to reduce future taxable income.

Utilization of Deferred Tax Assets:

In the following year, ABC Corp. has a taxable income of $100,000 before considering the NOL carryforward.

- Taxable Income Before NOL Carryforward:

Next Year Taxable Income: $100,000

- Applying NOL Carryforward:

- The $50,000 NOL can be applied to the next year’s taxable income

- Adjusted Taxable Income: $100,000 – $50,000 = $50,000

Tax Liability Calculation:

- Tax Liability Before NOL: $100,000 * 30% = $30,000

- Tax Liability After NOL: $50,000 * 30% = $15,000

Summary:

- In the current year, ABC Corp. recognizes a deferred tax asset of $15,000 due to the $50,000 NOL.

- In the next year, ABC Corp. reduces its taxable income by $50,000 using the NOL carryforward, resulting in a tax liability of $15,000 instead of $30,000.

- The deferred tax asset of $15,000 is utilized to offset the future tax liability, providing a financial benefit to the company.

The calculations over the 2-3 year timeframe will look something like this:

| Year 1 | Year 2 | Year 3 | |

| Accounting Profit / Loss | -50000 | 100000 | 100000 |

| Tax Profit/Loss | 0 | 50000 | 100000 |

| Tax Rate | 30% | 30% | 30% |

| Taxable income difference | 50000 | -50000 | 0 |

| DTA | 15000 | -15000 | 0 |

| Cumulative DTA | 15000 | 0 | 0 |

This example illustrates how a deferred tax asset is created from an NOL and how it can be used to reduce future tax liabilities.

IMPACT ON FINANCIAL STATEMENTS

• Income Statement: Deferred tax assets and liabilities affect income tax expense. Increases or decreases in deferred tax liabilities and assets result in higher or lower tax expenses, respectively.

• Balance Sheet: They are reported as non-current assets or liabilities. They can affect a company’s overall financial position and are important for financial statement users to understand future tax implications.

DEFERRED TAX INFORMATION IN THE FOOTNOTES OF THE FINANCIALS

To comprehend the factors influencing these deferred taxes, analysts find it beneficial to review the tax disclosures in the footnotes provided by the company. Typically, companies detail significant transactions that have affected the balances of deferred tax assets and liabilities during the period. In addition, these disclosures often include reconciliations of effective tax rates.

Here are some key categories of information to seek in tax footnotes that can help analysts interpret changes in deferred tax balances. These details may manifest in the income statement or balance sheet:

- Guidelines on estimating warranty expenses, bad debt provision accounting, and write-downs.

- Capitalization and depreciation of fixed assets policies

- Procedures for amortizing financial assets.

- Guidelines for revenue recognition.

Understanding these aspects enables analysts to grasp the factors contributing to the creation of deferred tax assets (DTAs) and liabilities (DTLs).

STRATEGIC CONSIDERATIONS

Understanding deferred taxes is crucial for strategic financial management:

•Financial Planning: Companies must manage their deferred taxes to optimize cash flow and ensure compliance with tax laws.

•Investor Relations: Transparent reporting of deferred taxes helps investors assess a company’s true financial health and future tax liabilities.

•Tax Planning: Businesses can strategically time their income and expenses to optimize tax benefits and manage their effective tax rate.

REAL-LIFE EXAMPLE OF DEFERRED TAXES IN THE FINANCIALS OF THE COMPANY

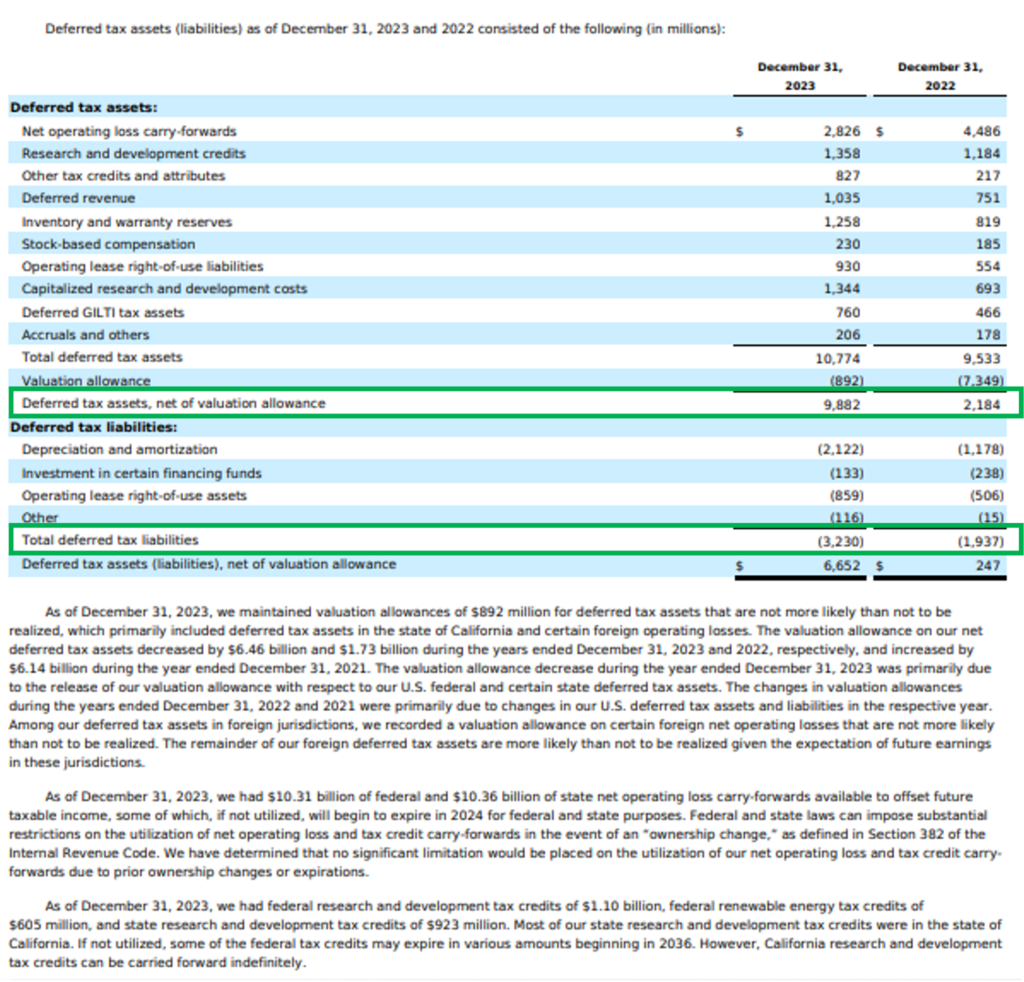

Let us see the Deferred Tax Calculation by Tesla Inc. for the fiscal year 2023 below.

Source: Note 14 (Income Taxes) of Form 10-K

https://ir.tesla.com/_flysystem/s3/sec/000162828024002390/tsla-20231231-gen.pdf

From the above information we can conclude the following:

- Tesla has Net Deferred Tax Assets of $9,882 during FY 2023. The major reasons for the creation of deferred tax assets are Net operating loss carryforwards, Research and development credits, Deferred revenue, Inventory and warranty reserves, and capitalized research and development costs.

- Tesla has Deferred Tax Liabilities of $3,230 during FY 2023. The major reasons for the creation of deferred tax liabilities are Depreciation and Amortization expenses.

CONCLUSION

Understanding deferred taxes is crucial for investors, analysts, and managers to assess a company’s true financial performance and tax obligations over time. It reflects the timing differences between when income and expenses are recognized for financial reporting versus tax purposes and can significantly impact a company’s reported earnings and financial health. Therefore, managing and disclosing deferred taxes accurately is essential for transparent financial reporting.