WHAT IS DISCOUNTED CASH FLOW (DCF)?

Discounted Cash Flow is one of the financial valuation model and is used widely to estimate the value of an investment, valuation of a company, or a project using its expected future cash flows and adjusting it for the time value of money. The DCF calculation model helps to determine the present value of any investment or a project based on the how much money that investment or project will generate in the future. The DCF model can be used in all the scenarios where the cash flow generation can be reliably estimated, such as an investor deciding to invest in a company or buy securities or business managers and owners making capital budgeting decisions or planning to incur major operating expenditures.

The DCF model since attempts to find the present value to an investment or a project today, it uses projected discount rate to pull the future value of cash flows in the present day.

WHY DO THE FUTURE CASH FLOWS NEED TO BE DISCOUNTED?

As per the concept of the time value of money, a dollar we have today is worth more than a dollar that we shall receive tomorrow because the same can be invested today which will yield higher return tomorrow. Hence DCF Calculation is commonly used as a valuation method were a person invest or spends money today to get money in the future. For Example, we all have money in savings account. If we have $100000 in our savings account today, and the bank savings interest rate is 5%, after one year we shall have a balance of $105000 ($100000*1.05) provided the no further funds are deposited or withdrawn from the bank. Similarly, if we do not deposit $100000 today and the deposition is delayed for a year, its present value shall be $95238.1 ($100000/1.05) because we could not transfer the account to our saving account to earn interest.

The DCF Calculation model uses two most important factors being the estimates of the future cash flows and the appropriate discount rate using which the future cash flows is discounted and the present value of the investment is found. DCF is used to find if the present value of the investment is greater than the value of the initial cost of investment, to make decision about whether to go for the opportunity or not.

WHAT IS THE DCF CALCULATION MODEL USED FOR?

DCF analysis is used to determine the value of business investment or in a project selection, M&A valuation, to determine the market value of a stock or other investment opportunities and all the other cases where the cash flows for the future can be determined.

Examples of the uses of the DCF model are as follows:

- Valuation of a share of a company: Investors can find the intrinsic value of a stock based on the present value of the future dividends with a perpetual growth rate.

- Valuation of a bond: DCF is used to find the value of a bond by adding the present value of the interest payments plus the present value of the principle that would be received at maturity.

- Valuation of the entire business: DCF is used by investors to determine how well company generates cash flows for its investors in the future.

- Valuation of a project or investment within a company: DCF model is used to determine which project to investment in by using the weighted average cost of capital as the discount rate to justify the investment projects. Positive cash flows should be generated by the investment project being evaluated at their present value and give a return of at least the company’s hurdle rate for the investment. The DCF model also includes finding the terminal value of a project in the estimated year of project completion.

- Valuation of an income-producing property: An income producing property can be a property purchased by an individual and renting it out to generate passive income.

- Valuation of the benefit of a cost-saving initiative at a company: A company often uses DCF model to evaluate between different investment alternatives to find the alternative which would give the maximum cost saving benefits at the least cost.

- Valuation of anything that produces cash flow or has an impact on the cash flow

DISCOUNTED CASH FLOW FORMULA

The DCF Calculation formula has three main components- the Discount rate, the Cash flows, and the number of periods. The formula of DCF is given below:

Where,

CF1= Cash Flow for the first period

CF2= Cash Flow for the second period

CF3= Cash Flow for the third period

CFn= Cash Flow for “n” period

n = Number of periods

r = Interest rate or Discount rate

ANALYZING THE COMPONENTS OF THE DCF FORMULA

1. Cash Flow (CF): When working on the financial model of a company, cash flow is known as the unlevered free cash flow, when valuing a bond cash flow will be the principal payments and interest earned and when valuing a share cash flow will be the dividends to be earned and the amount to be earned on sale of the share. Basically the cash flows represent the net cash payments an investor shall receive over a given period of time for owning the investment or any cash generating property, or for being invested in a project. The CFn also includes the terminal value of the investment when valuing a business project which does not have a fixed life time. The terminal value may be calculated using the perpetual growth rate or exit multiple methods.

The terminal value under the perpetual growth rate method is calculated as:

TVn = CFn (1+g)/(WACC-g)

where,

- TVn = Terminal value at the end of the specified period of the project

- CFn = The cash flow of the last specified period of the project

- g = the growth rate

- WACC = Weighted average cost of capital

The Terminal value under the exit multiple method is calculated using the multiple of EV/EBITDA, EV/Sales etc., giving a multiplier.

2. Discount rate (r): The discount rate is used to pull the future value of cash flows to present value. The discount rate is basically how much a company should earn to justify its cost of operation or the company’s cost of capital. For most of the DCF valuation purposes, specially to value a business investment or a project, the weighted average cost of capital (WACC) is used. The weighted average cost of capital is used as it incorporates both the company’s interest rate on borrowed funds and dividend payouts or the expected rate of return by the shareholders of the company.

WACC= (E/V * Re) + (D/V *Rd * (1-Tc))

Where,

- E= market value of company’s equity

- D= market value of the company’s debt

- V= sum of the market value of the company’s equity and debt i.e E+D=V

- Re= Cost of Equity

- Rd= Cost of Debt

- Tc= Corporate Tax Rate

- Period Number (n): Each cash flow of an investment or a projectis associated with a time period and the time period may be in years, months or quarter. The time periods may be equal or different. If the time periods are different, they are expressed as a percentage of a year.

SEVEN STEPS OF VALUATION USING THE DCF CALCULATION MODEL

Step by step method to calculate the discounted cash flow for a business investment or a project is as follows:

- Projection of the Financial Statements

The first thing to be done while using the DCF model of valuation is deciding the forecasting period, since any business or a project have a definite life unlike human beings. Analysts have to decide the number of years for which they want to forecast any business. Any business has various stages, and each company after reaching the maturity stage have a stagnant growth rate. The forecasting period of the company depends on growth stages like early, high, stable and perpetuity growth rate. The forecasting period needs to determined carefully because different types of firm have different life growth cycle. The small companies have a higher growth rate since they grow faster than the more mature companies and are more to acquisition or bankruptcy. So analyst need to study the business and its nature to determine the forecasting period. Once the forecasting period is decided the analyst then project the financial statements and its supporting schedules like the working capital schedule, depreciation schedule, shareholder’s equity schedule debt schedule etc. In the Income Statement the most crucial part to be forecasted is the top line growth that is the revenue and sales figures. Various factors are considered while forecasting the top-line growth like the economy’s growth, the industry growth and the company historical growth. Once the forecasted income statement is prepared, the analyst needs to prepare the forecasted balance sheet and cash flow statement.

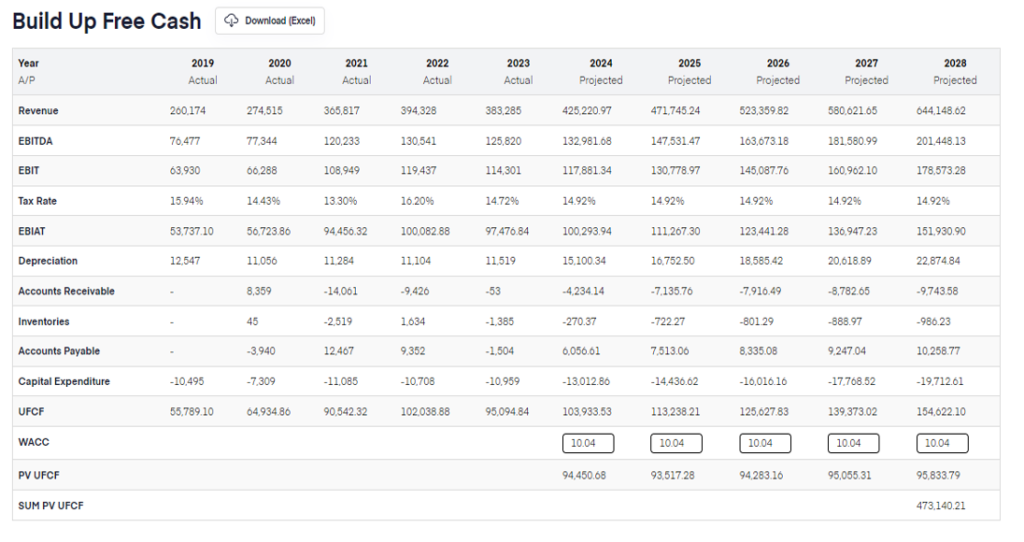

2. Calculation of the Free Cash Flow to Firm (FCFF)

Once the financial statements are forecasted the next step is to calculate the free cash flow to firm. Free cash flow is the cash left with the company after paying for all the operating expenses and capital expenditures. This FCFF is used by the company to grow by developing new facilities, launching and developing new products, conducting a share buyback or paying dividends to its shareholders. FCFF strengthens the financial flexibility of the company as it enhances the company’s ability to generate money out of its business and can be used by the company to pay off its existing debt or to increase the shareholder’s value.

Formula to calculate FCFF = Earnings before Interest and Taxes * (1- tax rate) + Non- cash charges+ Changes in Working Capital – Capital Expenditure

Points to note:

- Here we reduce the tax effect from the EBIT

- Non-cash charges include depreciation and amortization since these are not actual cash outflow

- Changes in the working capital can be either inflow or outflow

- Capital Expenditure is critical to determine the Capex required to support the business sales and margin in the forecast.

We can get all the components to calculate the FCFF from the projected financial statements.

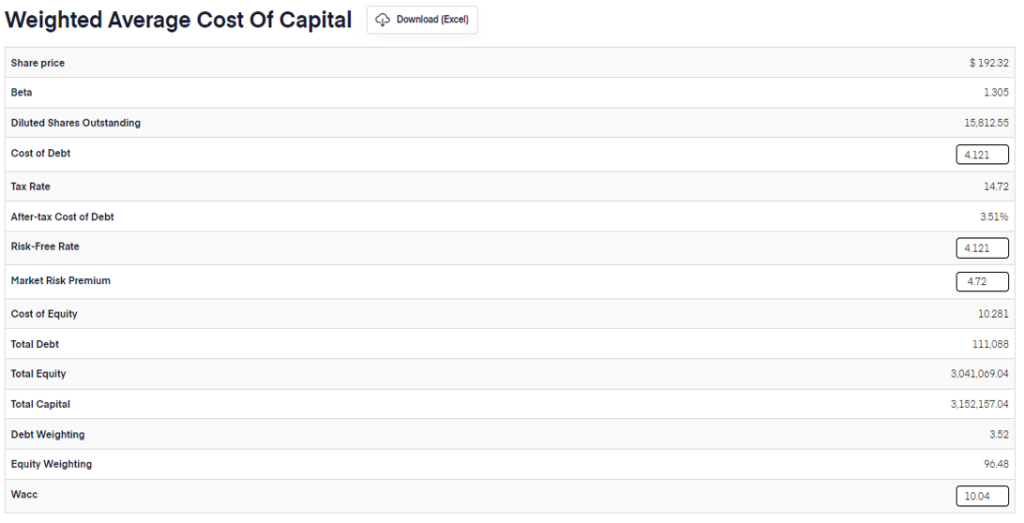

3. Calculation of the Discount Rate

Once the FCFF has been calculated for the forecasted period determined in step 1, the next step is to find the present value of the FCFF using the discount rate. Though there are several ways to calculate the discount rate, the most appropriate method is to use the weighted average cost of capital method. To use the weighted average cost of capital method we would require to calculate the market value of the debt and equity and cost of equity and cost of debt. The cost equity can be calculate using several methods the most common method being the Capital Asset Pricing Model (CAPM). As per CAPM, the cost of equity would be Re= Rf+ Beta (Rm-Rf), where Rf is the risk free rate of return, Rm is the market rate of return, Beta is the sensitivity of the stock to the market, and Re is the calculate cost of equity. The cost of debt is usually taken as the current market rate that the company pays on its current debt. The formula to calculate WACC is discussed in the article above.

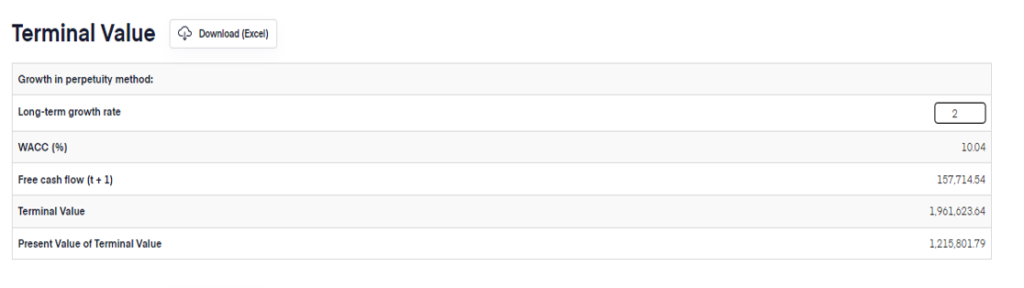

4. Calculation of the Terminal Value

Before finally calculating the discounted cash flow for a business we calculate the terminal value. The most common method for the calculation of the terminal value is to apply the perpetuity method using the Gordon Growth Model. The formula to calculate the terminal value is as follows:

Terminal Value= Projected cash flow of the final year * (1+ Indefinite growth rate)/ (Discount rate – Long term cash flow growth rate)

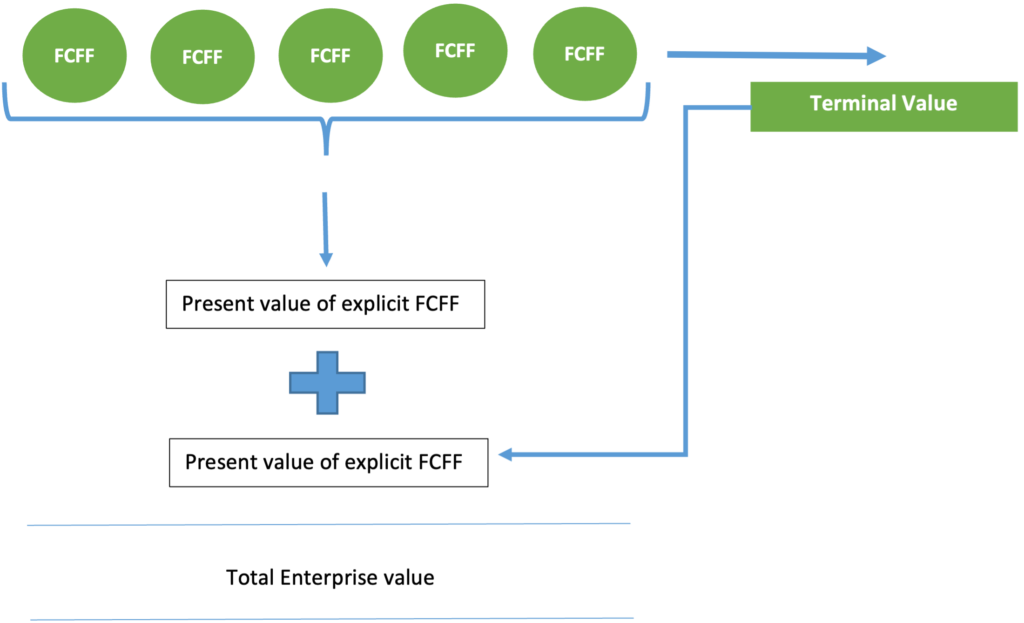

5. Calculation of the Present Value

Once the FCFF and the terminal value is determined we have to find the present value of both the FCFF and terminal value. The present value is calculated using the NPV or XNPV formula in excel. The calculation of projected cash flow is divided into 2 parts:

- The explicit period: that is the period for which the free cash flow to firm is calculated

- The period after the explicit period

For example, we are preparing a forecast for 5 years starting from the year 2024

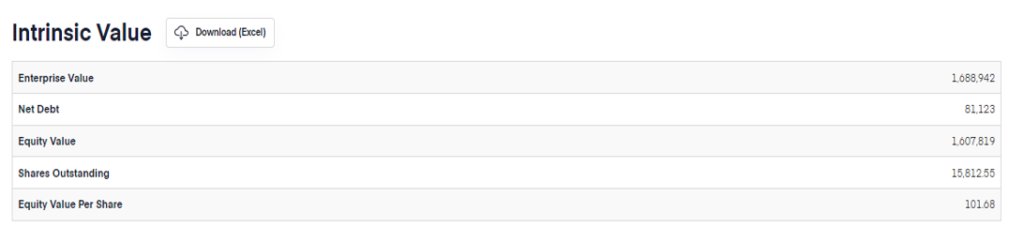

6. Adjustments to be made in the Enterprise value

For all the non-core assets and liabilities that have not been considered in the free cash flow projections, adjustments to the DCF valuations are made. One has to adjust valuation by subtracting unusual liabilities or adding unusual assets to find the adjusted fair equity value.

Below discussed are some of the common adjustments to the cash flows:

| Items | Adjustments to DCF |

| Investments and Associates | Market value or Estimated value |

| Net Debt( Total Debt-Cash) | Market Value |

| Minority Interest | Market value or Estimated value |

| Operating Lease Liabilities | Estimated Value |

| Overfunded/Underfunded pension liabilities | Market Value |

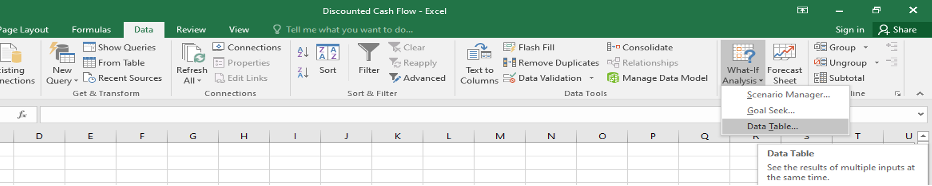

7. Conducting Sensitivity Analysis

The final step in the DCF Calculation model is to calculate the output’s scenario and sensitivity analysis. Since the DCF model is based on assumptions it is important to check the model against the changes in assumptions. The two most important assumptions that affect the valuation are:

- WACC i.e the weighted average cost of capital

- Infinite growth rate

Hence the output needs to be checked against the changes in these two assumptions. We can do the sensitivity analysis in excel using the Data Table from the what if analysis option in the forecast section of the Data tab.

ADVANTAGES OF DISCOUNTED CASH FLOWS

DCF is one the most used valuation model to find whether an investments future return is worth the cost of an investor and is used in practically to find the present value in all those cases where the cash flow generation in future is involved. Some of the advantages of the DCF method are as follows:

- It includes projections of the future financial statements of the company and the expectations a company have about the returns on investment.

- It helps calculate the Internal Rate of Return (IRR) on a company’s investments

- It provides a detailed description of various assumptions used by the company about its future cash flows

- It helps to evaluate a stock investment decision to the merger and acquisition decisions. Basically wherever the cash flow in future can be reliably estimated DCF method can be used for valuation.

- The projections in the DCF method can be tweaked to provide different end results using the what- if- scenario function. This helps the decision makers make more informed decisions about the investment or the project and what can be the result if the assumption taken by them changes for good or bad.

DISADVANTAGES OF DISCOUNTED CASH FLOWS

Some of the limitations of the Discounted Cash Flow model are as follows:

- One of the major limitation is that this model is based on assumptions of future cash flows, discount rate and growth rate and not the actual figures. As a result of this the end DCF is also an estimate figure. Estimates can never be relied upon completely as they are bound to change and subject to many external factors like inflation, micro and macro- economic factors not in the control of the company.

- The future cash flows of the company rely on various internal and external factors. The internal factors like change in the management or processes in future, any unforeseen losses faced by the company and the external factors like economy, technology, political changes and competition in the market have a great impact on the future cash flows of the company.

- The companies and investors should not rely solely on the DCF model to take major decisions. They should also conduct industry comparative analysis and study the past trends to take a more informed decision.

- Since DCF is based upon estimation of future cash flows, all those projects were future cash flows cannot be estimated should not be considered for DCF valuation.

DISCOUNTED CASH FLOW VS. NET PRESENT VALUE

These two concepts though not same are very closely related to each other. NPV is a step beyond the DCF calculation. Once we perform all the 7 steps as discussed above and find the sum total of the present value of the future cash flows, NPV then deducts the upfront cost of the investment or the money spent today from the DCF. Let’s understand this with the help of an example:

We are evaluating an investment opportunity that would generate a future cash flow of $200 per year for five years and the discount rate is 10%. We would take two scenarios were the Initial cost of investment in the opportunity is

Our goal is to calculate

- the present value of the Investment returns today and

- decide whether to invest in the opportunity or not.

Solution: To calculate the present value of the Investment returns we use the DCF model of valuation.

| Year | Cash Flow | Discounting factor | Present Value |

| 1 | 200 | 0.909090909 | 220 |

| 2 | 200 | 0.826446281 | 242 |

| 3 | 200 | 0.751314801 | 266.2 |

| 4 | 200 | 0.683013455 | 292.82 |

| 5 | 200 | 0.620921323 | 322.102 |

| Total | 1343.122 |

So from the above table we get DCF as $1343.122.

However, this figure alone cannot help us decide whether to go for the investment opportunity or not. Hence, we need to calculate the NPV of the project to decide whether to invest or not.

Scenario 1: Initial Investment cost is $1100

NPV= Present value of the discounted cash flow – the initial investment cost

= $1343.122 – $1100

= $243.122

Since the NPV is positive, the investor can expect to get return in excess of their initial cost and hence the decision should be to “Invest” in the opportunity.

Scenario 2: Initial Investment cost is $1500

NPV= Present value of the discounted cash flow – the initial investment cost

= $1343.122 – $1500

= -$156.878

Since the NPV is negative, the investor can expect to return less than their initial cost and hence the decision should be to “Not to Invest” in the opportunity.

DCF FORMULA IN EXCEL

In MS Excel the DCF can be calculated using two functions.

- NPV Function

=NPV (discount rate, series of cash flows)

According to this formula it is assumed that the cash flows are evenly spread across the projected period whether the period be in years, months or quarter.

- XNPV Function

=XNPV (discount rate, series of all cash flows, dates of all cash flows)

This is the time adjusted NPV formula. The cash flows may be received over irregular time periods and the XNPV function is used to calculate the DCF for such scenarios. XNPV is especially useful in financial modeling where a company is acquired in the middle of the year. For example, if the investment is made on 15th of Oct, and the 1st cash flow is on 31st of Dec and from then onwards at the end of each calendar year, then XNPV is the best function to calculate DCF.

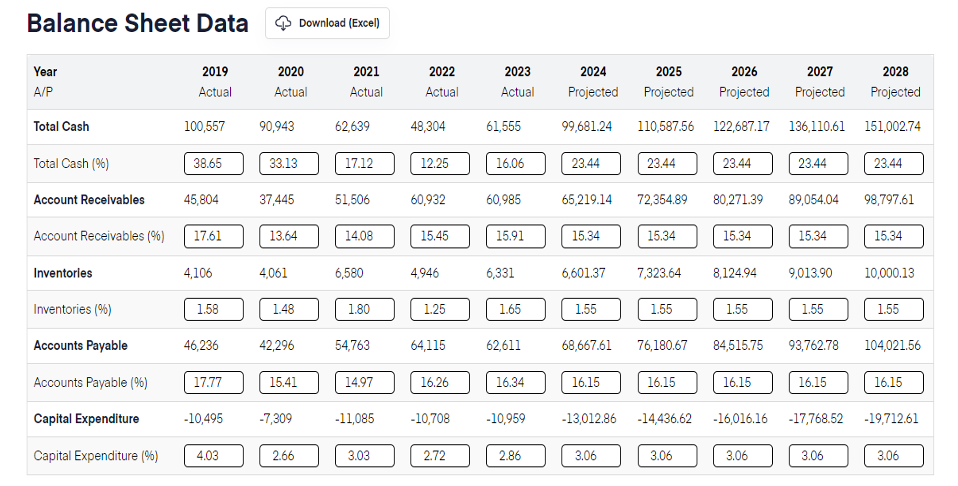

REAL LIFE EXAMPLE OF VALUATION USING THE DCF METHOD

Let’s take the example of Apple Inc. and show the DCF valuation done for it.

Source Images: https://site.financialmodelingprep.com/discounted-cash-flow-model/AAPL

- Preparation of the forecasted Financial Statements

- Calculation of the Discount Rate

- Calculate the Free Cash Flow

- Calculate the Terminal Value

- Calculate the Intrinsic Value

This valuation data is taken as on 07/12/2023 when the Apple Inc.’s share price is $192.32. Since the Equity value per share as per DCF valuation is $101.68, the share of Apple Inc. is overvalued and the decision should be “Sell” the investment if an investor already has Apple Inc.’s share or “Not to Invest” for a new investor.

Conclusion : In summary, DCF Calculation is a simple mathematical formula to arrive at the potential share value of a company estimating the future cash flows generation potential of the company.

You can also view this post on our LinkedIn page below:

6 thoughts on “DCF Calculation – a scientific valuation methodology”

[…] value of XYZ Corporation. This can be done using various methods such as discounted cash flow (DCF Calculation) analysis, comparable company analysis, or precedent transaction […]

[…] method is to calculate the discounted cash flow – DCF Calculation – method. This technique begins with the net income from the most recent fiscal year. It then […]

very informative articles or reviews at this time.

Good post! We will be linking to this particularly great post on our site. Keep up the great writing

Attractive section of content I just stumbled upon your blog and in accession capital to assert that I get actually enjoyed account your blog posts Anyway I will be subscribing to your augment and even I achievement you access consistently fast

You did a great job. I will definitely digg it and personally recommend it to my friends. I’m sure they’ll benefit from this site.

Comments are closed.