INTRODUCTION

The decision of how to finance a company’s growth is a critical balancing act—one that can shape its financial future and overall success. Businesses rely on both debt and equity capital structure to fund day-to-day operations, invest in capital expenditure, or finance strategic acquisitions. However, each option carries its own trade-offs. Debt offers cost advantages but increases financial risk, while equity dilutes ownership but provides flexibility. The challenge for managers is finding the ideal balance between these two funding sources to craft a capital structure that supports long-term growth. In this article, we explore how companies navigate these choices to fuel their expansion while managing financial risks effectively.

WHAT IS CAPITAL STRUCTURE?

Capital structure denotes how a company funds its overall operations and growth by utilizing various sources of financing. These funds generally come from two key avenues: debt (loans or bonds) and equity (issued shares). While both methods bring in needed capital, they carry different costs and risks.

Debt entails obtaining funds that need to be repaid gradually, typically along with interest. It’s a cheaper source of finance since interest payments are tax-deductible, lowering the company’s tax bill. However, it comes with the risk of default if the company cannot meet its repayment obligations.

In contrast, equity signifies a stake or ownership interest in the company. Selling shares does not require repayment or incur interest. Instead, shareholders receive dividends, and their shares may appreciate as the company grows. However, issuing equity is typically more expensive than taking on debt. This is because shareholders demand a higher return for the greater risk they assume, as they are only rewarded if the company performs well. Additionally, issuing too much equity dilutes existing shareholders’ ownership, reducing their control over the company.

The capital structure of a company is often expressed as a ratio, representing the proportion of debt and equity in its financing. There are two methods to calculate the capital structure of the company -One is using the book value of equity and the second is by using the market value of equity.

CAPITAL STRUCTURE CALCULATION

Method 1: Net Debt to Book Value of Equity

Capital Structure = Net Debt / (Net Debt + Equity)

Where, Net Debt= Debt + Debt Equivalent – Cash and Cash Equivalents – Marketable Securities

and, Equity = Book value of Equity + Book value of Equity Equivalents

vs

Method 2: Net Debt to Market Value of Equity

Capital Structure = Net Debt / (Net Debt + Equity)

Where, Net Debt= Debt + Debt Equivalent – Cash and Cash Equivalents – Marketable Securities

and, Equity = Market value of Common Equity (Market Capitalization) + Market value of Equity Equivalents

This ratio helps businesses understand the mix of debt and equity they are using to fund their operations and growth. Maintaining the right balance is crucial for optimizing financial health and minimizing risk.

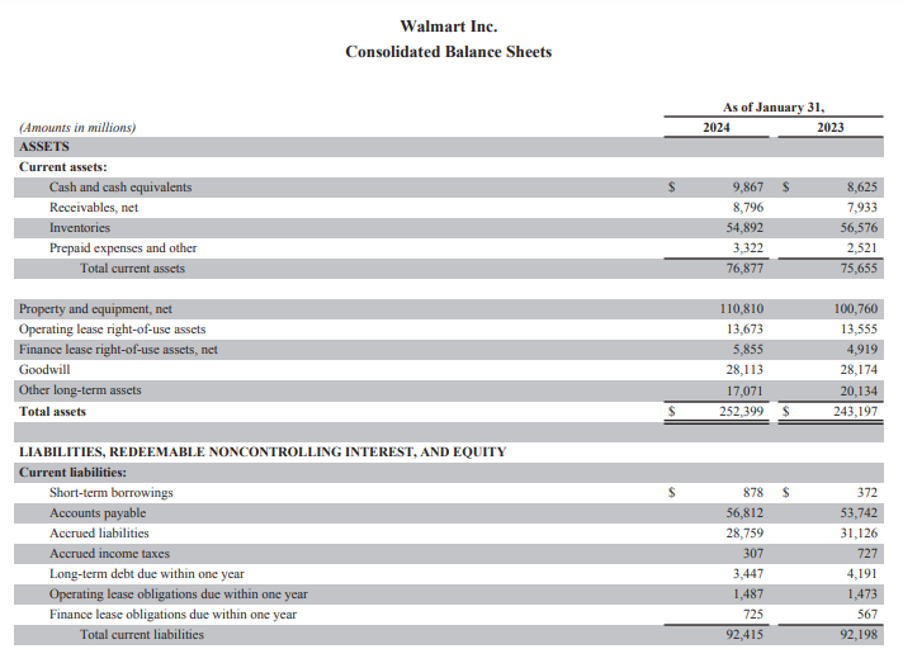

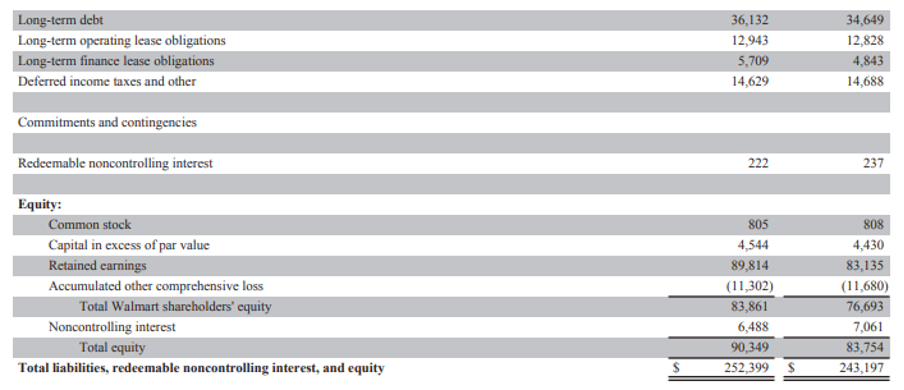

For example, let’s see the calculation of Capital Structure of Walmart Inc. (both the methods) from the financial statements below.

From above we can see that the company has:

Method 1:

Debt = ($878 + $3,447 +$36,132) mn

= $40,457 mn

Debt Equivalents (includes leases) = ($1,487 +$725 + $12,943 +$5,709) mn

= $20,864 mn

Cash and Cash Equivalents = $9,867 mn

Net Debt= ($40,457+$20,864- $9,867) mn

= $51,454 mn

Book value of Equity = $83,861 mn

Equity Equivalents (Non controlling interest) = $6,488 mn

Total Capital= Net Debt + Book value of Equity and Equity Equivalents

= ($51,454 + $83,861 + $6,488) mn

= $1,41,803 mn

Capital Structure (Book Value) = Net Debt/ (Net Debt + Equity)

= $51,454 mn/ $1,41,803 mn

= 0.36

Walmart Inc.’s debt-to-capital ratio of 0.36 means that 36% of the company’s capital is financed through debt, with 64% coming from equity. This indicates a balanced approach, where the company uses more equity than debt to fund its operations. While a lower reliance on debt reduces financial risk, it also limits the potential tax advantages that come with leveraging debt.

**

Method 2:

Net Debt (from above) = $51,454 mn

Market Value of Equity = Current share price * no. of outstanding shares

= 80.81*8,040 mn

= $6,49,712.40 mn

P/B ratio = Current Market price per share/ Book value per share

= $80.81/$10.51

= 7.69

Market Value of Equity Equivalents= NCI at book value*P/B ratio

= $6,488 mn* 7.69

= $49,885.37 mn

Market Value of Equity and Equity Equivalents = $6,49,712.40 mn + $49,892.72 mn

= $6,99,605.12 mn

Total Capital (at market value) = $51,454 mn + $6,99,605.12 mn

= $7,51,059.12 mn

Capital Structure (market value) = Net Debt/ (Net Debt + Equity)

= $51,454mn/$7,51,059.12mn

= 0.07

A capital structure of 0.07 for Walmart indicates that only 7% of the company’s total capital comes from debt, with the remaining 93% coming from equity. This low ratio suggests that Walmart relies primarily on equity financing rather than borrowing, reflecting a strong financial position with minimal reliance on debt to fund its operations and growth.

**

USAGE OF THE ABOVE TWO METHODS TO CALCULATE CAPITAL STRUCTURE

Credit rating agencies, banks, and other financial institutions mostly calculate Capital Structure using Method 1 discussed above taking the value of equity based on the book value. However, the company internally for valuation and budgeting purposes mostly uses Method 2, since the Market value reflects real-time stock prices, incorporating investor sentiment, market conditions, and future growth potential, while book value only accounts for historical costs. Market value better represents future growth prospects, giving a clearer idea of a company’s true worth and profitability potential. Additionally, Method 2 is more relevant to investors, as it reflects the price they are willing to pay for equity and captures intangible assets like brand value that book value may overlook.

For Walmart, two methods were used to assess its capital structure. Method 1, which uses the book value of equity, resulted in a debt-to-capital ratio of 0.36, meaning 36% of the company’s capital is financed by debt, with 64% funded by equity. This indicates a moderate reliance on debt, offering a balanced approach between leveraging debt and maintaining financial stability. In contrast, Method 2, using the market value of equity, yielded a much lower ratio of 0.07. This indicates that only 7% of Walmart’s total capital comes from debt, with 93% financed through equity. The result from Method 2 highlights Walmart’s strong financial position, demonstrating a heavy reliance on equity rather than borrowing, reducing financial risk and emphasizing stability.

HOW DOES THE CAPITAL STRUCTURE OF A COMPANY WORK?

A company’s capital structure refers to the mix of debt and equity it uses to fund its operations, growth, and investments. Each component plays a different role. Imagine you’re starting an eco-friendly electric bike company and need funds to grow. You can borrow $100,000 from a bank (debt), which requires regular interest payments but gives you quick access to capital with tax benefits. You also sell 30% of your company to investors for $200,000 (equity), providing more funds without repayment pressure, but reducing your ownership. Your capital structure is this mix of debt and equity—balancing both allows you to fund growth without taking on too much debt or giving away too much control.

WHAT IS AN OPTIMAL CAPITAL STRUCTURE?

An optimal capital structure is the ideal mix of debt and equity financing that minimizes a company’s overall cost of capital while maximizing its value. In other words, it’s the combination of debt and equity that strikes the best balance between risk and return, enabling the company to grow and operate efficiently.

Achieving an optimal capital structure involves:

- Minimizing the Weighted Average Cost of Capital (WACC): The company aims to lower its overall cost of financing by balancing cheaper debt (with tax advantages) and the higher cost of equity (due to the risks shareholders take). A lower WACC means a more cost-efficient capital structure.

- Managing Financial Risk: Too much debt increases the risk of bankruptcy or default during difficult financial times, while too much equity can dilute ownership and reduce the return for shareholders. An optimal structure keeps financial risk at a manageable level.

- Maximizing Firm Value: By reducing financing costs and risk, the optimal capital structure can enhance the company’s overall value in the eyes of investors.

Different industries and companies have different optimal capital structures based on their business models, market conditions, cash flow stability, and risk tolerance. For example, a capital-intensive company like Delta Airlines might rely more on debt to finance large fixed assets like planes, whereas a tech company like Microsoft may favour equity for greater flexibility and less financial risk.

HOW IS CAPITAL STRUCTURE USED TO CALCULATE COST OF CAPITAL?

The cost of capital is calculated using a company’s capital structure, which is the mix of debt and equity it uses for financing. The most common way to calculate this is through the Weighted Average Cost of Capital (WACC). This metric indicates the average return that both debt and equity holders expect, adjusted according to their respective shares in the capital structure.

WACC Formula Using Capital Structure:

WACC= {E/(E+D) × Cost of Equity} + {D/(E+D) × Cost of Debt × (1−Tax Rate)}

Where:

E = Market value of equity (the proportion of capital raised through issuing shares)

D = The market value of debt, representing the part of capital obtained through loans or bonds.

Cost of Equity = The return expected by shareholders, often estimated through the Capital Asset Pricing Model (CAPM)

Cost of Debt = The effective interest rate paid on the company’s debt

Tax Rate = The corporate tax rate, which reduces the cost of debt due to tax-deductible interest payments

Example:

Let’s say a company has 60% equity and 40% debt in its capital structure. The cost of equity is 12%, the cost of debt is 6%, and the tax rate is 25%. The WACC calculation using the capital structure would be:

WACC= (0.60 × 12%) + (0.40 × 6% × (1−0.25)) = 9%

This calculation provides the company’s total capital cost, reflecting its distinct capital structure. It is a critical metric for evaluating investment opportunities and determining the minimum return a company must earn to satisfy its investors.

CONSIDERATIONS WHEN SELECTING THE OPTIMAL CAPITAL STRUCTURE

When choosing the optimal capital structure, companies must carefully consider several factors that influence the balance between debt and equity. These factors ensure that the chosen structure minimizes costs, manages risks, and maximizes long-term value. Here are key considerations:

| Factor | Key Considerations |

| Cost of Debt vs. Cost of Equity | Debt financing is generally cheaper because interest payments are tax-deductible, lowering the effective cost of borrowing. However, debt comes with fixed repayment obligations. Equity is more expensive, as shareholders expect a higher return to compensate for the risk they bear, but it doesn’t require repayment or interest payments. |

| Business Risk | Companies with stable, predictable cash flows (e.g., utilities) can handle more debt, as they are better equipped to make regular interest payments. Companies with unpredictable or volatile earnings (e.g., tech startups) are more likely to favor equity to avoid the risk of default and financial instability. |

| Financial Flexibility | Maintaining a balanced capital structure ensures a company can access additional funds when needed. Excessive debt can limit a firm’s borrowing capacity for future needs or growth opportunities. A flexible capital structure enables companies to adapt to market conditions and secure funding when it is beneficial. |

| Tax Considerations | Interest payments on debt reduce taxable income, creating a tax advantage (tax shield). However, if a company over-leverages, the increased financial risk may outweigh these tax benefits, leading to potential financial distress or bankruptcy. |

| Control and Ownership Dilution | Issuing new equity dilutes the ownership of existing shareholders, reducing their control over the company’s decision-making. Conversely, debt financing enables owners to maintain control of their company while obtaining capital. However, the need to meet debt obligations increases financial risk. |

| Market Conditions | During periods of low interest rates, debt becomes an attractive financing option due to lower borrowing costs. Conversely, when stock markets are booming, companies might prefer to issue equity to take advantage of high stock prices and investor demand. |

| Industry Norms | Different industries have different capital structure norms based on their risk profiles and capital needs. For example, capital-intensive industries like airlines or utilities often use higher levels of debt to finance large asset purchases. In contrast, tech companies tend to rely more on equity due to their higher growth potential and riskier business models. |

| Growth Opportunities | High-growth companies often rely more on equity because they need to reinvest their earnings into expansion rather than paying off debt. Mature companies with slower growth and more predictable cash flows might prefer debt to finance operations, as they can handle the regular interest payments. |

| Regulatory and Legal Constraints | Some industries or countries impose legal or regulatory restrictions on the amount of debt a company can take on. For example, financial institutions must comply with regulatory capital requirements, which may limit the use of debt. |

CAPITAL STRUCTURE BY INDUSTRY

Capital structure varies across industries because each sector faces different financial risks, growth opportunities, and operational needs. Companies in capital-intensive industries like automobiles or utilities often rely heavily on debt because their stable cash flows allow them to handle regular interest payments. In contrast, high-growth industries like e-commerce or technology prefer equity to finance innovation and expansion, as debt could burden them with fixed obligations. The optimal balance between debt and equity is determined by factors such as cash flow stability, business risk, and industry norms, which shape a company’s financial strategy.

To explain how capital structure varies according to industry type, we can examine the capital structure data of two companies each from two distinct industries—one that relies heavily on debt financing and another that primarily uses equity financing.

Check out the detail calculation of capital structure for the below examples/

| Capital Structure (Debt/Total Capital) for E-Commerce Industry for 2023 (as on 22nd Oct 2024) | |||

| Particulars | Walmart | Amazon | |

| Capital Structure based on Book value of Equity | 0.36 | 0.32 | |

| Capital Structure based on the Market value of Equity | 0.07 | 0.03 | |

| Capital Structure (Debt/Total Capital) for Automobile Industry for 2023 (as on 22nd Oct 2024) | |||

| Particulars | Ford Motors | General Motors | |

| Capital Structure based on Book value of Equity | 0.72 | 0.60 | |

| Capital Structure based on the Market value of Equity | 0.72 | 0.64 | |

Observations: The table provides an analysis of the debt-to-total capital ratio for companies in the e-commerce and automobile industries for 2023, based on both book value and market value of equity. This ratio represents the proportion of a company’s capital that is financed through debt as opposed to equity.

In the e-commerce industry, Walmart shows a debt-to-capital ratio of 0.36 based on its book value, meaning that 36% of its capital structure is financed by debt, with the remaining 64% by equity. However, when considering Walmart’s market value, the ratio drops significantly to 0.07, indicating that only 7% of its capital comes from debt, highlighting Walmart’s reliance on equity financing when market capitalization is considered. Similarly, Amazon has a ratio of 0.32 based on book value, suggesting that 32% of its capital is financed by debt. When measured by market value, Amazon’s ratio decreases drastically to 0.03, showing that just 3% of its capital structure relies on debt, reflecting Amazon’s low dependence on debt relative to its vast market value.

In the automobile industry, Ford Motors has a much higher debt-to-capital ratio of 0.72 based on both book value and market value, meaning that 72% of its capital structure is debt-financed, reflecting a heavy reliance on debt. General Motors, on the other hand, has a ratio of 0.60 based on book value, indicating that 60% of its capital comes from debt, while the ratio increases slightly to 0.64 when using market value. This suggests that the automotive industry, due to its capital-intensive nature, relies more heavily on debt financing compared to equity, regardless of whether equity is measured by book or market values.

In summary, e-commerce companies like Walmart and Amazon exhibit much lower debt-to-capital ratios when based on market value, demonstrating their reliance on equity financing. In contrast, automobile companies like Ford and General Motors maintain higher ratios, reflecting their heavier use of debt financing in their capital structure.

HOW IS CAPITAL STRUCTURE USED BY ANALYSTS AND INVESTORS?

Analysts and investors use capital structure to evaluate a company’s financial health, risk, and growth potential. A high Debt-to-Equity (D/E) ratio signals greater financial risk, while a low D/E ratio suggests stability. They assess a company’s Weighted Average Cost of Capital (WACC) to determine how efficiently it raises funds and consider whether the company can cover debt payments with earnings. Capital structure affects key ratios, such as the Interest Coverage Ratio, which measures how well a company can meet its debt obligations, and the Return on Equity (ROE), which shows how effectively a company is using equity to generate profits. Capital structure also impacts investment decisions—risk-tolerant investors may favor debt-heavy companies for higher returns, while conservative investors prefer equity-heavy firms for stability. Analysts also factor capital structure into company valuations to gauge future growth potential.

WHY DO COMPANIES DO RECAPITALIZATION?

Recapitalizing a business and balancing capital structure are interconnected strategies that help companies maintain financial stability and optimize their cost of capital over time.

In the long run, a company’s capital structure naturally adjusts like demand and supply, balancing debt and equity. Too much debt brings risks of financial distress and higher borrowing costs, while too much equity dilutes ownership and increases the cost of capital. To achieve equilibrium, companies adjust their financing over time, finding the optimal mix that balances risk, flexibility, and profitability.

Recapitalization is a practical way to realign this balance when the capital structure skews too far in one direction. If a company is overly dependent on equity, it might issue new debt to leverage tax benefits or buy back shares to reduce dilution. Conversely, if the company is burdened with too much debt, it can issue new equity or swap debt for equity to lower financial risk and improve cash flow.

Together, balancing capital structure and recapitalizing are essential tools for companies to manage financial health, seize growth opportunities, and respond to market conditions, ensuring long-term success.

Here are a few real-life examples of recapitalization or restructuring by U.S. companies:

- General Motors (GM): After the 2008 financial crisis, GM underwent a major restructuring as part of its government bailout. The company swapped much of its debt for equity, with the U.S. government and other stakeholders receiving significant ownership in exchange for reducing GM’s debt burden. This allowed the company to stabilize and regain profitability.

- Tesla: In 2019, Tesla raised $2.7 billion through a combination of debt and equity offerings to strengthen its balance sheet and fund its expansion, including new factories and production facilities. This recapitalization helped the company manage its debt load while continuing to grow aggressively.

- Hertz Global Holdings: In 2021, Hertz emerged from bankruptcy by restructuring its debt and raising new equity through a group of investors. This allowed Hertz to reduce its massive debt load, exit bankruptcy, and refocus on its operations with a more balanced capital structure.

- Dell Technologies: In 2018, Dell issued new shares to simplify its capital structure and buy out shareholders of VMware, its subsidiary. This was part of Dell’s effort to reduce its debt and regain full control over VMware, balancing its financing and ownership structure.

These examples show how companies use recapitalization to adjust their financial strategies, reduce debt, or raise equity, ultimately strengthening their operations and long-term outlook.

CAPITAL STRUCTURE IN MERGERS AND ACQUISITIONS (M&A)

Capital structure plays a crucial role in mergers and acquisitions (M&A) by affecting how deals are financed, valued, and integrated. Companies may use debt to leverage acquisitions, potentially amplifying returns but also increasing financial risk, while equity financing can help avoid over-leveraging but may dilute existing ownership. The capital structures of both the acquiring and target companies influence their valuations; as high debt levels can lower a company’s value due to perceived risk. During due diligence, understanding the capital structure helps assess financial stability and identify potential liabilities. Furthermore, it informs integration strategies and impacts post-merger performance; a balanced capital structure enhances cash flow and return on investment, whereas an imbalanced structure can lead to financial strain.

Notable examples include AT&T’s debt-financed acquisition of Time Warner and Amazon’s cash-based acquisition of Whole Foods, highlighting the different approaches to capital structure in M&A. In summary, a thoughtfully planned capital structure is crucial for the success of M&A transactions and sustainable long-term growth.

CONCLUSION

Choosing the right capital structure is crucial in the quest for growth and profitability. The ideal debt-to-equity mix is different for every company, depending on its industry, financial health, and risk tolerance. Smart decision-making in this area can reduce financial risks, optimize returns, and keep the company competitive in the long run. By carefully balancing the benefits and risks of both debt and equity, companies can pave the way for sustainable growth and profitability.