INTRODUCTION

In the dynamic business landscape, understanding the distinction between Capital Expenditures (Capex) and Operating Expenditures (Opex) is crucial for a company’s financial health. Take Tesla, for instance. The electric vehicle giant allocates billions in Capex to build and expand its Gigafactories, fueling production capacity and innovation. Meanwhile, it also manages significant Opex, such as maintaining its global service infrastructure and ongoing research and development efforts. This strategic balance allows Tesla to pursue its ambitious objectives while managing rapid growth and technological evolution challenges. Similarly, Verizon Communications invests heavily in Capex to expand its 5G network, while simultaneously managing Opex for maintaining its extensive telecommunications infrastructure. In this article, we will explore the concepts of Capex vs Opex, using Tesla and Verizon as core examples, to understand their accounting treatment, impact on financial statements and taxation, and the importance of maintaining a balance between these two expenditures.

WHAT IS CAPEX?

Capital Expenditures (Capex) involve the funds a company allocates to acquire, upgrade, or maintain its fixed assets, such as property, machinery, technology, and equipment. These expenditures are crucial for a company’s long-term growth and success. For instance, when Tesla invests in building a state-of-the-art Gigafactory, it’s making a Capex investment in physical assets that will enhance production capacity and innovation. Similarly, when Verizon Communications invests in expanding its 5G infrastructure, it’s engaging in Capex to strengthen its technological edge. Capex is not just about immediate spending—it’s about investing in a company’s future by enhancing its capabilities and competitive position. Although Capex often involves significant upfront costs, the long-term benefits include increased efficiency, capacity, and market strength, ultimately shaping the company’s trajectory and standing in the industry for years to come.

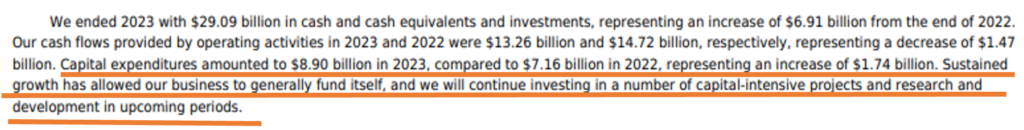

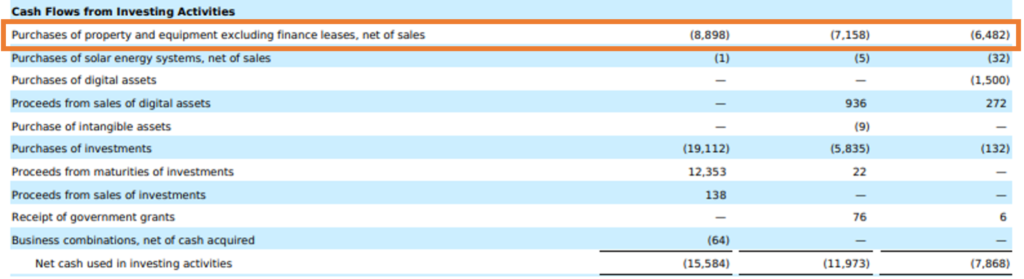

Let’s see various disclosures made by Tesla and Verizon Communications regarding its Capex in the annual reports.

- Tesla’s capex has increased by $1.74 billion in the year 2023 over the year 2022 due to various investments in various capital-intensive projects.

Source: Annual Report https://ir.tesla.com/_flysystem/s3/sec/000162828024002390/tsla-20231231-gen.pdf

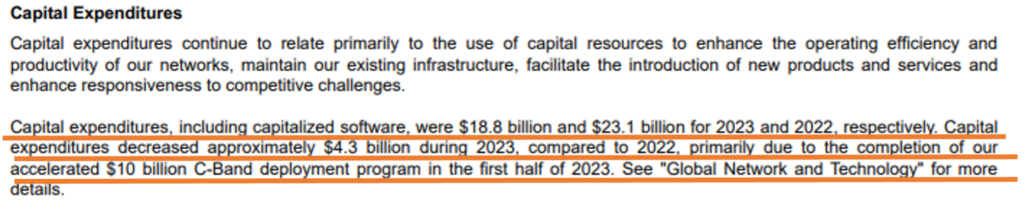

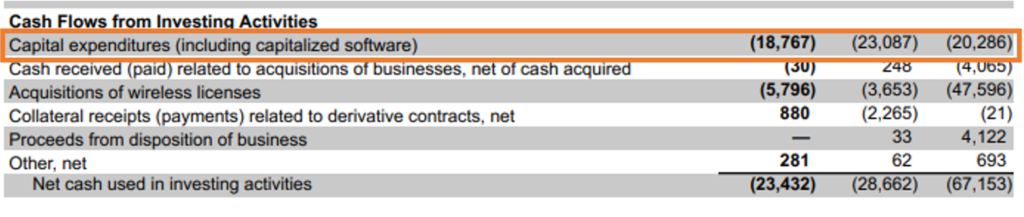

- Verizon’s capex has decreased by $4.3 billion in the year 2023 over the year 2022 due to the completion of Verizon’s accelerated $10 billion C-Band deployment program in the first half of 2023.

Source: Annual Report https://www.verizon.com/about/sites/default/files/2023-Annual-Report-on-Form-10k.pdf

WHAT IS OPEX?

Operating expenditure, or Opex, encompasses the daily costs required to keep a business running, such as employee salaries, utility bills, and the cost of sales or services. These are the ongoing, necessary expenses that ensure a company can function efficiently and meet customer demands. Opex is characterized by its recurring nature, its direct impact on a company’s cash flow, and its immediate influence on operational efficiency. For Tesla, Opex includes the costs associated with keeping its Gigafactories operational, such as electricity, employee wages, and the logistics of delivering vehicles to customers, as well as the cost of materials used in production. Similarly, for Verizon Communications, Opex covers expenses like maintaining its network infrastructure, employee wages, and the cost of services provided to customers. Efficient management of these expenditures is vital for both companies to sustain their operations, maintain service quality, and meet global demand.

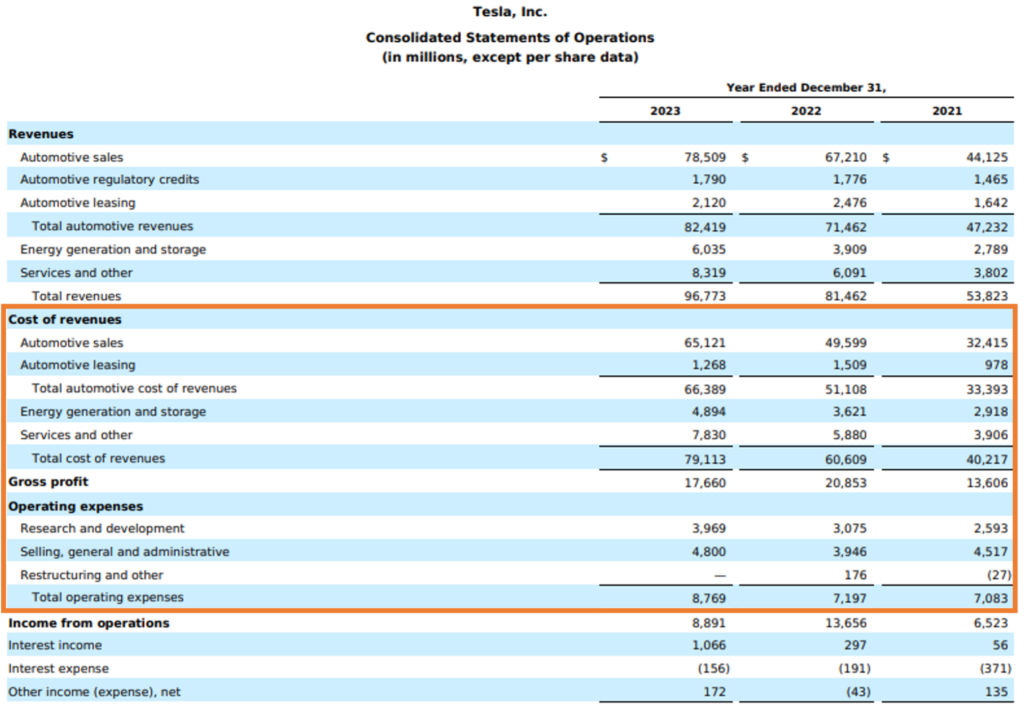

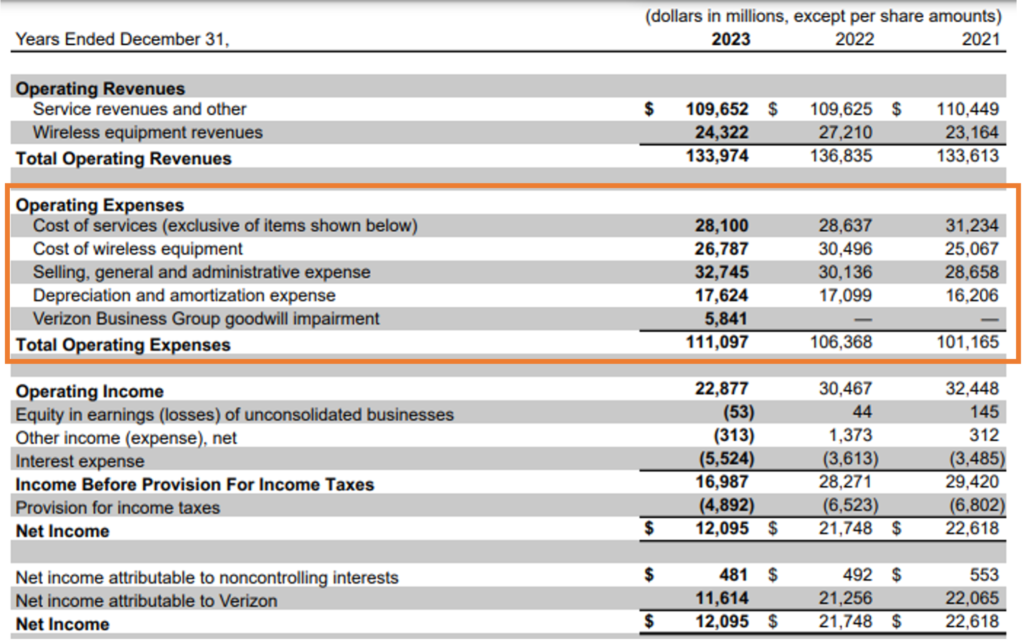

Different companies may present the opex differently in their Income Statements. Let’s see how Tesla and Verizon disclose their Opex in the Income Statement.

- From the Income Statement of Tesla, we find that the company has shown a part of the operating expenses as the cost of revenues before the calculation of gross profit and part of the operating expenses as R&D expense, Selling, general, and administrative expenses and restructuring and other expense under the head operating expenses.

Source: Annual Report https://ir.tesla.com/_flysystem/s3/sec/000162828024002390/tsla-20231231-gen.pdf

- From the Income Statement of Verizon, we find that the company has shown all of the operating expenses like cost of services, selling, general and administrative, and depreciation and impairment expenses under the head operating expenses in the Income Statement.

Source: Annual Report https://www.verizon.com/about/sites/default/files/2023-Annual-Report-on-Form-10k.pdf

ACCOUNTING TREATMENT OF CAPEX vs OPEX AND IMPACT ON THE FINANCIAL STATEMENTS & TAXATION OF THE COMPANY

Here’s a table that explains the accounting treatment of Capital Expenditures (Capex) and Operating Expenditures (Opex):

| Category | Capital Expenditures (Capex) | Operating Expenditures (Opex) |

| Initial Recording | Recorded as an asset on the balance sheet. | Recognized as an expense on the income statement. |

| Depreciation/Amortization | Depreciated (tangible assets) over the asset’s useful life. | Neither depreciated nor amortized; entirely expensed in the period it occurs. |

| Impact on Balance Sheet | Increases the asset’s value on the balance sheet. | Neither depreciated nor amortized; entirely expensed in the period it occurs. |

| Impact on Income Statement | Depreciation expense is recorded on the income statement over time, reducing net income gradually. | Directly reduces net income in the period incurred. |

| Impact on Cash Flow Statement | Shown under “Investing Activities” as cash outflow when the asset is purchased. | Shown under “Operating Activities” as cash outflow when the expense is incurred. |

| Tax Treatment | Depreciation is tax-deductible, reducing taxable income over the asset’s useful life. | Fully tax-deductible in the year the expense is incurred, reducing taxable income immediately. |

| Future Periods | Asset continues to be depreciated over future periods, impacting future income statements. | No impact on future periods once the expense has been recorded. |

RELEVANCE OF UNDERSTANDING CAPEX vs OPEX BY INVESTORS, ANALYSTS AND MANAGEMENT

Understanding the distinction between Capital Expenditures (Capex) and Operating Expenditures (Opex) is crucial for investors, analysts, and management because it provides insights into a company’s financial health, operational efficiency, and long-term growth potential. Here’s why it matters for each group:

1. Investors

- Financial Health and Risk Assessment: Investors use the distinction between Capex and Opex to gauge a company’s financial stability. High Capex indicates investment in long-term assets, which could signal growth potential or strain on cash flows if not managed well. Conversely, high Opex can show that the company is heavily investing in operations, but it might also raise concerns about efficiency if these expenses are not leading to profitability.

- Valuation and ROI: Capex influences the valuation models like Discounted Cash Flow (DCF) and Return on Investment (ROI). Understanding Capex helps investors assess the sustainability of future cash flows and the potential returns on their investment.

- Growth vs. Maintenance: Distinguishing between growth Capex (for expansion) and maintenance Capex (to sustain current operations) helps investors understand whether the company is focusing on expansion or merely maintaining its existing operations.

2. Analysts

- Financial Analysis and Ratios: Analysts examine Capex and Opex to calculate key financial ratios like the Capital Expenditure to Sales ratio or Operating Expense ratio. These metrics help in comparing companies within the same industry and understanding their cost structures.

- Earnings Quality: Understanding the split between Capex and Opex allows analysts to assess the quality of a company’s earnings. For instance, high Capex might mean lower free cash flow in the short term, but it could lead to higher earnings in the long term. On the other hand, high Opex might indicate higher immediate expenses but could also mean lower future liabilities.

- Forecasting: Capex and Opex are essential for forecasting future financial performance. Analysts use historical Capex and Opex data to predict future trends, making it easier to project earnings, cash flow, and potential growth.

3. Management

- Budgeting and Resource Allocation: Management needs to differentiate between Capex and Opex to make informed budgeting decisions. Understanding these expenditures helps in allocating resources effectively, ensuring that the company invests in long-term assets while also managing day-to-day operational costs.

- Cost Control and Efficiency: By analyzing Opex, management can identify areas where costs can be reduced or optimized. Effective management of Opex can improve operational efficiency and profitability. Similarly, prudent Capex decisions can enhance the company’s competitive position without overextending its financial resources.

- Strategic Planning: Understanding Capex and Opex is vital for strategic planning. Management uses Capex data to plan for future growth, such as expanding production capacity or entering new markets. Opex data helps in planning operational strategies, such as improving supply chain efficiency or reducing overhead costs.

BALANCING CAPEX vs OPEX

For most companies, striking the right balance between Capex and Opex is a critical component of their financial strategy. This balance depends on the nature of the business, its growth objectives, and its current financial position.

Take the motor automobile industry, for example, where Tesla invests heavily in both Capex and Opex. Tesla’s Capex includes massive expenditures on gigafactories and advanced manufacturing facilities, crucial for scaling production and developing new technologies. Simultaneously, Tesla allocates significant Opex towards research and development, software updates, and customer service to ensure continuous innovation and operational excellence.

Similarly, a tech company may prioritize Capex to invest in cutting-edge technology and infrastructure that will drive future growth. In contrast, a service-oriented business might focus more on optimizing Opex to ensure operational efficiency and customer satisfaction.

In recent years, the trend toward cloud computing and “as-a-service” models has blurred the lines between Capex and Opex. Companies increasingly opt to lease rather than buy assets, converting traditional Capex into Opex. This shift allows businesses to preserve cash flow, reduce upfront costs, and maintain flexibility.

CONCLUSION

Understanding the differences between Capex vs Opex is crucial for effective financial management. Capex represents long-term investments in assets that drive future growth, while Opex covers the day-to-day expenses necessary for business operations. Both types of expenditures are essential, but they require different approaches to budgeting, financial reporting, and strategic planning. By carefully balancing Capex and Opex, companies can optimize their financial performance, manage risks, and position themselves for sustained success.