A bank valuation exercise is no ordinary task. For example, Deutsche Bank, one of the world’s leading financial institutions, operates within a complex and highly regulated industry, making traditional valuation methods less effective. Investors, analysts, and regulators alike must delve deeper to understand the bank valuation, beyond its balance sheet numbers or earnings reports. This is where the Free Cash Flow to Equity (FCFE) method shines, offering a more tailored approach. Unlike non-financial companies, where valuation revolves around assets and operations, banks like Deutsche Bank are driven by capital adequacy, regulatory constraints, and their ability to generate sustainable shareholder value. The FCFE method considers these factors, providing insights into how much cash is truly available to equity holders after meeting all regulatory obligations. By focusing on Deutsche Bank, we can unravel the complexities of bank valuation and see how FCFE serves as a powerful tool in assessing its true worth amidst an ever-evolving financial landscape.

WHY BANK VALUATION MATTERS?

Understanding a bank’s value is crucial for several reasons: investment decisions, regulatory compliance, and strategic planning are just a few. Investors need to assess whether a bank’s stock is undervalued or overvalued, while regulators and management use valuation to ensure financial stability and optimal capital allocation. Accurate valuation also supports mergers and acquisition, helping to gauge fair market prices.

WHY IS BANK VALUATION MORE CHALLENGING THAN VALUING A NON-FINANCIAL FIRM?

Valuing banks is notoriously complex compared to non-financial firms due to several factors:

- Regulatory Environment: Banks are subject to rigorous regulations that influence their financial statements and performance metrics. These regulations can differ greatly between jurisdictions, making valuation more complex.

- Unique Financial Metrics: Banks operate on a different set of financial metrics, such as net interest margins and loan loss provisions, which aren’t as prevalent in non-financial companies.

- Asset Quality and Risk: The quality of assets, including loans and investments, and the associated risks play a critical role in valuation. These factors are often less transparent and harder to quantify.

- Business Complexity: Financial services companies like banks and insurance firms are inherently complex, making it challenging to define debt and reinvestment accurately. This complexity directly impacts cash flow estimation, which is fundamental to valuation.

- Regulatory Sensitivity: Banks are heavily regulated, and changes in regulatory frameworks can significantly affect their value. Regulatory requirements influence how much capital a bank needs to hold and can restrict or enhance a bank’s ability to generate cash flows.

- Unique Accounting Rules: The accounting standards that govern banks differ from those used by non-financial firms. Assets are frequently marked to market, meaning they are adjusted to reflect current market values. This frequent revaluation adds volatility and complexity to the balance sheet, making valuation more difficult.

METHODS OF BANK VALUATION

Bank valuation can be approached through various methods, each with its strengths and limitations:

- Price-to-Earnings (P/E) Ratio: This method uses the bank’s earnings to estimate its value, but it may not capture all nuances of a bank’s financial health.

- Price-to-Book (P/B) Ratio: This method compares a bank’s market value to its book value, providing insight into how much investors are willing to pay for the bank’s net assets.

- Dividend Discount Model (DDM): Suitable for banks with stable dividend payouts, this model values a bank based on its expected future dividends.

- Free Cash Flow to Equity (FCFE) Method: This method estimates the value of a bank by calculating the cash available to shareholders after accounting for all expenses, taxes, and reinvestment in regulatory capital.

FCFE METHODOLOGY OF BANK VALUATION EXPLAINED

The Free Cash Flow to Equity (FCFE) methodology is particularly useful for valuing banks because it emphasizes the cash flows available to equity shareholders, with a focus on regulatory capital requirements. In financial services firms like banks, capital adequacy is crucial, as they must maintain sufficient capital to meet regulatory standards. These requirements often necessitate reinvestment in regulatory capital, which reduces the free cash flow available to shareholders.

The simplified FCFE formula for banks is as follows:

FCFE = Net Income−Reinvestment in Regulatory Capital

Where:

- Net Income reflects the bank’s profits after all taxes have been deducted.

- Reinvestment in Regulatory Capital refers to the capital that banks are required to reinvest to grow in compliance with regulatory standards. This reinvestment is subtracted from net income, as it decreases the cash available for distribution to equity shareholders.

This formula is specifically designed for banks, as they don’t require substantial reinvestment in physical assets like manufacturing firms. Instead, the focus is on maintaining and reinvesting in regulatory capital, which is critical for ensuring solvency and covering potential losses in periods of financial stress.

Original FCFE Formula

In general, the FCFE formula for non-financial companies includes additional components such as working capital and capital expenditure. The original FCFE formula is:

FCFE=Net Income+Net Borrowing−Capital Expenditure−Change in Working Capital

Where:

- Net Borrowing is the net increase in debt.

- Capital Expenditure involves spending on long-term physical assets.

- Change in Working Capital represents the changes in short-term operational assets and liabilities.

For banks, the simplified version eliminates these components as they are less relevant, focusing instead on regulatory capital requirements, making it more suitable for financial services firms.

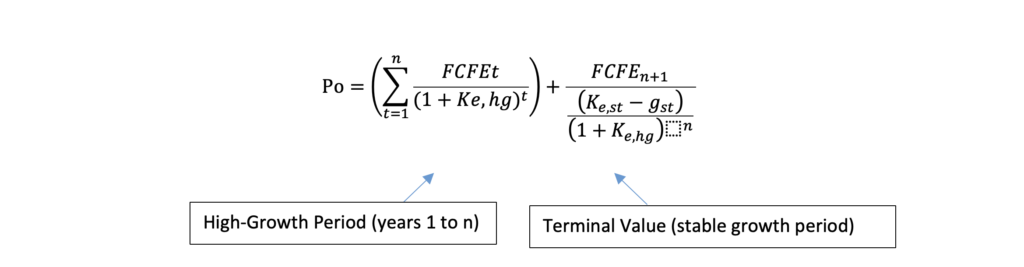

The two-stage growth model of FCFE is particularly effective when a bank is expected to experience a period of high growth followed by a stable, slower growth phase. This method allows for capturing the dynamic nature of a bank’s growth, especially when it transitions from rapid expansion to a more mature and steady phase. The model divides the valuation process into two phases: a period of high growth followed by a phase of stable growth.

The value of a bank’s equity using the two-stage FCFE growth model is calculated as:

Where:

- High-Growth Period (Years 1 to n):

During the initial phase, the bank is assumed to have a higher growth rate. The FCFE is calculated for each year and then discounted back to the present using the cost of equity during the high-growth phase Ke,hg. - Po = Current value of equity

- FCFEt = represents the free cash flow available to equity holders in year t

- Ke,hg= cost of equity throughout the high-growth phase

- n= Number of years of the high-growth period

- Terminal Value (Stable Growth Period):

At the end of the high-growth period, the terminal value represents the expected value of the bank once it enters a stable growth phase. The terminal value is calculated using - FCFEn+1= Free cash flow to equity in the first year of stable growth

- Ke,st = represents the cost of equity during the stable growth phase

- gst= Stable growth rate

Step-by-Step Process OF BANK VALUATION:

- Calculate FCFE during the high-growth phase

For each year in the high-growth phase (Years 1 through n), calculate the FCFE based on projected net income and reinvestment in regulatory capital. - Discount FCFE to Present Value

Discount each year’s FCFE back to the present using the cost of equity during the high-growth period, Ke,hg. - Calculate the Terminal Value

At the end of the high-growth phase, estimate the terminal value based on expected stable growth, and discount it to the present. - Sum the Present Values

The current equity value of the bank is derived by summing the discounted cash flows (dcf) from the high-growth phase and the present value of the terminal value.

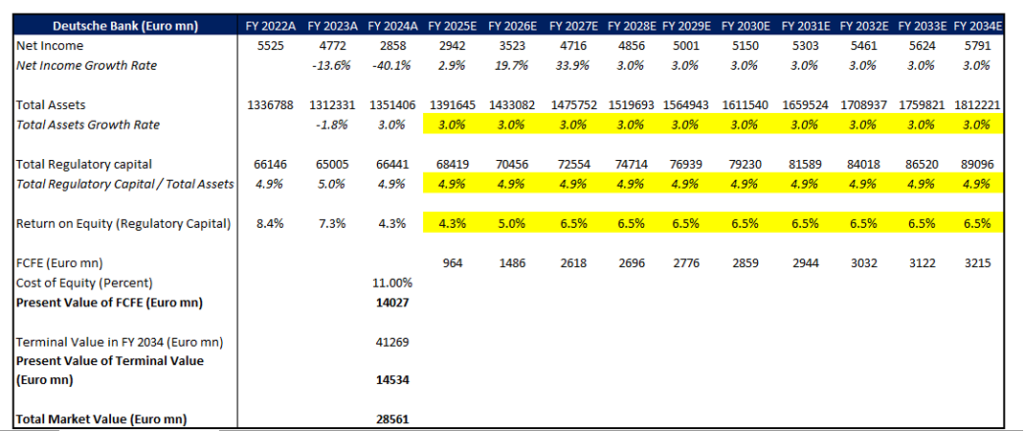

TOTAL MARKET VALUE CALCULATION FOR DEUTSCHE BANK USING TWO- STAGE GROWTH FCFE MODEL

You can download the valuation model here.

Assumptions used in the above table:

- cost of equity assumed to be 11%

- total assets growth rate and return on equity rates for future years are assumed rates and market as yellow.

ADVANTAGES OF FCFE OVER OTHER METHODS

The FCFE methodology offers several key advantages over other valuation methods:

- Focus on Shareholders’ Value: The FCFE method directly calculates the cash flows available to shareholders, making it highly relevant for equity investors.

- Adaptability to Bank-Specific Metrics: FCFE incorporates regulatory capital requirements, which are critical for banks. Unlike traditional methods like P/E and P/B (Market to Book) ratios, FCFE captures the nuances of capital adequacy, an essential factor for banks’ solvency and value.

- Better for Non-Dividend-Paying Banks: Unlike the Dividend Discount Model (DDM), which requires stable and predictable dividend payouts, FCFE can be applied to banks that do not have consistent dividend policies. This makes FCFE a more flexible approach for a wider range of banks.

- Captures Future Growth and Risks: By focusing on future cash flows rather than just current earnings or book values, FCFE better accounts for growth prospects and the impact of risk factors, such as changes in regulatory requirements or economic conditions.

CONCLUSION

Valuing banks requires a sophisticated approach due to their unique operational and regulatory environment. The FCFE methodology offers a robust way to estimate a bank’s value by focusing on the cash flows available to shareholders, specifically accounting for regulatory capital reinvestment. While challenging, mastering this valuation technique equips investors and analysts with valuable insights into a bank’s true worth, helping them make informed decisions in the financial landscape.