In today’s fast-paced and ever-changing world, the financial industry has undergone a substantial transformation. With the advent of big data analytics, financial institutions are now able to gain valuable insights into their operations, customers, and markets. However, the future of financial data analytics looks even brighter, with new trends and innovations emerging that promise to revolutionize the way financial institutions operate.

From artificial intelligence and machine learning to blockchain technology and predictive analytics, the possibilities are endless. As a highly skilled assistant specializing in digital marketing, I am excited to explore the latest trends and innovations in financial data analytics and share my insights with you. In this article, we will delve into the future of analytics and discuss the key trends and innovations that you should watch out for. So, sit back, relax, and let’s explore the exciting world of financial data analytics together.

What is Financial Data Analytics?

Financial data analytics is the process of collecting, analyzing, and interpreting data from financial sources to gain insights and make better business decisions. Financial institutions use data analytics to analyze vast amounts of data to identify trends, patterns, and anomalies that can help them make informed decisions. It can be used for various purposes such as risk management, fraud detection, customer segmentation, and marketing. With the help of financial data analytics, financial institutions can make better decisions, reduce risks, and improve their overall performance.

The Importance of Financial Data Analytics

Financial data analytics plays a critical role in the success of financial institutions. It enables financial institutions to gain insights into their operations, customers, and markets. It helps financial institutions to identify trends and patterns that can help them make informed decisions.

It also helps financial institutions to detect fraud, manage risk, and improve their customer experience. By using this analytics, financial institutions can optimize their operations, reduce costs, and improve their overall performance. As the financial industry becomes more complex and competitive, financial data analytics will become even more critical for financial institutions to stay ahead of the competition.

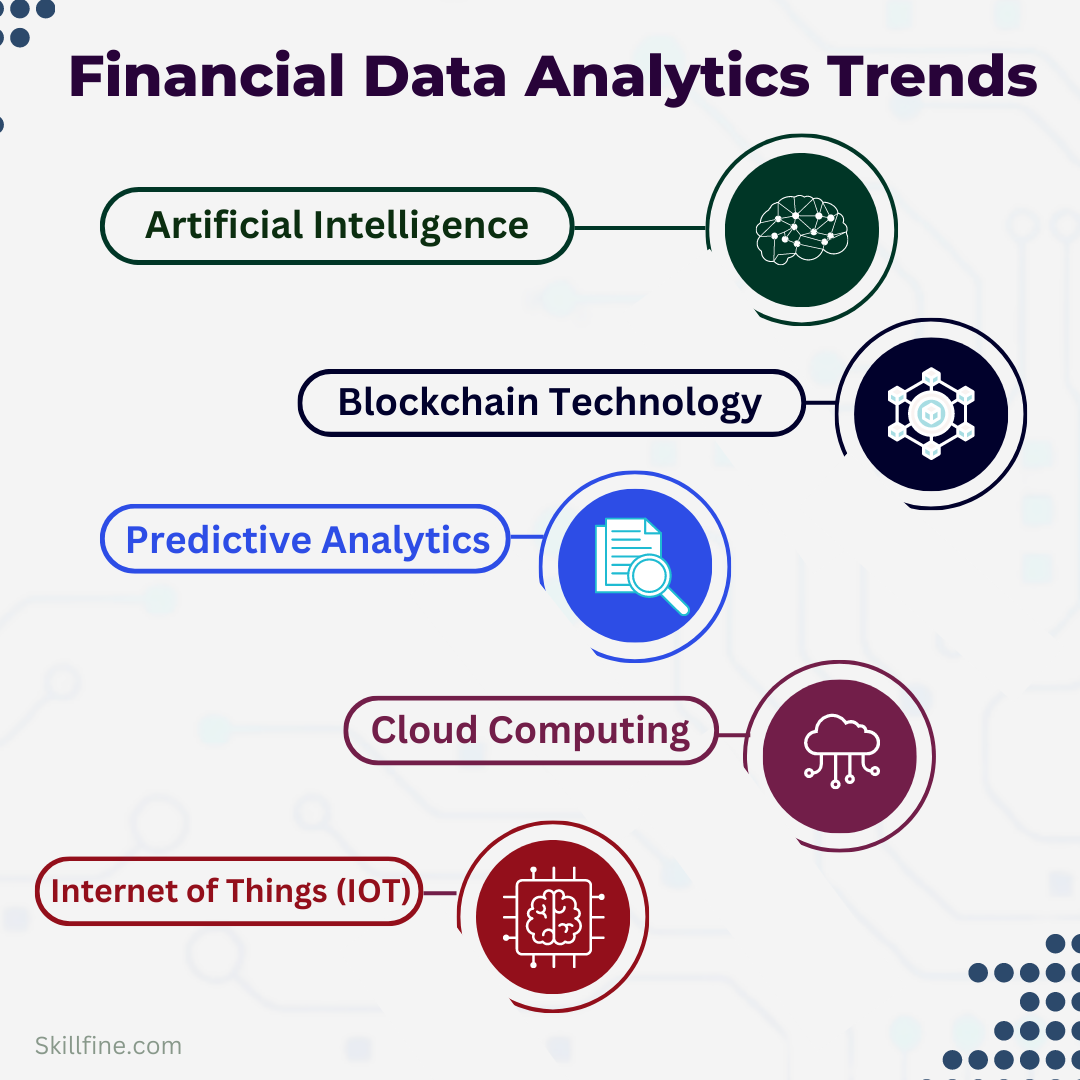

Trends in Financial Data Analytics

Financial data analytics are constantly evolving, and new trends are emerging that promise to revolutionize the way financial institutions operate. Here are some of the key trends in financial data analytics that you should watch out for:

Artificial Intelligence and Machine Learning in Financial Data Analytics

Artificial intelligence and machine learning are transforming the financial industry by enabling financial institutions to analyze vast amounts of data quickly and accurately. With the help of AI and machine learning, financial institutions can automate their processes, reduce costs, and improve their decision-making. AI and machine learning can be used for various purposes such as fraud detection, risk management, and customer service. As AI and machine learning continue to evolve, their applications in financial data analytics will become even more significant.

Big Data and Cloud Computing in Financial Data Analytics

Big data refers to large and complex data sets that cannot be analyzed using traditional data processing methods. With the help of big data analytics, financial institutions can gain valuable insights into their operations, customers, and markets.

Cloud computing is also transforming the financial industry by providing financial institutions with the computing power they need to process large amounts of data quickly and efficiently. As big data and cloud computing continue to evolve, their applications in financial data analytics will become even more significant.

Blockchain and Cryptocurrency in Financial Data Analytics

Blockchain technology is transforming the financial industry by enabling secure and transparent transactions. With the help of blockchain technology, financial institutions can reduce the risk of fraud and improve the speed and efficiency of transactions. Cryptocurrency is also becoming increasingly popular as a form of payment, and financial institutions are starting to explore its potential applications. As blockchain technology and cryptocurrency continue to evolve, their applications in financial data analytics will become even more significant.

Innovations in Financial Data Analytics

In addition to the key trends, there are also several new innovations that are emerging that promise to revolutionize the way financial institutions operate. Here are some of the key innovations in financial data analytics that you should watch out for:

Predictive Analytics

Predictive analytics is the use of statistical algorithms and machine learning techniques to predict future outcomes based on historical data. With the help of predictive analytics, financial institutions can forecast trends and patterns, identify risks, and make informed decisions. Predictive analytics can be used for various purposes such as risk management, fraud detection, and customer segmentation. As predictive analytics continues to evolve, its applications in financial data analytics will become even more significant.

Robotic Process Automation

Robotic process automation (RPA) is the use of software robots to automate repetitive tasks. With the help of RPA, financial institutions can reduce costs, improve efficiency, and free up their employees to focus on more strategic tasks. RPA can be used for various purposes such as data entry, reconciliation, and reporting. As RPA continues to evolve, its applications in financial data analytics will become even more significant.

Natural Language Processing

Natural language processing (NLP) is the use of machine learning algorithms to analyze and understand human language. With the help of NLP, financial institutions can analyze customer feedback, social media posts, and other unstructured data to gain insights into their customers’ preferences and opinions. NLP can be used for various purposes such as sentiment analysis, chatbots, and voice assistants. As NLP continues to evolve, its applications in financial data analytics will become even more significant.

Financial Data Analytics Tools and Software

To harness the power of financial data analytics, financial institutions need to use the right tools and software. There are also some courses that offer the ultimate value proposition to bring about the awareness among the professionals today. But, let’s discuss some of the most popular financial data analytics tools and software:

Tableau

Tableau is a data visualization tool that enables financial institutions to create interactive dashboards and reports. With the help of Tableau, financial institutions can gain valuable insights into their operations, customers, and markets.

Alteryx

Alteryx is a data preparation and analytics tool that enables financial institutions to combine, cleanse, and transform data from various sources. With the help of Alteryx, financial institutions can streamline their data preparation processes and gain more accurate insights.

IBM Watson

IBM Watson is a cognitive computing platform that enables financial institutions to analyze and interpret complex data sets quickly and accurately. With the help of IBM Watson, financial institutions can automate their processes, reduce costs, and improve their decision-making.

Microsoft Power BI

Microsoft Power BI is a business intelligence tool that enables financial institutions to create interactive dashboards and reports. With the help of Microsoft Power BI, financial institutions can gain valuable insights into their operations, customers, and markets.

Challenges and Opportunities in Financial Data Analytics

While financial data analytics presents many opportunities for financial institutions, there are also several challenges that they need to overcome. Here are some of the most significant challenges and opportunities in financial data analytics:

Data Quality

One of the biggest challenges in financial data analytics is ensuring data quality. Financial institutions need to ensure that their data is accurate, complete, and consistent to gain valuable insights. Poor data quality can lead to inaccurate insights and decisions, which can have severe consequences for financial institutions.

Talent

Another challenge in financial data analytics is finding and retaining talent. Financial institutions need skilled professionals who can collect, analyze, and interpret data effectively. However, there is a shortage of skilled professionals in the financial industry, and competition for talent is fierce.

Regulation

Financial institutions also need to comply with various regulations when collecting and analyzing data. Regulations such as GDPR and CCPA require financial institutions to protect their customers’ data and ensure that they use it appropriately.

Despite these challenges, financial data analytics presents many opportunities for financial institutions. By harnessing the power of data analytics, financial institutions can gain valuable insights, reduce costs, and improve their overall performance.

Conclusion

In conclusion, the future of financial data analytics looks bright, with new trends and innovations emerging that promise to revolutionize the way financial institutions operate. From artificial intelligence and machine learning to blockchain technology and predictive analytics, the possibilities are endless. However, financial institutions need to overcome several challenges to harness the power of financial data analytics fully.

By using the right tools and software, attracting and retaining skilled professionals, and complying with regulations, financial institutions can gain valuable insights, reduce costs, and improve their overall performance. As the financial industry becomes more complex and competitive, financial data analytics will become even more critical for financial institutions to stay ahead of the competition.

7 thoughts on “The Future of Financial Data Analytics: Trends and Innovations to Watch For”

[…] Data analytics has become the backbone of fintech. Financial institutions are now able to gather and analyze vast amounts of customer data, providing valuable insights into spending habits, investment preferences, and risk profiles. This data-driven approach allows them to offer personalized products and services that cater to individual needs, enhancing customer satisfaction and loyalty. […]

Thanks for giving this sort of nice information to all of us and please keep us updated in future also. I want to share some information about the Data Structures And AlgorithmsFor best career in Data science And web development Join skillslash it is best online platform For learning Data science And web development Courses for more information go through website links down :

Data science course in chennai

Data science course in Bangalore

Data science course in Pune

Some private photo files you delete on your phone, even if they are permanently deleted, may be retrieved by others.

What should I do if I have doubts about my partner, such as monitoring the partner’s mobile phone? With the popularity of smart phones, there are now more convenient ways. Through the mobile phone monitoring software, you can remotely take pictures, monitor, record, take real – Time screenshots, real – Time voice, and view mobile phone screens.

882732 977049This sort of considering develop change in an individuals llife, building our Chicago Pounds reduction going on a diet model are a wide actions toward generating the fact goal in mind. shed weight 808525

599274 974934Hello! I could have sworn Ive been to this blog before but soon after browsing by way of some with the post I realized it is new to me. Anyways, Im undoubtedly happy I identified it and Ill be book-marking and checking back frequently! 578704

882445 643743There is visibly a bunch to know about this. I believe you made various great points in attributes also. 361485