Introduction

In taxation, we hear numerous terms like statutory tax rate, effective tax rate, tax liability, marginal tax, etc but we fail to understand the intricacies of these terms. Effective Tax Rate is one of these terms that holds its mystery. In this article, we will try to decode what the effective tax rate is, how it is calculated, and how it differs from statutory tax and marginal tax. We will also compare the effective tax rates of two prominent conglomerate businesses. And perform a reconciliation of statutory tax to the effective tax rate.

What is the Effective Tax Rate?

The Effective Tax Rate (ETR) is the average tax rate levied on an individual or a corporation in a period. Investors use effective tax rates as one of the financial ratios metric to understand the company’s profitability. Companies use ETR to analyse various tax deductions, exemptions and overall tax liability. It is also used by companies for tax planning by performing a reconciliation of statutory tax to the effective tax rate. The effective tax rate is calculated in percentage, this eases the year-on-year or long-term effective tax reconciliation.

An individual’s effective tax is the average tax rate levied by the taxation authorities of a country. The effective tax rate for a company is the average of tax rates levied by the authorities for the computation of tax liability.

The concept of the effective tax rate is generally related to direct taxation. Direct tax is a structure of taxation imposed by the government of a country on individuals and persons on their income earned during a period.

Formula for Effective Tax Rate

| Effective Tax Rate (Individuals) | = (Total Tax Liability/ Taxable Income) * 100 |

| Effective Tax Rate (Corporates) | = (Total Tax Liability/ Profit Before Tax) * 100 |

- Tax Liability is the amount that an individual or a business has to pay to the taxation authority of a country on the income earned in a period.

- To calculate the effective tax rate for an individual, we consider its Taxable Income for a period.

- By dividing the tax liability by the Profits before tax, we get the effective tax rate for a company.

Real Life Example for Effective Tax Rate Calculation

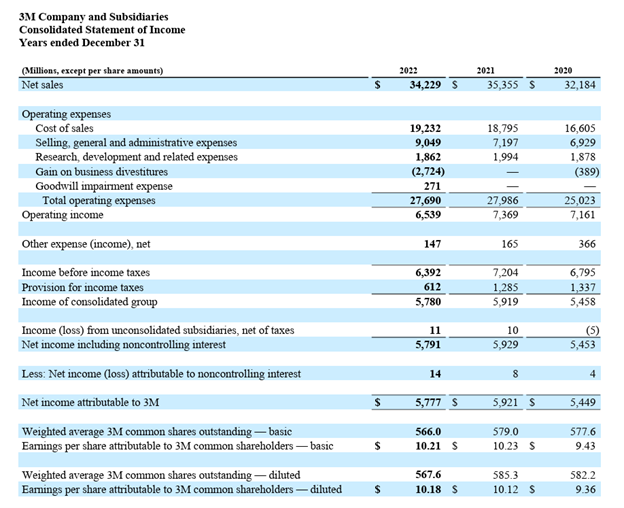

For understanding the computation of the effective tax rate we have taken, 3M is a US conglomerate working in the transportation & electronic industry, healthcare sector, safety and industrial segment and consumer business segment.

Let’s calculate the effective tax rate of the conglomerate business 3M for the year ending 2022:

Source: https://investors.3m.com/financials/annual-reports-proxy-statements

For the calculation of the Effective Tax Rate, for the value of tax liability, we are taking the amount of the line item Provision for Income Tax.

| Provision for Income Tax | = 612 |

| Profit Before Tax | = 6,392 |

Calculation of ETR of 3M:

| Effective Tax Rate | = (Total Tax Liability/ Profit Before Tax) * 100 |

| = (612/ 6,392) * 100 | |

| Effective Tax Rate | = 9.6% |

The effective tax rate computed for the year 2022 of 3M company is 9.6%.

Effective Tax Rate vs Marginal Tax Rate

The effective tax rate is the average tax rate at which the taxable income of an individual or a corporation is taxed.

However, the Marginal tax rate is the additional tax rate imposed by the tax authorities on additional income earned. The concept of marginal tax is applicable in a progressive tax system. A progressive tax system is a method of taxing income in which individuals with higher incomes pay higher taxes, and persons with lower incomes fall under the category of lower tax rate.

Effective Tax Rate vs Statutory Tax Rate

As we know, the effective tax rate is the average tax rate applicable to the person’s taxable income. Statutory Rates, on the other hand, are the tax rates imposed on the income of persons by enforcing a law by the government.

The statutory tax rate for 3M in the USA for 2022 was 21%, and the effective tax rate for 3M is 9.6%.

Hence, the primary difference between the effective tax rate and the statutory tax rate is that statutory tax is the tax rate established by laws, and the effective tax rate is the average of all the rates applicable at different tax slabs.

Comparative Analysis of Effective Tax Rate

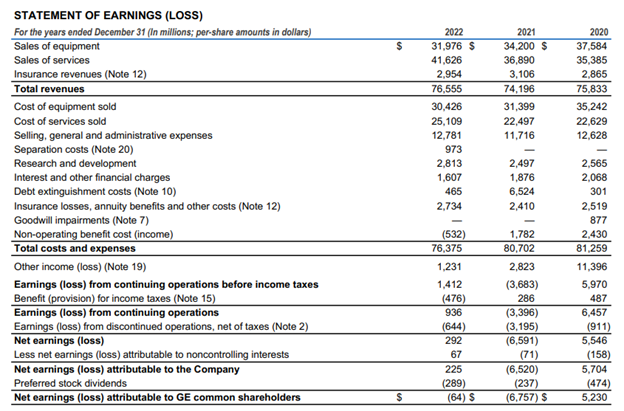

For the comparative analysis, we will be calculating the ETR of GE and 3M. General Electric Company (GE) is an American Multinational company working in different industries like aerospace, power, and renewable energy.

Let’s perform a comparative analysis of these two prominent US conglomerate businesses:

Source: https://www.ge.com/investor-relations/annual-report

| Provision for Income Tax | = 476 |

| Profit Before Tax | = 1,412 |

Calculation of ETR of GE:

| Effective Tax Rate | = (Total Tax Liability/ Profit Before Tax) * 100 |

| = (476/ 1,412) * 100 | |

| Effective Tax Rate | = 33.7% |

ETR of 3M is 9.6%, and GE is 33.7%. Hence, by calculating the ETR of both businesses, we can say that the ETR of 3M is 24.1% less than that of GE.

Reconciliation of Statutory Tax Rate to the Effective Tax Rate

The term reconciliation is the process of comparing and understanding the differences between items. Therefore, in the reconciliation of the Statutory Tax Rate to the Effective Tax Rate, we will compare what items brought in the difference in the default Statutory Tax Rate and the Effective Tax Rate. The items which cause the difference in the two rates are called reconciling items.

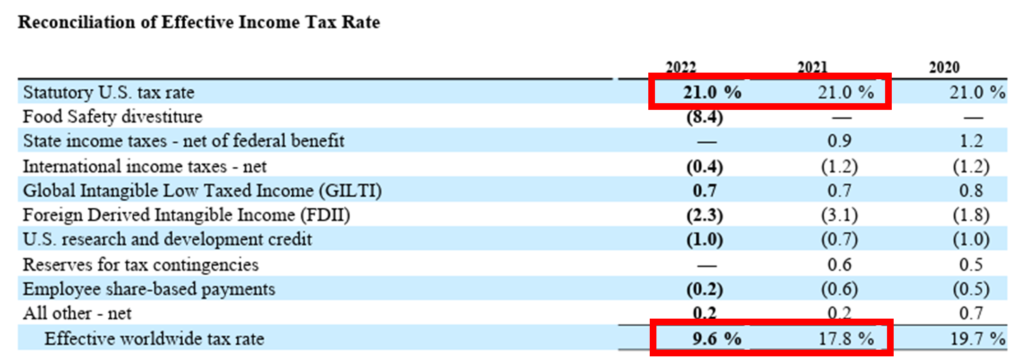

Let’s understand the reconciliation of 3M for the year 2022:

Source: https://investors.3m.com/financials/annual-reports-proxy-statements ; 3M Annual Report 2022, Notes to accounts: 10

The statutory tax rate is 21% for 2022 and 2021, and the effective tax rate is 9.6% and 17.8% for 2022 and 2021, respectively. This 8.2% difference in the effective tax rates is because of the following reconciling items.

- The one-time primary factor in reducing the effective tax rate is the Food Safety Divestiture, which decreased ETR by 8.4% in 2022. However, this is a one time factor.

- The second line item is State income taxes, which was 0.9% in 2021 but was nil in 2022.

- The next reconciling item is the international income taxes, which dropped from 1.2% in 2021 to 0.4% in 2022.

- The fourth item in the reconciliation statement is Global Intangible Low Taxed Income (GILTI), which remained constant at 0.7% for 2021 and 2022.

- The next reconciling item is Foreign Derived Intangible Income (FDII). FDII is the second prominent item, even though FDII shrunk by 0.8% in 2022, it still resulted in a lower ETR.

- U.S. research and development credit grew by 0.3% and contributed by 1% to reduce the statutory rate.

- The last three line items had negligible impact on ETR.

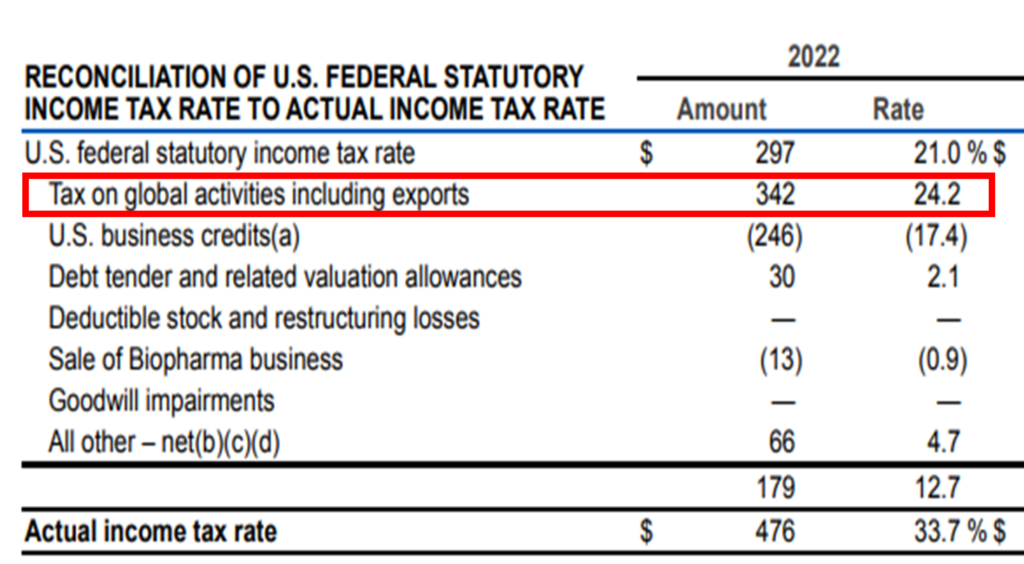

Let’s understand the reconciliation of GE for the year 2022:

For GE, given that they are a globally diversified company with significant operations outside of USA, the effective tax rate is quite different than the statutory tax rate. The line item “tax on global activities including exports” refers to the fact that they pay higher tax on their international operations outside of USA.

Conclusion

The effective tax rate is the average tax burden borne by individuals and corporations in a given period. Unlike the marginal tax rate, which applies to additional income earned, the effective tax rate provides a comprehensive view of the overall tax liability relative to taxable income or profits before tax.

It offers valuable insights into the actual tax impact faced by taxpayers, taking into account various tax rates applicable at different net income levels or corporate profits. While statutory tax rates are established by laws, the effective tax rate reflects the practical application of these rates in determining tax liabilities.

By understanding and monitoring the effective tax rate, individuals and businesses can make informed decisions regarding tax planning, compliance, and financial management, ensuring optimal tax efficiency and adherence to regulatory requirements.