WHAT IS ACCRUAL ACCOUNTING?

In Financial Accounting, Accrual accounting is an accounting method in which revenue is recognized by the company in the period in which it’s earned and realizable and not necessarily when the cash is actually received. Similarly, expenses are recognized by the company in the period in which the related revenue is recognized rather than when the related cash is paid. In short under accrual accounting method the company records the journal when the transaction is initiated regardless of when the money transaction takes place.

The accrual accounting method is based on the matching principle, which says revenue should be recognized when earned and expenses should be matched at the same time as the revenue is recognized. The accrual method of accounting is often compared against cash accounting since they are opposite to each other. Under cash accounting, income is recorded when cash is received and expenses is recorded when paid, as opposed to accrual accounting where revenue is recognized when earned and expenses are recognized when they are incurred.

Accrual accounting has become the standard accounting practice for most of the companies except for individuals and small companies since it is encouraged by the International Financial Reporting Standards(IFRS) and Generally Accepted Accounting Principles (GAAP).

REAL LIFE EXAMPLE OF COMPANIES RECORDING ACCRUALS IN ITS FINANCIALS

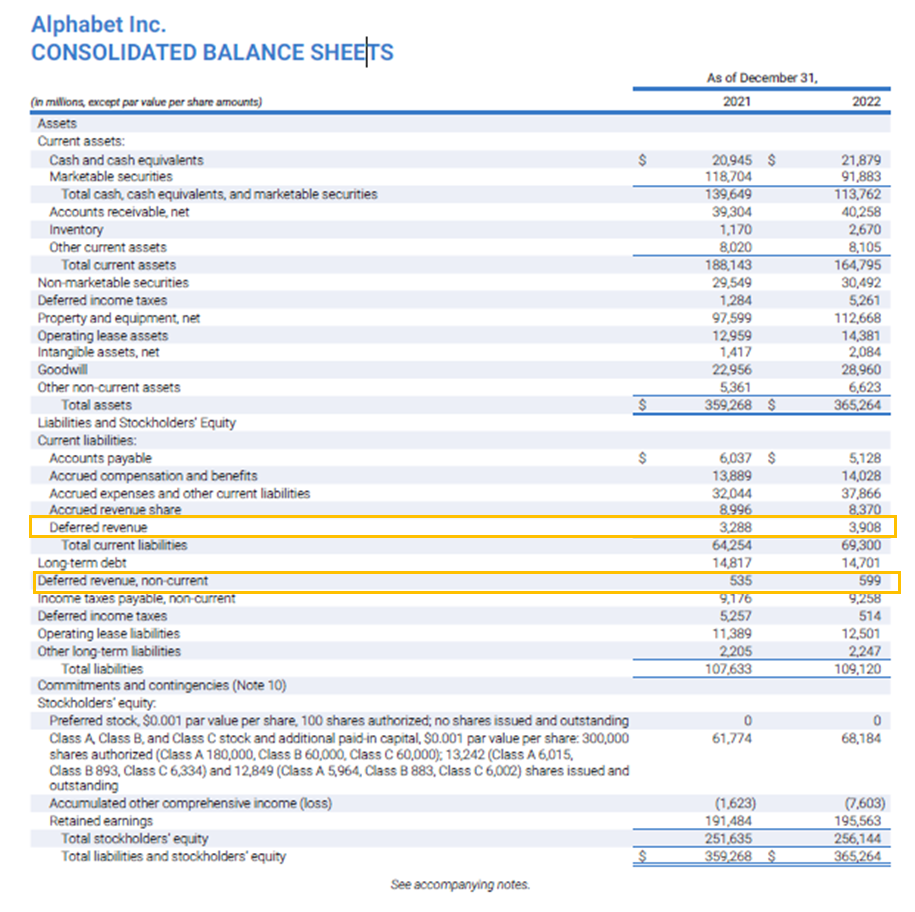

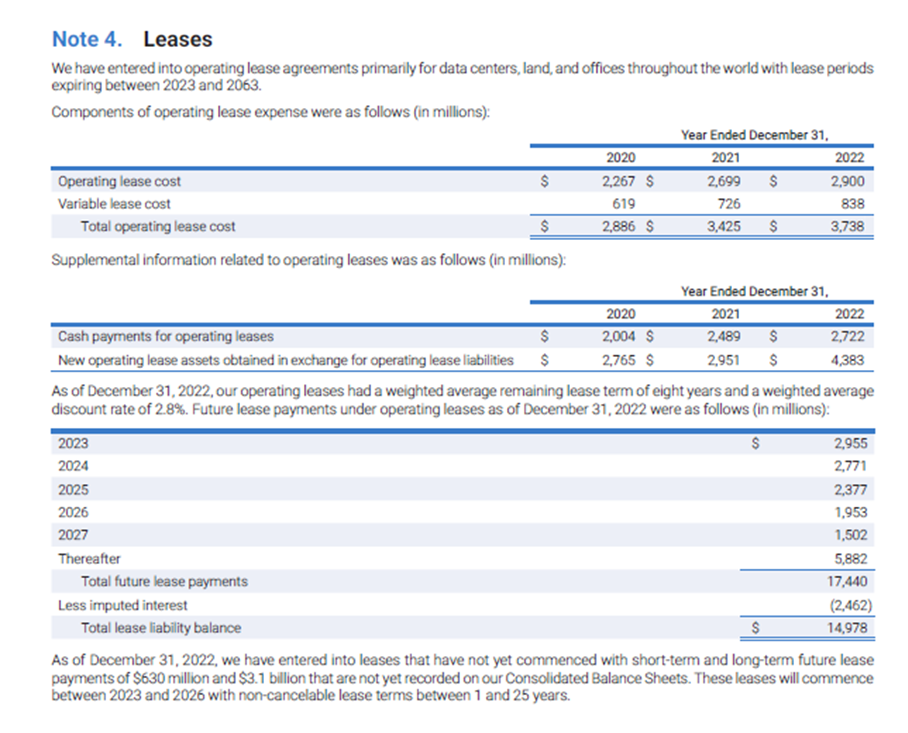

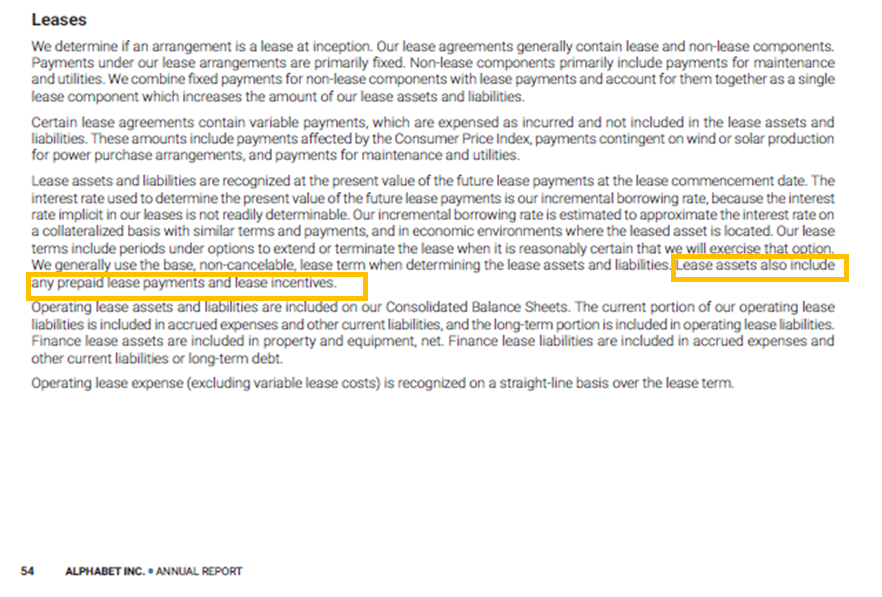

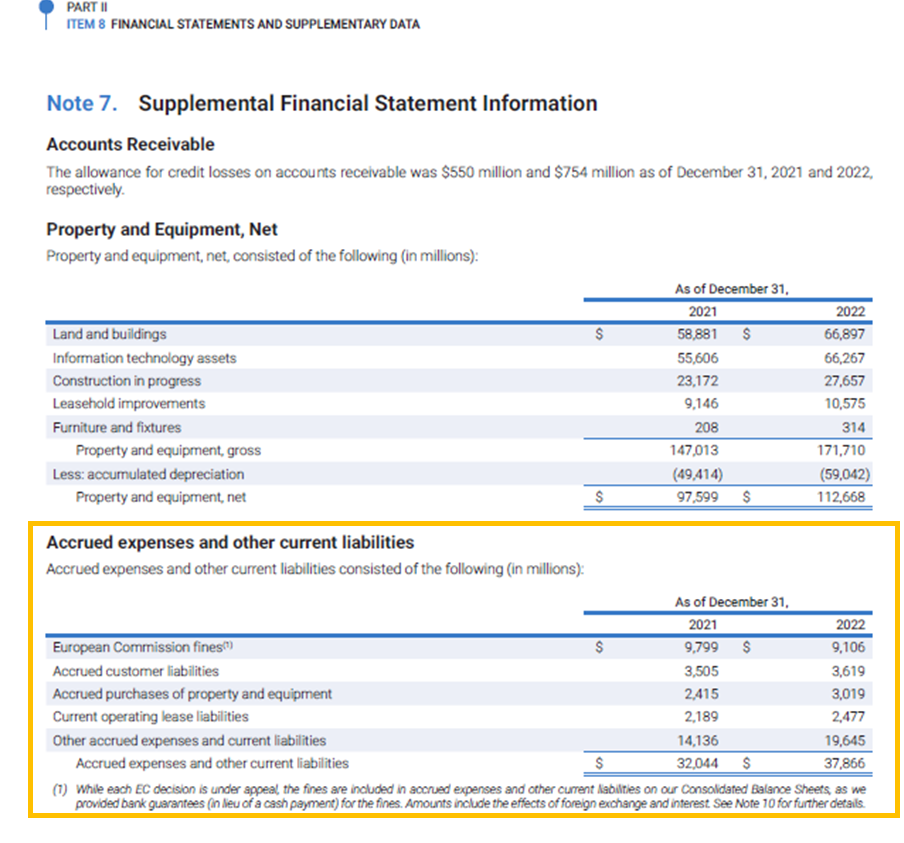

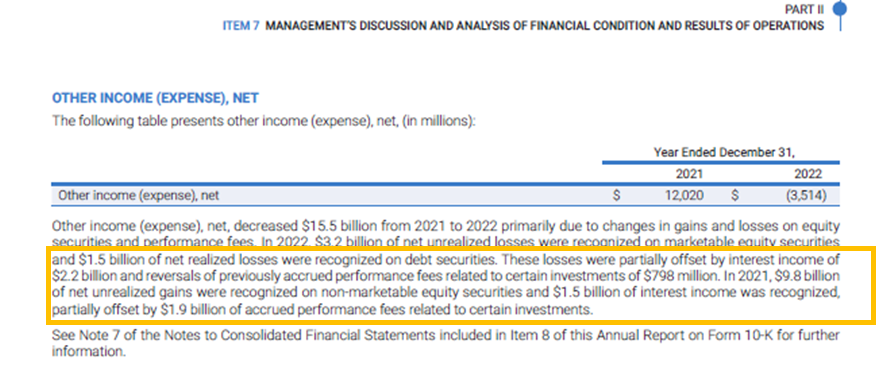

Let’s see how Alphabet Inc. records accruals in its financial statements.

- Deferred Revenue is recorded as follows:

Source: https://abc.xyz/investor/

- Prepaid Expenses details in annual report:

- Accrued expenses and other current liabilities recorded in annual reports

- Accrued Income details in notes:

WHEN TO USE ACCRUAL ACCOUNTING

Accrual method of accounting is required to be followed by the large companies if their average gross receipts of revenues is more than dollar 25 million over the previous three years. However, small businesses with less than $25 million in annual revenue are allowed by the Internal Revenue Service (IRS) to use either accrual or cash basis accounting. Cash accounting is also allowed to sole proprietors, partnerships and S-Corps. It is important to note that additional filings are required with the Internal Revenue Service on changing one’s method of accounting.

Companies that carry inventory or make credit sales, always require accrual accounting irrespective of the company size or revenue.

Neither Generally accepted accounting principles nor International financial reporting standards allows cash accounting. For any regulatory filing that requires Generally accepted accounting principles, accrual accounting method should be used such as a company’s annual 10-K filing to the Securities and Exchange Commission (SEC). GAAP financial statements are required by most of the financial institutions, investors and financial lenders for evaluating a business position and profitability. For this reason, accrual accounting method is more popularly used by companies across the world.

ACCRUAL ACCOUNTING VS. CASH ACCOUNTING

Although the accrual accounting method is the most widely used, some small businesses prefer to use cash basis accounting due to its simplicity. Under the Cash accounting method revenue is recorded only when cash is received, and expenses are recorded only after cash payments are made.

The main difference between accrual accounting and cash accounting is the timing when transactions are recorded. Revenue and expenses under accrual accounting are recorded as soon as the transactions occur i.e. revenue is recorded when it is earned and expenses recoded when it is incurred, whereas under the cash accounting these transactions are not recorded until money changes hands.

Out of these two accounting methods the cash accounting is easier since companies only record transactions when cash is exchanged (i.e. paid or received). However, the cash accounting cannot be used by most of the large companies with large number of transactions as this method does not reflect a true and fair view of the financial position of the company on any given date. The accrual accounting gives a more accurate picture of the financial position of the company since it does not factor in when money actually changes hands and reduces the impact of timing on a company’s financial statements and financial records.

We can understand this with the help of a simple example. Most of the software companies sell subscriptions to use software for different time periods. Say a software company ABC Ltd. sells a 5-year subscription of its software usage to a customer for $10 million and receives the full payment in cash at the start of the subscription. If the company uses cash based accounting it would record the entire $10 million during the first period and nothing for the next 4 years. This would result in revenue being overstated in the first period and understated for the next 4 years during which the subscription is being used by the customer. However, under the accrual accounting method, revenue is recognized only when it is earned and not necessarily when received. In accrual accounting $10 million is evenly distributed ($2 million recorded each year) among the 5-year period during which the company offers subscription service to the customer. This avoids the net income for any of the 5-year period to be overstated or understated.

The summary of key differences between accrual and cash accounting is as follows:

| Particulars | Accrual Basis | Cash Basis |

| Revenue Recognized | When revenue is earned | When cash is earned |

| Expenses Recognized | When expenses is incurred | When cash is paid |

| Taxes Payable | On all revenue earned | Only on collected cash |

ACCOUNTING METHOD AND TAXATION

The appropriate taxation authority of any country requires the taxpayers to consistently use any accounting method that accurately captures the organizations true financial position. It important for the taxpayers to be consistent since changing the accounting method frequently can create potential loopholes that can be used by company to manipulate its revenue and expenses and thereby reduce its tax burdens. In general, as discussed above cash accounting is only allowed for small businesses with less than $25 million in annual revenue and sole proprietorships, partnerships, S-corps, whereas large businesses will use accrual accounting when preparing its tax returns.

TYPES OF ACCOUNTING METHODS

There are three types of Accounting Methods.

- cash basis of accounting

- accrual basis of accounting

- hybrid basis of accounting i.e., modified cash basis of accounting

ADVANTAGES OF ACCRUAL ACCOUNTING

The accrual accounting method is more complex of the two commonly used accounting methods. However, accrual accounting is considered the standard accounting practice for most organizations since companies get a more accurate snapshot of their financial position and health by looking at both current and expected cash flows.

Accrual accounting is more widely used since it captures all the underlying business transactions during a period and not just those transactions with cash involved. Not all the transactions of a company are straightforward with cash exchange happening at the time of the transaction. Some transactions may require a company to account for money that they will have to pay or receive at a future date that involve buying and selling on credit to customers, while some transactions require receiving money from customers or paying for goods or services in advance. The timing when these transactions of revenue and expenses are recorded in the books of accounts have a major impact on the financial performance of a company.

Hence using the accrual accounting method companies can better manage their current resources and plan for the future of the company by getting immediate feedback on their expected future cash inflows and outflows.

TYPES OF ACCRUALS

Accruals are the revenues for which the company has not yet received the payment or expenses for which payment has not yet been paid by the company. There are typically 4 types of accruals recorded on the balance sheet of the company following the accrual method of accounting.

- Accrued Revenue: Accrued revenue is that income that a company has earned by delivering a good or providing a service but for which has yet not received payment. This type of account is often found in the books of companies with long-term construction projects, or a company providing consulting service to a client in January but does not issue an invoice until September of the following year.

For example, an electronics retailer rents out a store for $3,000 per month. He pays each month’s rent within the first week of the following month. Even after the service has been provided by the landlord each month he receives his payment only after the end of the month. Under the accrual accounting method, an accrued revenue receivable account (i.e. an asset account) would be set up by the landlord for the $3,000 to show that they are yet to receive the rent payment from the tenant although they have provided the services.

- Accrued Expenses: Accrued expenses are liabilities that occur when a company incurs an expense but has yet not been billed for. In other words, the company has received the goods or services but has not paid for those yet. Hence accrued expense is an accrued liability.

For example, a company receives service of internet connectivity for every month but is billed quarterly by the internet service provider and pays only at the end of the quarter. Although the company incurs monthly internet expense it pays only at a future date i.e. at the end of the quarter. For the quarter January to March, the company shall record expected cost of the internet as accrued expense at the end of month January and February where although it receives the service, it does make payment at a future date.

- Deferred Revenue: Deferred revenue also known as unearned revenue is when a company receives payment before a good has been delivered or a service has been rendered. The deferred revenue account is a liability account because it shows that the company has an obligation to deliver the good or render the service to customers at a future date for which it has already received advance payment.

For example, a company takes yearly club membership for its employees paying a one- time annual fees of $1,200. The club records this advance receipt as deferred revenue account since it is the payment received for services to be provided throughout the year. The club using the accrual accounting method would set up a deferred revenue account (i.e. a liability account) for the $1,200 to show that it had received the payment but have not yet provided the service.

The club can reduce the deferred revenue account by $100 each month, as service is provided equally over the entire year. At the same time revenue is recorded of $100 each month to show that the revenue has been earned through providing the membership service.

- Prepaid Expenses: Prepaid expenses is when a company pays before the goods have been provided or services have been rendered. This account is an asset account because it shows that the company has made advance payment and is entitled to receive a good or a service in the future.

For example, a finance company buys software license from an IT company to be used for the entire year for $1,200. At the time of the payment, the finance company sets up a prepaid expense account for $1,200 to show it has not yet received the services, but has already made the payment for the entire year.

As each month of the year passes, the finance company reduces the prepaid expense account by $100 to show that it has received one-months service out of the 12 months. For rest of the months it records an expense of $100 each month to show that the expense has been incurred officially through receiving the software license service.

ACCOUNTING UNDER FASB AND IFRS

Generally Accepted Accounting Principles (GAAP) has been set out by The Financial Accounting Standards Boards (FASB) in the United States for dictating how and when should companies accrue for a revenue or expense. However, International Financial Reporting Standards (IFRS) is followed by International companies outside the United States. Cash Accounting is neither allowed by GAAP nor IFRS.

Conclusion:

Accrual accounting is an important application of the matching principle that records income and expenses in the year of actual event independent of cash received or not.