WHAT IS OPEARTING CASH FLOWS (OCF)?

The amount of cash generated by the business from its regular operating activities within a specific time period is called as Operating Cash Flow (OCF). In financial accounting it is also known by other names like cash flow from operating activities (CFO), Free cash flow from operations (FCFO) or cash flow provided by operations. Operating activities of a business includes any sources of cash or spending of sources that’s involved in the day to day business operations of the company like generating revenue from sale of goods or rendering of services, paying regular business expenses and funding of the working capital. Cash flow from operations is that section of the Cash Flow Statement of the company that reflects the amount of cash generated or consumed by a company from carrying out its primary business operations.

Financial analysts often use Cash flow from operations along with other important financial metrics like Net Income, Free cash flow (FCF), EBITDA etc., to assess the financial performance and health of the company.

The Cash flow statement of any company is divided into three major parts- Cash flow from Operating activities, Cash flow from Investing activities and Cash flow from Financing activities. The Cash flow from Operating activities focus on company’s primary business activities like selling goods or rendering services, purchasing inventory, and paying salaries. Cash flow from Investing activities includes all capital assets purchases or sales and investments in other business ventures. Cash flow from Financing activities includes all proceeds from issuance of debt or equity as well as dividend payments made by the company.

As per the Generally accepted accounting principles (GAAP), two methods of presentation of operating cash flows is acceptable- Indirect method or the Direct method. However, even if the company uses the Direct method, it still has to prepare the operating cash flow section separately as a reconciliation.

WHY DO WE CALCULATE OPERATING CASH FLOWS?

Operating cash flows refers to amount of cash bought in by the business from its day to day operations. The Income statement of a company is prepared as per the accounting standards established by the US GAAP in the United states or as established by IFRS for other countries. One of the shortcomings of reporting as per the accounting standards set is that the Income statement fails to reflect the actual liquidity position (i.e. cash in hand position) of the company and does not provide the current reality of the business operations. Since the accounting standards require to report revenue and book expenses on accrual basis, the revenue reported in the income statement may not match with the actual cash collected by the business or the expenses recorded in income statement may not match with the actual cash outflow of the company. For example, a company may have reported huge sales in a given reporting period but it may be having a hard time in actual collection of cash from its debtors. It may also happen that a company is reporting high cash flow operations but low net income as it has a lot of fixed assets and uses accelerated method of depreciation.

Hence, to understand the real cash inflows / (outflows) from operating activities it is important to prepare the Cash Flow Statement. It is important for a company to bring enough money from its primary business operations otherwise it may have to resort to temporary sources of external financing which is unsustainable in the long run.

A positive operating cash flow reflects that a business has sufficient cash flow from operations which means adequate cash is generated to meet the company’s reinvestment needs i.e., the capital expenditures and working capital needs, whereas a negative operating cash flow reflects insufficient cash flow from operations which means the company may have to raise finance from external sources (via debt or equity issuance) to meet its reinvestment spending needs.

HOW TO CALCULATE OPERATING CASH FLOW?

The cash flow statement (CFS) of a company can be prepared by any of the two methods — the indirect or the direct method:

INDIRECT METHOD

Under the Indirect method, the accrual based Net Income which is the bottom line of the Income statement is adjusted to a cash basis. The Net Income is adjusted for non-cash items like depreciation and amortization expenses and changes in the working capital (i.e., changes in accounts receivables, accounts payable, inventory etc.) of the company to arrive at the cash flow from operations. This method is more commonly followed by companies than the Direct method.

The Indirect method uses the following formula for calculation of OCF:

- Formula in short:

Operating Cash Flow (OCF)= Net Income + Non-Cash Expenses- Increase in Working Capital

where,

- Net income: Is the bottom line of the Income Statement and is used as the starting point in the Cash flow statement to calculate cash flow from operating activities.

- Non-Cash Expenses: All non-cash expenses are added back to the net income, which means all accruals are reversed. Non- cash expenses include the following:

- Depreciation, which is an accounting method for systematic expensing off fixed assets like plant, property and equipment.

- Stock-based compensation which is paid out with issuance of shares and not the actual cash.

- Other expense/income which includes various items such as accrued items or unrealized gains or losses.

- Deferred taxes that arises as a result of timing difference between accounting as per books of accounts and accounting for the tax purposes.

- Increase in Working capital (operating assets and liabilities) adjustments include:

- When the inventory balance geos up in the balance sheet as compared to the last reporting period or financial period, it results in reduction of cash balance.

- When the accounts receivable balance in balance goes up, it means that increased amounts have not been paid in cash by the customers and hence result in reduction of cash.

- When prepaid expenses balance increases, it means reduction of cash.

- When accounts payable, unearned revenue or accrued expenses increases in the balance sheet, they result in increase in cash balance as it reflects inflow of cash.

Hence the above formula can also be written as:

Operating Cash Flow(OCF) = Net Income + Depreciation & Amortization expenses+ Stock Based Compensation + Deferred Tax + Other Non-Cash Items – Increase in Accounts Receivable – Increase in Inventory + Increase in Accounts Payable + Increase in Accrued Expenses + Increase in Deferred Revenue

If operating cash flow deviates from the net income of the company substantially then a further analysis is required to understand the factors that are causing this difference. For example, if the OCF of a company is much lower than its Net Income, then on further analysis we may find that the difference is due to sharp rise in accounts receivables of the company, i.e., the company has made huge credit sales and is not able to collect cash efficiently on time and the company should hence reconsider its cash collection policy from its customers.

The relationship between cash flow and the changes in working capital can be shown as below:

| Changes in Working Capital | Impact on Cash Flow |

| Increase in Working Capital Asset | Cash Outflow (“Use of Cash”) |

| Decrease in Working Capital Asset | Cash Inflow (“Source of Cash”) |

| Increase in Working Capital Liability | Cash Inflow (“Source of Cash”) |

| Decrease in Working Capital Liability | Cash Outflow (“Use of Cash”) |

EXAMPLE 1: A company named ABC Ltd. Reports a net income of $ 200 million, and records depreciation and amortization expenses of $50 million. It Balance sheet shows a net increase of accounts receivables account by $40 million, increase in accounts payable by $30 million and decrease in Inventory by 20 million.

Hence, the operating cash flow calculated by indirect method would be as following:

Operating cash flow= Net Income+ Non-Cash Expenses- Increase in working capital

= $200m +$50m-($40m-$30m-$20m)

= $200m+$50m-(-$10m)

=$200m+ $50m + $10m

=$260m

DIRECT METHOD

The Direct method is lesser used approach to calculate Operating cash flow. This method utilizes cash accounting to track the movement of cash during a specified period. This method is much simpler than the Indirect method as the formula consists of subtracting operating cash expenses from cash revenue during the accounting period. Examples of some items considered under the direct method of calculating operating cash flow includes:

- Salaries expenses of employees

- Cash payment to vendors and suppliers

- Cash collection from customers

- Receipt of Interest income and dividends

- Payment of Income tax paid and interest thereon

The formula for Direct method to calculate OCF is as follows:

Operating Cash Flow (OCF) = Cash Revenue – Operating Expenses Paid in Cash

WHY IS OPERATING CASH FLOW IMPORTANT?

Operating cash flow shows how self-sustainable and self-reliant a business is in terms of generating and ongoing business profit and cash. The accrual system of accounting followed by most companies reports the Net Income which takes into account various non-cash items into consideration and hence gives a false picture on face of the liquidity of the company. Hence, OCF calculation enables us to see the true cash bought in or expensed by the company during any given period of time to help us make better decisions.

The OCF is important to different category of people as follows:

- Financial Analysts: OCF particularly for larger companies are analysed by the Financial Analyst to find the actual cash position of the company and whether the company is sustainable enough to generate sufficient amount of cash from its primary business activities.

- Investors: Investors are keen to put in their money in companies which generate real money and OCF is one such measure that shows the real money bought in or expensed by a company. OCF keeping aside the accrual accounting method shows how much a company has earned in cash in true sense and helps instil confidence amongst investors that the company will be able to generate ROI on investment or not.

- Lenders: Lenders consider OCF as an important metric to assess whether the potential borrower earns enough cash from its core operations so that it can service its debt and interest on debt obligations timely without having to rely on outside sources of finance.

OPERATING CASH FLOW VS. NET INCOME, FREE CASH FLOW, AND EBITDA

OPERATING CASH FLOW VS. NET INCOME

The financial statements of the company are prepared by the accrual principle of accounting and matching principle. Net Income which is the bottom line of the income statement includes all sorts of expenses, some of which might have been actually paid by the company and some of which have simply been created and accounted by accounting principles such as the depreciation expenses. Also as per company’s matching of expenses to the timing of revenue and revenue recognition principle a material difference can occur between the revenue recognised in the income statement and the actual cash received by the company. Hence, Net income reports Income as per the accounting policy of the company whether or not it involves actual movement of cash. Operating cash flow is however a reflection of actual cash earned or cash expensed by a company from its primary business operations during any specific period of time. Net Income is the starting point in the Cash flow statement to calculate the cash flow from operating activities. Net income is adjusted for non-cash items and changes in working capital to arrive at the actual operating cash flows.

OPERATING CASH FLOW VS. FREE CASH FLOW

Operating cash flow differs from Free cash flow since the calculation of Free cash flow includes capital expenditures (Capex), unlike Operating cash flow. Both these metrics are used to assess the financial stability of a company and to determine if enough cash is by the company to meet its spending needs.

Free cash flow(FCF) can be either Free cash flow to firm (FCFF) or Free cash flow to equity (FCFE). However, the simplest formula to calculate FCF is subtracting capital expenditure (CAPEX) from cash from operations (CFO).

Free Cash Flow (FCF) = Cash from Operations (CFO) – Capex

Since Capex is a major cash outflow that is a core part of a company’s ability to produce cash flows, FCF goes an extra step by considering Capex and is a better metric than CFO. However, a higher amount of both metrics is considered to be positive signal for the company.

OPERATING CASH FLOW VS. EBITDA

Earnings Before Interest Taxes Depreciation and Amortization (EBITDA) is one of the most used financial metrics. Financial Analysts use it frequently to compare companies using the EV/EBITDA ratio. EBITDA is also considered as a proxy for cash flow, since it does not include depreciation and amortization expense. Sometimes companies also use a Non-GAAP measure like Adjusted EBITDA to reflect the impact of one time non-recurring non-operating expense on the reported EBITDA earnings of the company.

However, EBITDA can be very different from operating cash flows since it excludes interest and taxes, and the impact of changes in working capital and other non-cash expenses.

WHAT IS THE OPERATING CASH FLOW RATIO?

The operating cash flow ratio is a measure of how readily the cash flows generated from a company’s core operations cover the company’s current liabilities. This ratio can help to assess a company’s short term liquidity.

Using cash flow in place of net income is considered more accurate and reliable measure since earnings of a company are more easily manipulated and may vary from company to company since the accounting practices followed by companies varies.

The Formula for the Operating Cash Flow Ratio is as follows:

Operating cash flow ratio= Operating cash flow/ Current liabilities

The operating cash flow ratio measures the number of times the cash generated by a company can pay off current debts within the specific period of time. A high ratio generally greater than one, indicates that a company has generated enough cash in a specific period of time than what is needed to pay off its current liabilities.

A ratio of less than one indicates that the company has not bought in enough cash to cover its current liabilities and a low ratio is an indication that the company needs more external capital to finance its operations and capital expenditures.

However, the ratio may be interpreted differently by different people and not all interpretations point towards poor financial health of the company. For example, a company may have started a new project that initially requires compromise of operating cash flows but in future would rather return substantial rewards.

EXAMPLE: Let us calculate Operating Cash Flow ratio of Alphabet Inc. for the following financial years as below:

| Particulars | 2022 | 2021 | 2020 | 2019 | 2018 |

| Current Liabilities | 69,300 | 64,254 | 56,834 | 45,221 | 34,620 |

| Operating Cash Flow | 91,495 | 91,652 | 65,124 | 54,520 | 47,971 |

| Operating Cash Flow Ratio | 1.32 | 1.43 | 1.15 | 1.21 | 1.39 |

We can see that Alphabet Inc. has a consistent Operating cash flow ratio more than one. This means that the company have sufficient operating cash flow to pay off its current liabilities.

THE OPERATING CASH FLOW RATIO VS. THE CURRENT RATIO

Both the operating cash flow ratio and the current ratio measure a company’s liquidity position. Both the ratios measure the company’s ability to pay its short-term debts and obligations. The only difference is that the operating cash flow ratio assumes that the current liabilities of the company will be paid using the cash flow from operations while the current ratio assumes that the current liabilities will be paid using the current assets of the company.

REAL LIFE EXAMPLE OF CALCULATION OF OPERATING CASH FLOW BY THE COMPANIES

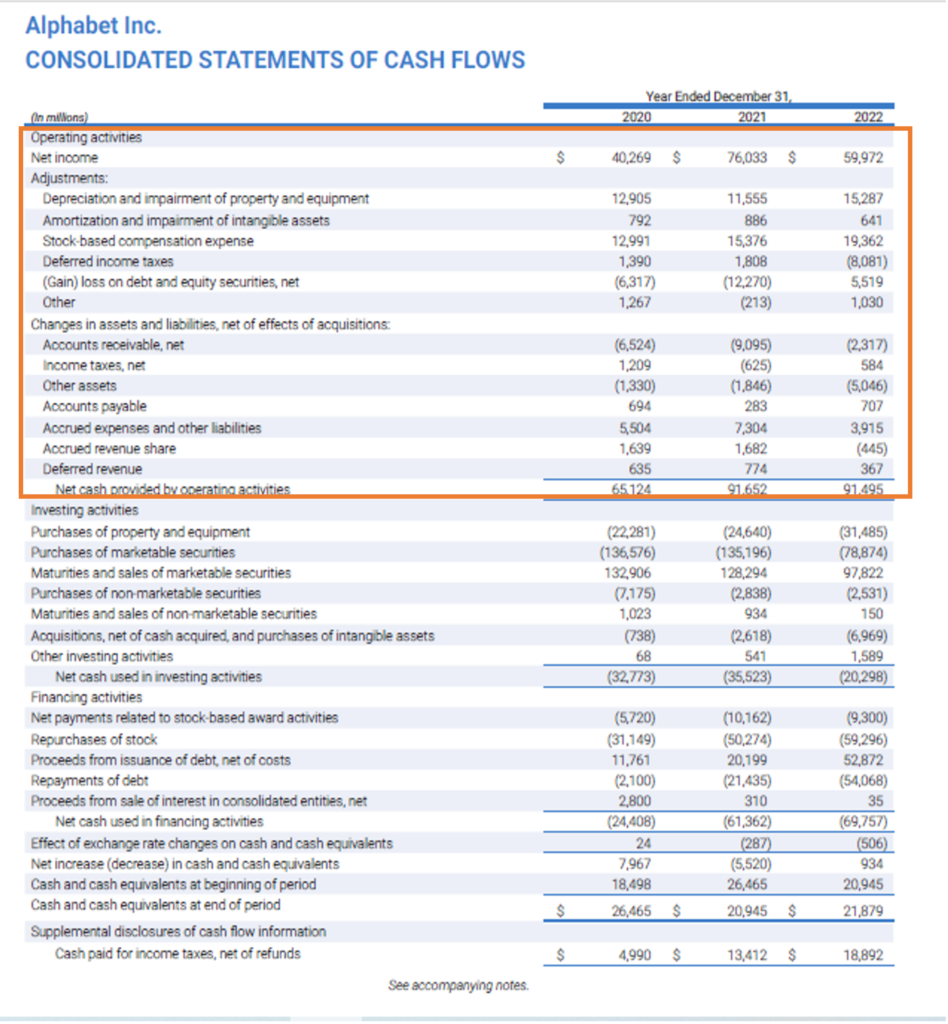

Let us have a look of the calculation of operating cash flow by Alphabet Inc. for the financial year ended 2022,2021 and 2020 through its consolidated cash flow statement published in the annual return.

Source: https://abc.xyz/investor/

We can see from the above cash flow statement that though the Net Income has fallen by 21.12% in the financial year ended 2022 as compared to 2021. However, the cash flow from operating activities have only fallen by 0.17%. This means there are other factors into play that leads to further reduction of Net Income.

Conclusion : If one were to argue upon the most important metric to evaluate a company from a sustainable business perspective, it would have to be the Operating Cash Flow metric. For most mature and stable business, it should be huge positive surplus so as to be able to invest back in the business through any capital expenditures or even pay back the debt or do a share buyback.

2 thoughts on “Operating Cash Flow – The only metric that matters”

[…] line of credit or other financing mechanism. However, remember Remember it is different than operating cash flow that you would get from the Balance Sheet of a […]

[…] first section of the cash flow statement, cash flow from operating activities, shows what happens when a company has income or expenses that are not related to investing or […]

Comments are closed.