WHAT IS MARKET TO BOOK RATIO?

The market to book ratio is also known as price-to-book ratio or P/B ratio and it is a financial valuation metric used to measure a company’s market capitalization relative to the company’s book value of equity, which for the book keeping purposes is recorded as the shareholders’ equity in the books of accounts.

IMPORTANT COMPONENTS OF MARKET TO BOOK RATIO

Two important components of Market to Book Ratio are as follows:

- Also known as the equity value of the company, market capitalization is determined by multiplying the total number of shares outstanding by the latest closing price of a company (latest price is available on the company website or the any investment website). The shares outstanding should be taken as the diluted shares outstanding since dilutive securities like options, convertible securities and warrants create additional shares and thereby diluting the ownership of existing shareholders. The share price of the company is also constantly changing due to fluctuating investor sentiments. The market capitalization reflects how much is the worth of the company’s equity in the eyes of the investors as on the present date.

- It is the Shareholders Equity section of the balance sheet and is an accounting metric calculated for accounting purposes. The Book Value of equity is the net difference between the carrying value of the company’s total assets less its total liabilities. The book value of equity also excludes the total of intangible assets from its calculation. Thus if the company were to undergo liquidation and all the proceeds from sale of assets were used to settle all the company’s outstanding liabilities, book value of equity can be said to be the residual value left for the shareholders of the company after settling for the external liabilities like debt and accounts payable.

MARKET TO BOOK RATIO FORMULA

The market to book ratio can be calculated as follows:

Market to Book Ratio = Market Capitalization ÷ Book Value of Equity

However, if we want to express the same on per share basis the formula will be as follows:

Market to Book Ratio = Market Share Price ÷ Book Value of Equity Per Share

HOW TO CALCULATE THE MARKET TO BOOK RATIO?

Let us see how the market to book ratio is calculated:

Market Capitalization = Current Stock Price* Number of outstanding shares

Total Book Value = Total Assets – Total Liabilities – Intangible assets – Preferred stock

Market to Book ratio = Market Capitalization/ Total Book Value

One thing to remember about the intangible assets that we deduct from book value of equity is generally Goodwill which arises on acquisition. Operating intangibles like software, patents, etc still is included in the above calculation. Sometimes analysts also keep the goodwill in the calculation to arrive at Market to Book ratio including goodwill.

INTERPRETATION OF THE MARKET TO BOOK RATIO AS TO WHAT IS A GOOD MARKET RATIO

Market to Book ratio analysis from the investors point of view is very important to decide whether a company’s stock is overvalued, undervalued or fairly priced in order to take important investment decisions. However, the market to book ratio should not be used as a standalone metric to take investment related decisions and should be used along with various other financial metrics to support an investment decision. Also, it should be noted that any ratio makes sense only when compared to ratios of peer companies in the same industry or used for year on year analysis for the same company.

Let’s understand what does a high or a low ratio here means:

- A high ratio means that the company’s share price and thus market capitalization is higher as compared to its book value of equity and might be trading at a premium over its intrinsic value. A high ratio means that the stock of the company is overvalued but always it may not be necessary to take a short position since it could simply mean that investors are confident about the future prospects of the company and are ready to pay a premium for its stock. In short what counts for a good or a bad ratio depends on the industry the company is in, the overall state of valuations in the market, whether the high ratio is due to company’s good growth prospects or is due to a temporary surge in its share price. A high ratio means that investors are ready to pay more dollars for each net assets in the company.

- Is a company’s share price falls it leads to low market capitalization in return and hence low market to book ratio. Low ratio often means the stock is undervalued. The decline may be due to steep fall in its valuation which often tends to be a warning signal of any trouble with the company, as any decline happens for a reason. However, the market also has many opportunistic investors who also gain from such situations. Sometimes the investors tend to overreact to the negative news about the company and over sell the shares, however the company in order to turn around its downward trajectory to upward soon implement corrective actions and measures. These opportunistic investors seen the low ratio as an opportunity to purchase shares at a lower price to gain when the market corrects itself in future.

DIFFERENCE BETWEEN THE MARKET VALUE AND BOOK VALUE OF EQUITY

Market value of equity means how much investors think a company is worth today and is commonly known as the share price of the company actively trading in the open markets. It reflects the forward looking assumptions regarding the company future prospects and what is the value of the company in the eyes of the investors. The Market value of equity is driven by market sentiments and often keeps fluctuating.

Mostly, the market value of equity for most of the publicly traded companies are higher than the book value of its equity except a few cases where the company is in financial distress or on the verge of bankruptcy or applying for the same.

The Book value of equity on the other hand is an accounting term represented by the shareholders’ equity on the Balance Sheet of the company. It is in short the net assets of the company i.e., total assets less the total liabilities.

Since the book value of equity is a levered metric as it pertains only to the equity holders and is a post debt metric, the market capitalization is used as the corresponding metric to calculate Market to book value since the enterprise value includes both equity and debt component. To avoid the mismatch between the group of capital providers, both the metrics used in the market to book ratio is post debt and levered metrics.

ADVANTAGES OF MARKET TO BOOK RATIO

Some of the advantages of market to book ratio are as follows:

- Market to book ratio can be used by companies with positive book values but negative earnings. Negative earnings can make Price to earnings ratio useless and may make inter-company comparison difficult. Hence, analysts and investors may resort to market to book ratio since only fewer companies may have negative book value as compared to companies with negative earnings.

- Market to book ratio is used for initial screening of companies which are undervalued or overvalued. The investor on basis of this metric may further evaluate the reason of the overvaluation or undervaluation using other financial metrics.

LIMITATIONS OF MARKET TO BOOK RATIO

Some of the limitations of market to book ratio are as follows:

- Companies may be governed by different accounting standards in different countries thus making market to book ratio comparison difficult amongst the companies.

- The market to book ratio calculation excludes the intangible assets from the book value of equity and hence is less useful for service and information technology companies with a significant amount of intangible assets and only a little amount of tangible assets on its balance sheet.

- A company with continues negative earnings can make the book value negative, thus making market to book ratio useless for relative valuation.

- Certain scenarios like recent buyback, acquisition of company or recent write offs can change the no. of outstanding shares and can distort the book value figure in the market to book ratio.

HOW IS THE MARKET TO BOOK FORMULA DERIVED?

By doing some financial analysis the market to book ratio can be shown to be equal to PE*ROE and therefore be shown to be driven by Return on equity and PE multiple.

PE multiple is driven by (1-g/ROE)/(r-g), where ROE is the return on equity, r is the cost of equity and g is the growth rate. My applying the mathematical calculation we get MB multiple as (ROE-g)/(r-g). If we assume the growth rate (g) to be zero, then the market value of equity is equal to the book value of equity if ROE=r.

The market to book ratio is greater than 1 if the company gives a ROE higher than the cost of equity (r) and a ratio less than 1 if the company gives a ROE less than the cost of equity (r).

REAL LIFE EXAMPLE ON CALCULATION OF MARKET TO BOOK RATIO

Let’s calculate the market to book ratio as of 13th December 2023.

The current share price of Apple Inc.’s stock as on 13th December 2023 is $194.71 (as per https://investor.apple.com/stock-price/default.aspx )

Apple’s Inc.’s book value per share for the quarter that ended in Sep. 2023 was $4.00. (as per https://www.gurufocus.com/term/pb/AAPL/PB-Ratio/Apple)

Hence, the Market to Book ratio = Market price per share/ Book value per share

= 194.71/ 4

= 48.67

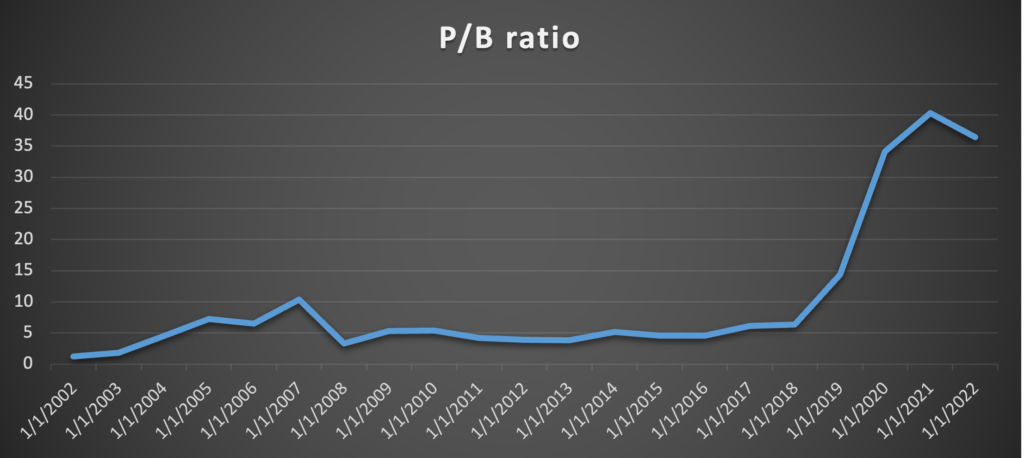

Apple – P/B ratio (from 2001 to 2022) is shown below:

| Year | P/B ratio | Change |

| 31-12-2002 | 1.25 | – |

| 31-12-2003 | 1.82 | 45.60% |

| 31-12-2004 | 4.5 | 147.25% |

| 31-12-2005 | 7.25 | 61.11% |

| 31-12-2006 | 6.5 | -10.34% |

| 31-12-2007 | 10.4 | 60.00% |

| 31-12-2008 | 3.32 | -68.08% |

| 31-12-2009 | 5.34 | 60.84% |

| 31-12-2010 | 5.43 | 1.69% |

| 31-12-2011 | 4.19 | -22.84% |

| 31-12-2012 | 3.92 | -6.44% |

| 31-12-2013 | 3.86 | -1.53% |

| 31-12-2014 | 5.21 | 34.97% |

| 31-12-2015 | 4.55 | -12.67% |

| 31-12-2016 | 4.6 | 1.10% |

| 31-12-2017 | 6.14 | 33.48% |

| 31-12-2018 | 6.33 | 3.09% |

| 31-12-2019 | 14.4 | 127.49% |

| 31-12-2020 | 34.1 | 136.81% |

| 31-12-2021 | 40.3 | 18.18% |

| 31-12-2022 | 36.4 | -9.68% |

Graphical representation of the data above

P/B ratio for similar companies or competitors of Apple Inc.

| Company | P/B ratio | difference | Country |

| Microsoft | 12.6 | -74.13% | USA |

| Amazon | 8.33 | -82.91% | USA |

| Alphabet (Google) | 6.09 | -87.51% | USA |

| Netflix | 9.17 | -81.19% | USA |

| HP | -27.9 | -157.35% | USA |

From the above analysis we can see that we are comparing Apple Inc.’s Market to Book ratio to the similar companies in the same industry and all the companies are from the same country to make comparison more reliable. We can observe that Apple Inc. has the highest Market to Book ratio. This implies that the shareholders for $1 of net assets of the company are willing to pay a premium of around $48.67. This only implies that the share price of the company is overvalued since the shareholders are optimistic of the future prospects of the company and are willing to spend more for future returns.

You can also read more about this on our LinkedIn page as well:

4 thoughts on “Market to Book ratio – did you create value?”

[…] metrics, as it is a key metric used. Sometimes to assess value creation in a business, we use the market to book ratio to understand valuation. This tells us how much times more is the value of the company compared to […]

I have been browsing online more than three hours today yet I never found any interesting article like yours It is pretty worth enough for me In my view if all website owners and bloggers made good content as you did the internet will be a lot more useful than ever before

I was recommended this website by my cousin I am not sure whether this post is written by him as nobody else know such detailed about my difficulty You are wonderful Thanks

Hi i think that i saw you visited my web site thus i came to Return the favore I am attempting to find things to improve my web siteI suppose its ok to use some of your ideas

Comments are closed.