WHAT IS RETURN ON ASSETS?

Return on assets (ROA) refers to a financial profitability ratio and return on investment metric that shows how profitable a company is relative to its total assets. ROA is used by corporate management, investors and analysts to determine how efficiently a company uses its investment in assets to generate a profit. The metric is commonly expressed as a percentage. Higher returns indicate that the management of the company is efficient and productive in utilizing its economic resources to generate profit for the company and the lower ROA indicates that the assets are not being utilized efficiently to generate profits and there is room for improvement in asset utilization of the company. ROA metric also helps the investors to analyze whether the company is able to utilize the money invested by it to give them higher returns. If the ROA is high, it means that the money invested in by the investors is reaping good results and vice versa for low ROA.

ROA shows how much a company is earning in net income for each dollar invested in assets. For example, if the ROA of any company is 15%, it means that for every dollar invested in assets, the company earns 15 cents in net profit.

HOW TO CALCULATE RETURN ON ASSETS?

ROA is calculated by dividing the company’s net income by its total average assets. Let us understand the steps involved to calculate ROA. The numbers needed to do this calculation is available on the Income Statement Balance sheet of the company.

- Find the Net Income of the Company: The first step in calculating the return on assets of a company is to find the net income of the company. Net income is the amount of total revenue that remains after accounting for all the expenses like cost of goods sold, other operating cost, Interest on debt and taxes. This information is often called as the “bottom line item” since it can be found at the bottom of a company’s income statement.

Net Income= Pre-tax income- Taxes

- Find the total assets of the company: The second step is to find the total of assets or average total assets of the company. We should use the average total assets for our calculation as it results in a more accurate calculation because a company’s total assets can vary over time. The total assets figure can be found on the company’s balance sheet.

Average total assets= (Beginning + Ending Total Assets)/2

- Divide net income of the company by its total assets: Lastly we divide the result in step 1 i.e., Net Income by result in step 2 i.e., average total assets.Multiply the result by 100 to get the metric in percentage form.

Return on Assets (ROA)= Net Income/ Average total assets

Or, Return on Assets (ROA)= Net Income/ Total assets

IMPORTANCE OF RETURN ON ASSETS

ROA is one of the most used profitability metric to assess whether a company generates profit in terms of asset usage. The most common reasons companies perform ROA analysis are as follows:

- ROA is used to determine the efficiency and profitability of the company: Return on assets give the profit earned by the company on per dollar of assets invested. Therefore, a high return indicates that a company has earned high profits from the assets invested in the company and is therefore more profitable and efficient. A company with consistently improving ROA ratio shows that it is efficiently utilizing the debtholders and equity holders’ money to generate profit. If the ratio is low in any one specific period, it may not necessarily mean that the company is underutilizing its resources. The ratio may be low in any one period due to the company expanding its operations and investing in new capital assets.

- ROA is used for inter-company performance comparison: Since ROA uses assets as its denominator, it should not be used for comparison across industries, since different type of companies have different kind of asset base. For example, some industries may require heavy investment in expensive plant, property and equipment to generate income like oil and gas, manufacturing and mining industries as against retail industry or software industry, where there is very less requirement of capital expenditure to generate income. The companies with high asset investment generally reports a lower return on assets when compared to companies that do not require much investment in assets. Hence, ROA should be used only for comparisons of companies within the same industry.

- ROA is used to distinguish between asset intensive and light companies: Return on assets is used to determine how asset intensive or asset light a company is. If the return on assets is low, the company is more asset-intensive. An example of an asset-intensive company would be a mining or an airline company. If the return on assets is high, the company is less asset-intensive. An example of an asset-light company would be a retail store or a software company.

Generally, a company with return on assets under 5% is considered an asset-intensive business and above 20% is considered an asset-light business.

RELEVANCE OF RETURN ON ASSETS (ROA) TO INVESTORS

Since Return on assets is a profitability ratio, it is widely used by investors to analyze a company’s performance across several periods and also compare its performance with its competitors. This ratio helps the investors to decide in which stock to invest based on which companies return more profit against the assets invested in the company. However, this ratio should be used along with other financial metrics to make an informed investment decision.

WHAT IS CONSIDERED AS A GOOD RETURN ON ASSETS RATIO?

In general, an ROA of 5% or lower might be considered low and a ROA of 20% or high may be considered as high. However, ROA’s should always be compared for companies within the same industry. A capital intensive company may have ROA of 2%, but a company with fewer assets and an equivalent profit or net income might have a ROA of 15%.

RETURN ON ASSETS (ROA) VS. RETURN ON EQUITY (ROE)

Both ROA and ROE are Return on investment type profitability ratio metrics and measures how efficiently a company utilizes its resources. The main difference between the two metrics is how debt is treated in each one of them. Since ROA has Total assets as its denominator, it includes both equity and debt component. It represents the total money put in by the debt holders and equity holders and factors in how leveraged a company is. On the other hand, ROE has Total equity as its denominator which means it only measures the profit a company earns for each dollar invested by its equity holders. Thus, ROA accounts for debt whereas ROE does not account for debt. This means the more debt and leverage a company takes, the ROE will be higher than ROA since ROE’s denominator will be lower than ROA denominator, while the numerator i.e., the Net Income being the same.

LIMITATIONS OF RETURN ON ASSETS

There are some limitations of ROA as a profitability measure and should be used along with other metrics like ROE and profit margin like net profit margin and gross profit margin to make any investment related decision. Some of the limitations are discussed below.

- ROA cannot be used across industries: Since different companies have different asset base ROA for one company may greatly vary from the ROA of another company belonging to a different industry. For example, the asset base of a mining company may vary hugely from that of a software company with a same asset base and hence their ROA comparison becomes unviable. Any day the ROA of a software company will be better off than that of a mining company.

- Basic ROA formula flaw: For non-financial companies both equity and debt are segregated and returns for both are also segregated. For the equity investors the return is the Net income and for debt providers the return is Interest expense recorded by the company. This is the point where the ROA formula suffers the major drawback. While the numerator i.e., the Net income shows return to equity holders, the denominator shows the total assets which is nothing but money invested by both the equity providers and debt providers. Hence, in real life this traditional ROA formula need to be fixed up by putting back interest expenses (net of taxes) to the numerator as follows:

ROA= [Net Income+ Interest Expense (1-Tax Rate)]/ Average Total Assets

Or,

ROA= Operating Income*(1-Tax Rate)/Average Total Assets

REAL LIFE EXAMPLE OF RETURN ON ASSETS CALCULATION

Let’s see ROA calculation of Apple Inc. for the financial year ended Sept30, 2023.

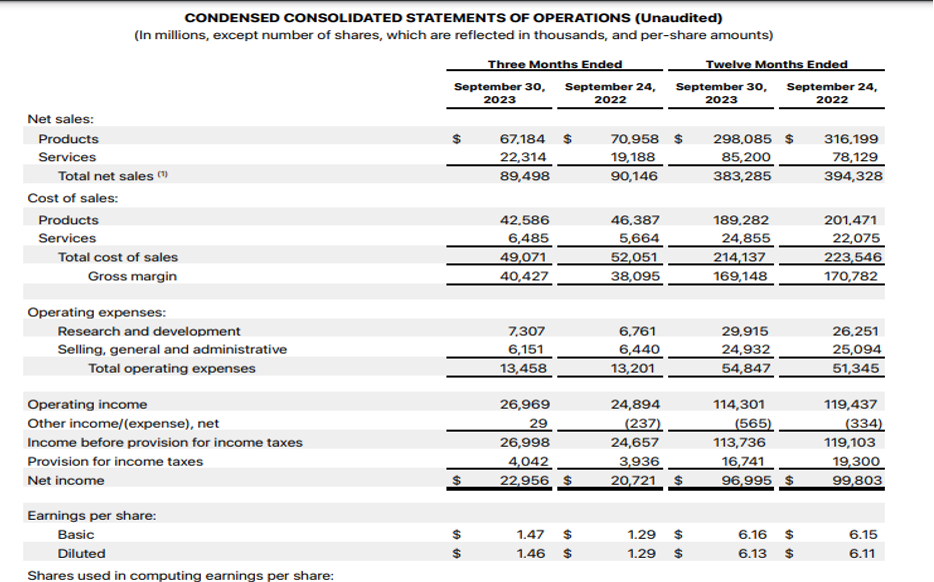

Source: https://www.apple.com/newsroom/pdfs/fy2023-q4/FY23_Q4_Consolidated_Financial_Statements.pdf

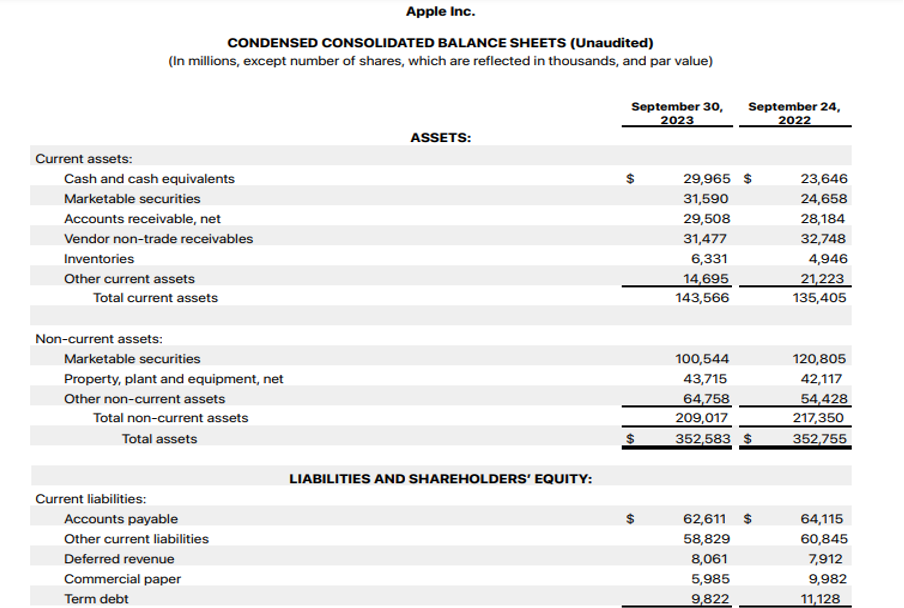

Source: https://www.apple.com/newsroom/pdfs/fy2023-q4/FY23_Q4_Consolidated_Financial_Statements.pdf

From the Income statement and Balance sheet of the company we gather the following data:

- Net Income for 12 months ended 30 Sept 2023 is $ 96,995 million.

- Average Total Assets= (352,583+ 352,755)/2 = 352,669

Hence ROA= Net Income/ Average Total Assets*100

= 96,995/352,669*100

= 27.51%

If we calculate the ROA by taking Total assets for the year ended instead of average total assets we get the following result.

ROA= Net Income/ Total Assets

= 96,995/ 352,583*100

= 27.51%

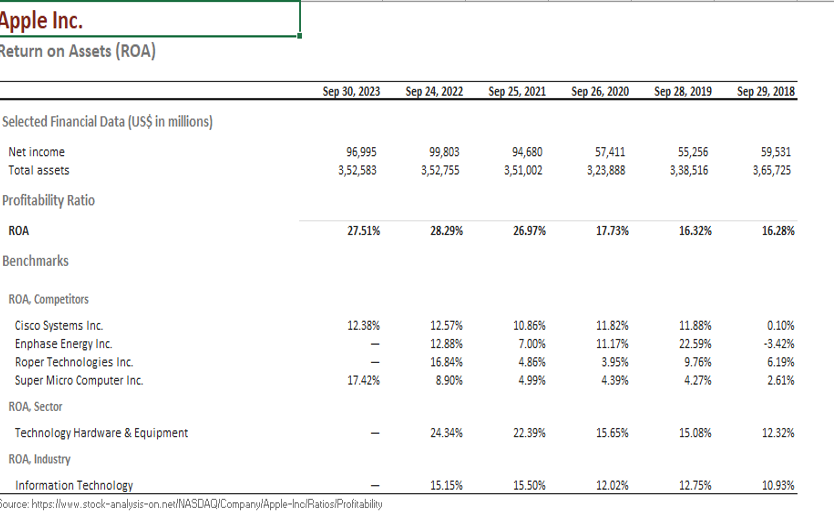

Following is the ROA calculation for Apple Inc. for the last 6 years and its competitors.

Source: https://www.stock-analysis-on.net/NASDAQ/Company/Apple-Inc/Ratios/Profitability

As can. be seen, Apple’s Return on Assets has been increasing year on year since 2018. When compared to the broader IT space, it is earning significantly higher than returns than most competitors.