WHAT IS ENTERPRISE MULTIPLE?

EV/EBITDA also known as Enterprise multiple or EV multiple is a financial ratio that compares a company’s Enterprise Value (EV) to its annual Earnings Before Interest, Taxes, Depreciation & Amortization (EBITDA either historical or a forecast). The ratio is commonly used as a financial valuation metric to compare the relative valuation of different companies in the same or an adjacent sector.

MULTIPLE USES OF EV/EBITDA

The enterprise multiple is used to compare the entire valuation of a company with the amount of annual EBITDA earned by it. This ratio tells us that if anyone wants to acquire the entire business then how many times EBITDA they have to pay for the business.

Some common uses of EV/EBITDA are as follows:

- Determination of what multiple a company is trading currently (i.e. 7x)

- Comparing the valuation of multiple similar companies across a group

- Calculation of the terminal value in a Discounted Cash Flow (DCF model)

- Negotiating for the private business acquisition (i.e. the acquirer offers 5x EBITDA)

- In an equity research report calculation of a target price for a company

HOW TO CALCULATE EV/EBITDA MULTIPLE?

The EV/EBITDA multiple involves two important variables: Enterprise value and EBITDA. The enterprise value (EV) represents the debt-inclusive value (i.e. unlevered value) of a company’s operations while EBITDA is also a capital structure-neutral cash flow metric as it involves returns to both the debt and equity holders. The formula of EV/EBITDA multiple is as follows:

EV/EBITDA = Enterprise Value ÷ EBITDA

Where,

- Enterprise Value: Enterprise value (EV) metric is used widely by investors and analysts to calculate a company’s total value or worth. To determine a company’s worth, while some investors simply look at a company’s market capitalization (i.e. the number of equity shares outstanding multiplied by the current market price of one share), other investors believe the enterprise value metric instead gives a more complete picture of a company’s true value because it takes into consideration the amount of debt carried by the company and its cash reserves. Since Enterprise Value (EV) includes ownership interests and asset claims from both equity and debt it shows the total company’s worth. In short is shows how much the company could sell for if someone bought it right now.

Calculation of the Enterprise value involves determination of the company’s market capitalization by multiplying the company’s outstanding shares by the current market price of one share and adding to this the company’s total debt both long-term and short-term, and subtracting cash and cash equivalents of the company. Cash is deducted since anyone acquiring the company can pay off its debt using cash thus giving net debt.

Hence, Enterprise value= Market Capitalization + Total Debt (short and long term)- Cash and Cash equivalents

- EBITDA: The full form of EBITDA is Earnings Before Interest, Taxes, Depreciation, and Amortization and is often used as a proxy for a company’s operating cash flows (i.e. unlevered). EBITDA is used by investors as a useful metric to measure the overall financial performance and profitability of the company. EBITDA can be easily calculated using numbers found on a balance sheet and income statement of a company. Investors can compare a company against industry averages and against its peer companies using the EBITDA metric.

For EBITDA calculation of a company, first we need to find the Net Income, tax, and interest figures on the company’s income statement and the depreciation and amortization amounts from the cash flow statement of the company. However, EBITDA can also be calculated adding depreciation and amortization expenses to the company’s operating profit also known as EBIT (Earnings before Interest and Tax).

Hence, EBITDA= Net Income+ Interest+ Taxes+ Depreciation and Amortization expenses

or, EBITDA= EBIT+ Depreciation and Amortization expenses

WHAT IS A GOOD EV/EBITDA RATIO?

There are generally no set rules to determine what constitutes a low or high EV/EBITDA valuation multiple because the answer is dependent on various contingent factors, competitive landscape and on the industry that the company being evaluated operates within. In general, EV/EBITDA values below 10 are seen as healthy however a more in-depth analyses are required before making a subjective decision on whether a company is overvalued, undervalued or fairly valued. A lower EV/EBITDA ratio suggests that a company may be potentially undervalued by the market and is a more attractive investment option.

A low EV/EBITDA ratio indicates that the company’s EBITDA is relatively higher than the enterprise value (EV). This means that the investors have to pay less for each dollar of returns generated by the company which means that the market potentially undervalues the company. A lower ratio is often interpreted by investors as an opportunity to purchase the company’s shares at a relatively lesser and favourable price and offering the potential for future growth when the market corrects the market price of share in future.

On the other hand, a high EV/EBITDA ratio implies that the Enterprise value of the company is higher than its EBITDA. This means that the investors shall pay more than what is earned by the company and indicates that the company is potentially overvalued by investors. A high ratio that the market is optimistic of the company’s performance and are willing to pay a premium for the company’s expected growth prospects and its future earnings.

For example, for a software company an EV/EBITDA multiple of 10.0x could be viewed as being low on the valuation range commonly found amongst the companies in the software industry whereas for a consumer goods company an EV/EBITDA multiple of 10.0x could be viewed as being high.

PROS AND CONS OF EV/EBITDA RATIO

EV/EBITDA ratio is often criticised many due to the usage of EBITDA in the formula as for many EBITDA is not an accurate representation of the true cash flow of a company and can be misleading especially for the highly capital intensive companies.

Pros of using EV/EBITDA ratio:

- Easy to calculate using publicly available information: The EV/EBITDA ratio calculation is relatively easy and straightforward as the information required for the calculation is generally publicly available. This allows investors and analysts to apply this metric in their financial valuation analysis. This ratio is also commonly used in industry analysis, economic research and investment reports.

- Effective valuation method for mature and stable companies: The EV/EBITDA ratio considers debt in its capital structure and hence used to assesses a company’s operating performance and hence used to value more stable and mature business.

- Used for comparing different business: Since EV/EBITDA metric takes into account enterprise value which takes debt into account and EBITDA which excludes depreciation and interest from earnings, it provides a more standardised base to compare companies with varying capital structures, profitability level and sizes.

Cons of using EV/EBITDA ratio:

- Less Appropriate for Capital-Intensive Industries: Though using EBITDA in the ratio helps comparison amongst companies more uniform, for some companies excluding capital expenditures could go wrong and make metric unviable. Some industries require hefty capital expenditure to be successful like the mining and oil and gas industry, automotive, airline, real estate and manufacturing companies. In some companies the capital expenditure may outweigh the earnings of the company and is a signal of financial failure. Excluding capital expenditure from the formula in EBITDA can give a false picture of financial well-being of the company.

- May be indication of value traps: For investors companies with low EV/EBITDA ratio may appear to be potentially undervalued and attractive investment option. However, in some cases, low EV/EBITDA multiples may point towards major fundamental issues with the company’s performance or the industry in which it is operating in and thereby suggesting potential for negative returns for investors. Hence, an investor before going in for value trap should carefully evaluate the company specific factors and industry trends.

- Difficult to compare companies with different growth rates: Different companies have different risk profile and different growth trajectories. Hence an investor should consider other valuation metrics like the PE ratio along with EV/EBITDA multiple to evaluate companies with different growth rates.

- Can Misrepresent Liquidity: The ratio often leads to misinterpretation of a company’s liquidity since it removes many of the non-core financial aspects from the EBITDA like interest, taxes and depreciation and amortization expenses which are otherwise crucial to run a business. In can give positive image of the profitability of the company but at the same time can mislead the investors by removing these expenses from the calculation.

WHAT DOES NEGATIVE EV/EBITDA MEAN?

A negative EV/EBITDA ratio can become confusing and does not help the investors make any investment related decision. Mostly start-ups and company in their initial growth stage have negative earnings and hence have negative EV/EBITDA multiple.

STEPS TO CALCULATE EV/EBITDA RATIO

Following are the steps to calculate the EV/EBITDA multiple to be used for valuation of a company.

- Selection of an Industry: The first step to calculate EV/EBITDA multiple is to identify the industry in which the target company operates to ensure comparisons with similar companies.

- Identifying comparable companies: The next step is to identify the companies within the chosen industry similar to the company to be evaluated. These companies chosen should have similar characteristics to the target company like size, geographical focus, product mix and market positioning.

- Comparative analysis to be conducted: For the comparison to be on equal grounds it is important that companies chosen above for comparison are actually comparable and companies that differ significantly in product offering, size or market reach should be eliminated to avoid distort valuation analysis.

- Gathering of Historical Financial Information: For each selected company at least three years of historical financial data should be collected like revenue, gross profit and EBITDA.

- Current market data to be obtained: To calculate the enterprise value collect current market data for each company like share price, number of outstanding shares and net debt.

- Calculation of enterprise value: The enterprise value can be calculated can adding the market capitalization (current share price multiplied by number of shares outstanding), debt and cash and cash equivalents for each company to be evaluated.

- Computation of EV/EBITDA ratio: Calculate the EV/EBITDA multiple for each company under evaluation for each year taken into consideration. EV/EBITDA can be calculated by dividing Enterprise value by EBITDA.

- Comparison of EV/EBITDA multiples: EV/EBITDA multiple for each company above should be analysed to gain insight into the relative valuations of the company and any discrepancies between the valuations.

REAL LIFE EXAMPLE OF EV/EBITDA CALCULATION

Let us calculate EV/EBITDA for Apple Inc. for the last 6 years.

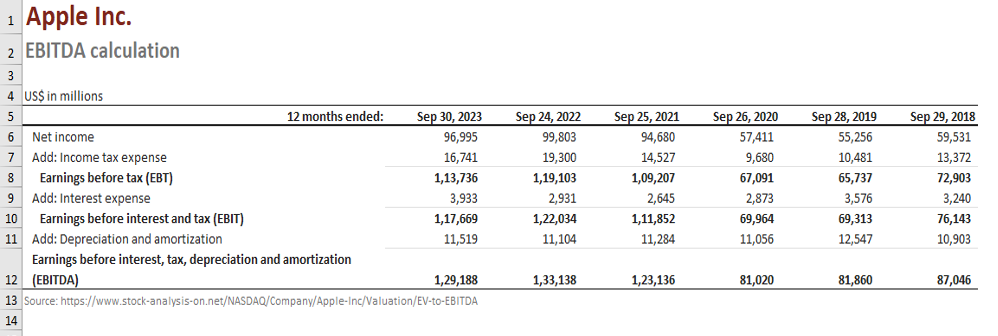

EBITDA calculation for last 6 years is as follows:

Source: Source: https://www.stock-analysis-on.net/NASDAQ/Company/Apple-Inc/Valuation/EV-to-EBITDA

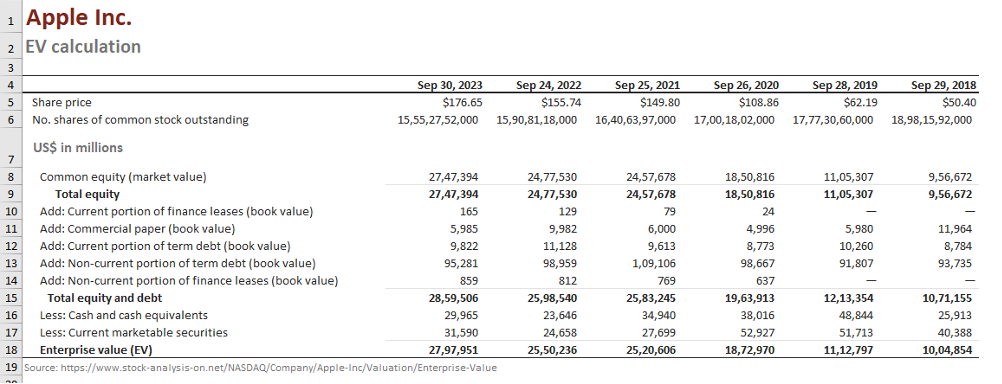

Historical Enterprise Value of last 6 years is as follows:

Source: Source: https://www.stock-analysis-on.net/NASDAQ/Company/Apple-Inc/Valuation/EV-to-EBITDA

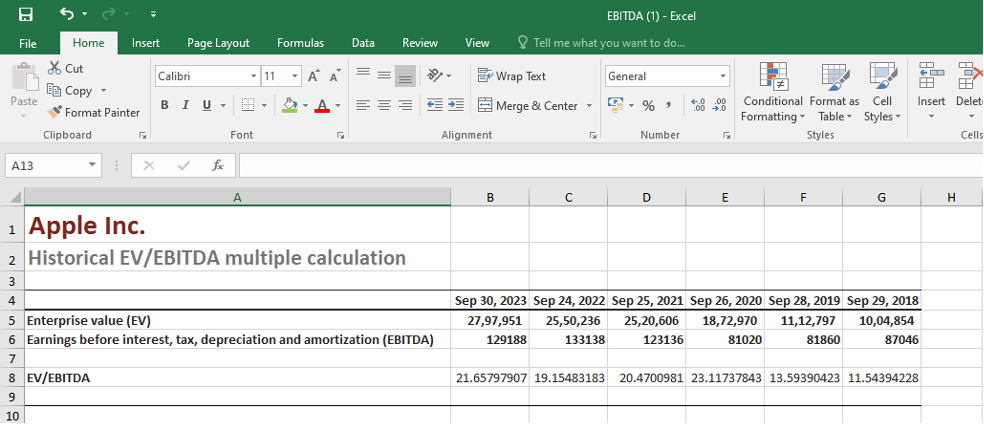

Historical EV/EBITDA ratio calculation of last 6 years:

Source: Source: https://www.stock-analysis-on.net/NASDAQ/Company/Apple-Inc/Valuation/EV-to-EBITDA

Conclusion : As you can see above, Apple’s enterprise value multiple has expanded significantly from 11.5x in 2018 to 21.6x in 2023. This reflect market/investors expectations that Apple will continue to doing well from a growth and profitability perspective. Given the recent news of slowdown in the iPhone sales in China and other market headwinds in Apple, the further expansion in the EV/EBITDA multiple looks unlikely from here on.

2 thoughts on “EV/EBITDA Multiple – do you feel the weight of expectations”

[…] value multiples (P/E ratio) and Enterprise value multiples (EV/EBITDA, EV/EBIT etc.) are generally used to compare valuation of Companies in the same or different […]

[…] Terminal value under the exit multiple method is calculated using the multiple of EV/EBITDA, EV/Sales etc., giving a […]

Comments are closed.