INTRODUCTION

If any person is looking out for building long term wealth, then investing in the stock market is one of the best options. One can earn money in the stock market through either buying stocks, holding them for an extended period of time and then selling them off once the stock price rises (also known as capital gains) or hold the stock of the company and receive a share of the company’s net profit distributed by the company periodically as Dividends.

WHAT ARE DIVIDENDS?

A dividend is the distribution of the surplus profits of the company to the shareholders who have invested their money in the company. A company is able to pay dividends only if it is earning enough revenue to cover its basic operational cost and non-operational cost and then chooses to divide up excess surplus remaining thereafter amongst its shareholders. The decision to distribute the dividends is taken by the board of directors and approved by the shareholders through their voting rights. Any surplus amount not distributed as dividends is re-invested in to the business called the retained earnings. Dividends may be distributed out of current year earnings as well as retained earnings of the previous year’s however paying dividends out of its capital is prohibited by the companies. The dividends may be distributed in cash usually by bank transfer to the shareholders or in the form of dividend reinvestment plan where the existing shareholders can re-invest their dividends to purchase additional stock or dividend may sometimes also be distributed in the form of assets.

However, the amount of distribution of dividends depend on various factors like: how much shares a shareholders own, the company one has invested in, the decision of the board of directors, future expansion plans of the company, approval by the shareholders, amount of profit made by the company, frequency of dividend payouts, payout rates and sometimes even the broader market conditions and major changes in the company’s industry.

For the investor dividends are assets whereas for the company is shown as a liability.

WHY DO COMPANIES CHOOSE TO PAY DIVIDENDS?

Some of the reasons why companies choose to payout dividends instead of retaining them all in the business for future expansion are as follows:

- Dividend payout attract more investors: Not all investors invest from the point of view of holding the assets in the long run to earn long term capital gains but some are also attracted by the regular dividend payouts by the company as it acts as a regular source of income for them.

- Dividend payout can be a signal of positive financial health of a company: A company paying dividends regularly gives an impression to the investors that the company has a track record of generating surplus cash flows which enable them to distribute it amongst the shareholders and can be a signal for them that they are investing their money in the right company. Consistent dividend payout indicates that the company has a long term viable business model. Due to this reason we can often see that a company which has a track record of paying regular dividends if declares a reduced dividend or choose not to pay dividends it may signal the investors that the company might be in some sought of trouble. However, the decision to pay reduced dividends or elimination of dividends may not always be a bad new, since the company may have plans to re-invest the money instead in high revenue generating future projects that will magnify the returns for shareholders in future.

However, all companies may not pay dividends. Some companies may decide to re-invest the surplus money in the company instead of paying them as dividends if the company is a startup and has just established itself or it is focusing to expand its existing business operations or planning to expand its operations in new opportunities. Companies may also decide to suspend the dividend payout due to some financial trouble or any expensive lawsuit.

COMPANIES PAYING DIVIDEND

A potential investor looking out to earn dividend income should target the large companies with predictable profit record as they are the best dividend payers in the market. Some of the industries that have maintained a regular record of paying dividends are Banks and Financial institutions, Oil and Gas, Healthcare and pharmaceuticals, and Utilities. Specified distribution of dividends is required by the Real State Investment funds and master limited partnerships. Funds also usually distribute dividends regularly as stated in their investment policy and objectives.

However, the companies which have just established or are in their early stages of development like startups or biotech sectors may not pay regular dividends since they retain those earnings instead for research and development, expansion of the business and operational activities.

DIVIDEND DATES

A chronological order is followed to pay the dividends and the dates are important to determine which shareholders are qualified to receive the dividend payment and which shareholders are not qualified.

- Announcement date or Declaration date: This is the date on which the directors announce their intention to pay dividend. The company on that day recognizes a liability in its books which shows that now it owes money to the shareholders.

- In-Dividend date: This is the last day, which is one trading day before the ex-dividend date. In-dividend date is date is said to be cum dividend that is including dividend. The dividend shall be paid to the shareholders who either are existing shareholders on that day or purchase the shares on that day. Anyone who sells the shares before on that date shall not be entitled to dividend declared. The shares become ex-dividend after this date.

- Ex-Dividend date: The Ex-Dividend date or Ex-Date is the day on which the stock starts trading without the value of the next dividend payment. It is typically one trading day before the record date in the United States and many European countries. This date is important for companies with large number of shareholders and those that trade on exchanges to do the reconciliation of shareholders who are entitled for dividend payment. The dividend shall be paid to the existing shareholders even who have sold the shares on or after that date. Any shareholder who has bought the shares on that day shall not be entitled to receive the dividend payment. The share price usually decreases on the ex-dividend date by the amount equal to dividend being paid. Dividend payment results in decrease of company’s assets and hence also its share price.

- Book closure date: The company announces the date on which it temporarily closes its books for share transfer usually on the date it announces a dividend. The book closure date is also usually the record date.

- Record date: The dividend paying companies establish a cutoff date to determine which shareholders are eligible to receive dividend or not. Dividend is paid to the shareholders registered in the company’s record as of the record date and those who are not registered as of this date are not paid dividend. In short the shareholders registered before the ex-dividend date are paid dividend.

- Payment date: This is the day when the company issues the dividend payment to shareholders either by crediting the amount to their bank accounts or issuing cheques which are mailed to the shareholders.

DIVIDEND FREQUENCY

The number of times the dividend is paid by the company within a single business year to its shareholders is called the Dividend Frequency.It may be paid monthly, quarterly, semi-annually or yearly. While most countries in US pay dividends quarterly while in UK and Australia it is mostly paid annually.

TYPES OF DIVIDEND

The different types of dividends that can be paid by a company to its shareholders are discussed below:

- Cash Dividend: This is the most common form of dividend payment by most of the companies and are usually paid out in currency, via electronic funds transfer or a printed paper check. These are the Investment income of the shareholders treated as earned when paid rather than when it is declared. The company pays dividend for each share owned at a declared dividend payout rate. For example, if a shareholder owns 100 shares of the company and cash dividend declared is 60 cents per shareholder earns in total $60 by holding the stock of the company.

- Stock Dividend: These are the dividends paid in the form of issuance of new shares in the company and are paid pro-rata based on the number of shares a shareholder is already holding in the company. For example, a shareholder holding 100 shares and where 5% stock dividend is declared, the shareholder gets 5 additional shares.

- Assets Dividend/ Property Dividends: Apart from cash and stock dividends, a company may also distribute other assets as dividends such investment securities held by the company of other companies, physical assets or real estate. However, distribution of such kind of dividends is not commonly practiced by companies.

- Special Dividends: When a company pays out dividend outside the company’s regular policy i.e., quarterly or annual distribution, it is known as the special dividends. A company generally distributes special dividends when it has excess cash in hand and does not need it immediately.

- Preferred dividends: This is the dividend payment made to preferred shareholders. Preferred stock is a type of stock which is more like bond than a share in its nature and enjoys a preferential treatment over the payment to equity shareholders. Dividends on preferred stock are generally fixed unlike the dividends on the common stock which may be paid annually or quarterly.

- Dividend reinvestment programs: Under this program the existing shareholders have the option to re-invest the dividends received by them into the stock of the company, often at a discount.

- Liquidating dividends: This type of dividends is paid during the liquidation of the company to the shareholders. The shareholders are returned the amount originally contributed by them in the company and are usually not taxable.

ARE DIVIDENDS EXPENSES?

Since the dividends are payments made to the shareholders of the company, it is not considered as an expense. Expense is any payment made for a service or goods to any third party whereas the shareholders are not the third parties but owners of the company, and hence dividend is not considered as an expense. Dividends are instead treated as a reduction of retained earnings. Dividends are not reported on the income statement. They are reported in the statement of retained earnings or statement of stockholders’ equity once declared and in a statement of cash flows once they are paid.

TREATMENT OF DIVIDENDS IN THE BOOKS OF ACCONTS OF THE COMPANY

Dividends are commonly paid as cash dividends and stock dividends. The treated of both these types of dividend have different impact on the Financial statements discussed below:

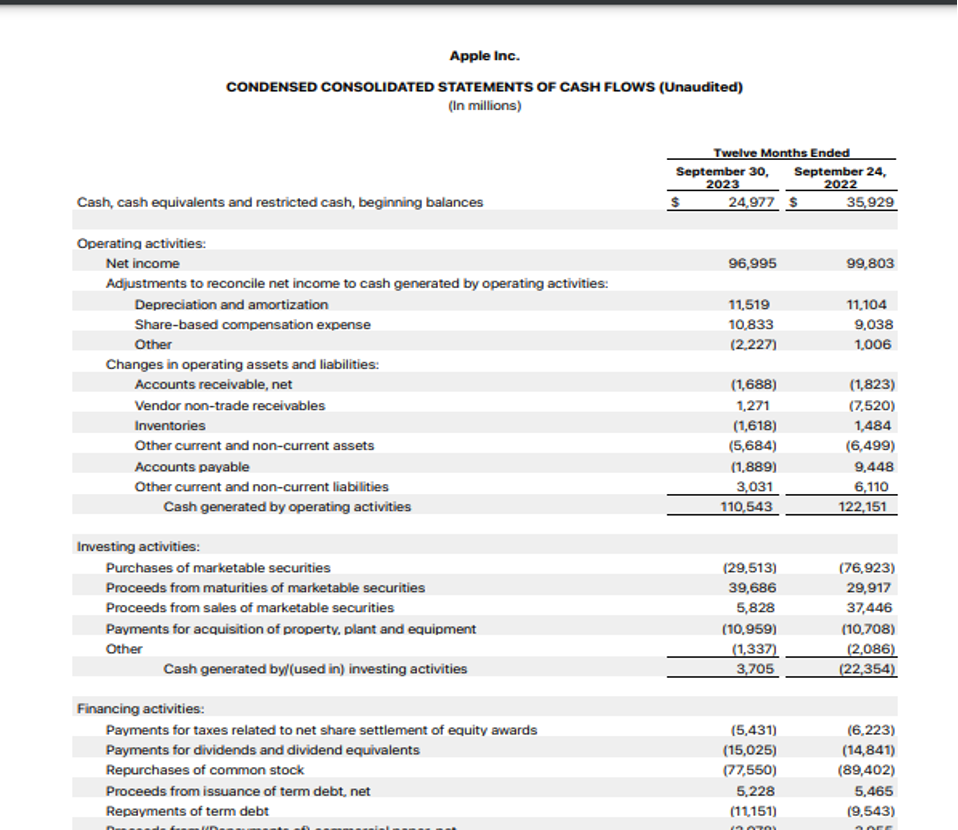

Cash dividend impact on the Balance Sheet: Cash dividends are paid out of company’s retained earnings. So when a company declares the dividend payment, it debits the retained earnings by the amount of dividend to be paid and credits the dividend payable account thereby recording liability in its books. On the payment date when the actual cash outflow occurs, the company debits the dividend payable account and credits the cash balance on the balance sheet. This has the ultimate impact of reducing both the cash and retained earnings balance on the Balance Sheet. The dividend paid is also shown in the Cash flow statement under the Financing Activities.

Example of Dividend paid reported by Apple Inc. in the Cash Glow Statement.

Stock dividend impact on the Balance Sheet: When the company announces a stock dividend it does not impact the cash balance of the company. The company increases the number of outstanding shares since new shares are issued to the shareholders and reduce the retained earnings balance. A company when announces a stock dividend then the amount to be debited is calculated by multiplying the current stock price per share by the dividend percentage and the number of shares outstanding. This type of dividend payment does not impact the asset side of the Balance Sheet and instead only has the impact on the equity side by relocating the dividend amount from retained earnings to stock account.

HOW DO DIVIDENDS AFFECT A STOCK’S SHARE PRICE?

The Stock price usually drops after the stock goes ex-dividend since when a dividend has just been paid there is no further anticipation of another immediate dividend payment and when dividend is paid the company’s assets i.e., cash is reduced and also the equity balance reduces. Let’s understand this with the help of a simple example. Company ABC Ltd.’s share was trading at $70 on the date of announcement of dividend and it announces dividend of $5. As soon as the news becomes public, the stock price starts trading at $75. The stock may trade at $75 one business day before the ex-dividend date, However, on the x-dividend date, the stock price is adjusted by $5 and starts trading at less than $75 at the start of the new trading session on the ex-dividend date. The price is adjusted because anyone who buys the stock ex-dividend is not entitled to the last declared dividend.

HOW TO EVALUATE DIVIDENDS?

Different methods can be used by investors to study and learn about a company’s dividend and compare it with the similar companies in the industry. Some of these methods are discussed below:

- Dividend per share (DPS): As already discussed investors are attracted by the companies that have a track record of paying increased dividends year after year. The DPS calculation shows the amount of dividend per share distributed by the company during a certain time period. DPS allows investors to keep track of companies which pay increased dividends over time and hence take more informed investment decision.

- Dividend Yield: It is a measure commonly reported by the online brokers and financial websites as the annual dividend paid by the company divided by the stock price on a certain date. This measure allows an even better comparison of dividend stocks. For example, a company trading at a share price of $10 pays dividend of $0.10 quarterly i.e., $0.40 annually. At the same time another company is trading at a share price of $100 and paying dividend of $1 quarterly i.e., $4 annually. However, in both the case the yield is same i.e., 4% (0.4/10*100 or 4/100*100).

Formula: Dividend Yield= Annual Dividends per share/Current share price

From the formula, we can see that the Dividend yield has an inverse relation with the share price. When share price goes up the dividend yield falls and vice versa. There are two ways in which a company’s dividend yield can be improved- by either raising its dividend payout or the stock price declining while dividend being the same.

- Dividend Payout ratio: The dividend payout ratio is the proportion of earnings paid out as dividends to the shareholders of the company and is typically expressed as a percentage. The part of earnings not distributed is retained in the company for future growth.

Formula: Dividend Payout ratio= Dividends per share/Earnings per share*100

A payout ratio of 100 or greater than 100 means that the company is paying dividends more than what it has earned in that year and could be a sign of trouble. The earnings may dip too low during the tougher times so as to cover the dividends. Hence, the investors generally look out for stocks with dividend payout ratio of 80% or less. Since earnings is an accounting measure and do not represent the actual cash flow of a company, calculating payout ratio based on free cash flow per share is a better approach to determine the safety involved in the company’s dividend policy. Hence the modified formula for the same is-

Formula: Dividend Payout ratio= Dividends per share/Free cash flow per share*100

ARE DIVIDENDS TAXABLE?

IMPLICATION FOR INVESTORS

For a shareholder Dividend is usually considered as a Taxable Income. It is subject to federal and state tax no matter whether the shareholder decides to keep the dividend income or decide to reinvest the funds. However, the dividends that are seen as a capital return or dividend stocks that are held in a tax-deferred account like 401 (k) or IRA are not taxed until the investment is sold. However, the amount of tax to be paid depends on whether the dividends are qualified or non-qualified.

Qualified Dividends: As defined by the United States Internal Revenue Code (IRC) qualified dividends are ordinary dividends taxed long-term capital gains(LTCG) that is lower than the tax rate rather than the tax rate for an individual’s ordinary income, since they meet specific criteria of minimum holding period. For an investor to qualify for the qualified dividend rate, must own the stock for a long enough time, generally 60 days for common stock and 90 days for preferred stock and must be paid by a corporation in the United states or with certain ties to the United States. These qualified dividends depending on the income and tax filing status are eligible for long-term capital gains tax rates which may be 0%, 15% or 20%.

Non-qualified dividends: Non-Qualified dividends are taxed as “ordinary income” and such dividends are taxed at normal income tax rates anywhere between 0% to 37%.

IMPLICATION FOR COMPANIES

The Dividends are taxable to a corporation as they represent a company’s profits. All the companies have to pay Corporate Tax on the profits earned during the period.

WHAT CAN AN INVESTOR DO WITH THE DIVIDENDS EARNED?

An investor can use the dividend earned on stock in different ways depending on their personal investment goals and financial situation. An investor may choose either of the option:

- Reinvest the funds: An investor who is more interested in long term growth instead of steady flow of income may choose to re-invest the dividend received in the additional stock purchase of the company. The additional shares can usually be purchased at a discount and helps one grow their investment little by little over a period of time.

- Keep the dividend money: An investor looking out to earn regular income in the form of dividend payments by companies can choose to keep the cash dividends as it is. Cash dividends act as a regular source of income for some investors.

IMPACT OF DIVIDEND ON VALUATION OF A COMPANY

There is no impact on the Enterprise value of the company when a company pays dividend. However, it lowers the cash and the equity value of the business by the value of dividend paid by the company.

This is demonstrated through the below example.

| Particulars | Start | Dividend payment | End |

| Equity Value | 100 | -5 | 95 |

| Cash | 50 | -5 | 45 |

| Debt | 10 | 10 | |

| Enterprise value | 60 | 60 |

DIVIDENDS VS BUYBACK

The company can make distributions to its shareholders in two most common forms: Dividend payout and share buybacks. Share buyback is when the company uses the cash balance in the balance sheet to repurchase its own shares in the open market. The share buyback returns the cash to the shareholders and reduces the number of shares outstanding of the company. The most common reason for companies to perform share buyback is to improve its Earnings per share (EPS). Through share buyback the number of shares outstanding reduces and hence the denominator of EPS is reduced resulting in increase in EPS. Since EPS is an important measure to evaluate managements performance this strategy is often adopted by companies.

REAL LIFE EXAMPLE ON EVALUATION OF DIVIDEND OF A COMPANY

Let us evaluate the dividend of Apple Inc. using different methods discussed above and compare it with the dividends of its competitors.

EXAMPLE 1: Dividend per share history of Apple Inc. from the year 1987 to 2023.

| Year | Dividend (stock split adjusted) | Change |

| 2023 | 0.95 | 4.40% |

| 2022 | 0.91 | 5.20% |

| 2021 | 0.86 | 7.12% |

| 2020 | 0.81 | 6.25% |

| 2019 | 0.76 | 7.80% |

| 2018 | 0.7 | 14.63% |

| 2017 | 0.62 | 10.31% |

| 2016 | 0.56 | 9.85% |

| 2015 | 0.51 | 9.98% |

| 2014 | 0.46 | 9.49% |

| 2013 | 0.42 | 122.64% |

| 2012 | 0.19 | 4318.44% |

| 1995 | 0.004284 | N/A |

| 1994 | 0.004284 | N/A |

| 1993 | 0.004284 | N/A |

| 1992 | 0.004284 | N/A |

| 1991 | 0.004284 | 6.65% |

| 1990 | 0.004017 | 9.72% |

| 1989 | 0.003661 | 20.63% |

| 1988 | 0.003035 | 69.93% |

| 1987 | 0.001786 | N/A |

Source: https://companiesmarketcap.com/apple/dividends/

From the above table we can see that Apple Inc. had not paid any dividend from the year 1996 to 2011. What could be the reason of the company not paying any dividends during this period? Also we can notice that it started paying dividends from the year 2012 and since then the DPS has being growing ever since.

Apple Inc. started losing money and was also facing bankruptcy form 1996. It was hence retaining all the earnings for internal financial growth of the company. Only at the end of the year 2011 when the company had accumulated enough cash balance of over $25 billion it decided to pay dividends to its shareholders. Apple Inc. has seen a steady rise in revenue and earnings since 2012 hence allowing the company to declare and pay dividends of $0.09464 from 3rd Quarter onwards.

EXAMPLE 2: Let us see the Dividend per share for Apple Inc. and its competitors for the last 15 years from 2009 to 2023.

| Year | Apple Inc. | Microsoft | Amazon | Netflix | HP | |

| 2023 | 0.95 | 2.79 | NA | NA | NA | 1.06 |

| 2022 | 0.91 | 2.54 | NA | NA | NA | 1.01 |

| 2021 | 0.86 | 2.3 | NA | NA | NA | 0.83 |

| 2020 | 0.81 | 2.09 | NA | NA | NA | 0.72 |

| 2019 | 0.76 | 1.89 | NA | NA | NA | 0.66 |

| 2018 | 0.70 | 1.72 | NA | NA | NA | 0.58 |

| 2017 | 0.62 | 1.59 | NA | NA | NA | 0.54 |

| 2016 | 0.56 | 1.47 | NA | NA | NA | 0.5 |

| 2015 | 0.51 | 1.29 | NA | NA | NA | 0.36 |

| 2014 | 0.46 | 1.15 | NA | NA | NA | 0.28 |

| 2013 | 0.42 | 0.97 | NA | NA | NA | 0.26 |

| 2012 | 0.19 | 0.83 | NA | NA | NA | 0.23 |

| 2011 | – | 0.68 | NA | NA | NA | 0.2 |

| 2010 | – | 0.55 | NA | NA | NA | 0.15 |

| 2009 | – | 0.52 | NA | NA | NA | 0.15 |

Source: https://companiesmarketcap.com/

From the above table we can see that the Dividend per share for Apple Inc., Microsoft, and HP has been increasing year on year, whereas companies like Google, Amazon and Netflix do not pay dividends to its shareholders. Thus while making investment related decision, an investor should study the dividend payment history of the company and its competitors. If the investors goal is to earn regular dividend income, then it should invest in either Apple Inc., Microsoft or HP and if the investor focuses on earning long term capital gains by holding the high growth stock and selling it in future then it should evaluate other options as well and determine the best investment alternative by studying other metrics like Dividend yield and Dividend payout ratio.

EXAMPLE 3: Let us compare the Dividend yield of Apple Inc. with its competitors for last 15 years.

Calculation of Dividend Yield for Apple Inc. for the year 2023

Apple Inc. current share price as on 22nd December 2023 is $194.68

Total Dividend paid by Apple Inc. in 2023 is $0.95

Hence, Dividend Yield = Annual Dividend per share/Current share price*100

= 0.95/194.68*100

= 0.49% (as of 22nd December 2023)

Dividend Yield at the end of each year (TTM) for Apple Inc. and its competitors is shown below.

| Date | Apple Inc. | Microsoft | Amazon | Netflix | HP | |

| 18-12-2023 | 0.48% | 0.75% | 0% | 0% | 0% | 3.52% |

| 30-12-2022 | 0.70% | 1.06% | 0% | 0% | 0% | 3.77% |

| 31-12-2021 | 0.49% | 0.68% | 0% | 0% | 0% | 2.21% |

| 31-12-2020 | 0.61% | 0.94% | 0% | 0% | 0% | 2.94% |

| 31-12-2019 | 1.04% | 1.20% | 0% | 0% | 0% | 3.19% |

| 31-12-2018 | 1.79% | 1.69% | 0% | 0% | 0% | 2.82% |

| 29-12-2017 | 1.45% | 1.86% | 0% | 0% | 0% | 2.56% |

| 30-12-2016 | 1.93% | 2.37% | 0% | 0% | 0% | 3.40% |

| 31-12-2015 | 1.93% | 2.33% | 0% | 0% | 0% | 3.01% |

| 31-12-2014 | 1.67% | 2.48% | 0% | 0% | 0% | 1.56% |

| 31-12-2013 | 2.10% | 2.59% | 0% | 0% | 0% | 2.03% |

| 31-12-2012 | 1.00% | 3.11% | 0% | 0% | 0% | 3.62% |

| 30-12-2011 | 0.00% | 2.62% | 0% | 0% | 0% | 1.71% |

| 31-12-2010 | 0.00% | 1.97% | 0% | 0% | 0% | 0.76% |

| 31-12-2009 | 0.00% | 1.71% | 0% | 0% | 0% | 0.62% |

Source: https://companiesmarketcap.com/

From the above table we can see that Amazon, Google and Netflix have 0% as Dividend yield since these companies do not pay dividends to its shareholders. If an Investor is looking out to invest in stock that gives highest Dividend yield in the year 2023, then it should go for HP as it has the highest dividend yield.

EXAMPLE 4: Dividend Payout ratio of Apple Inc. for 5 years is shown below.

| Year | EPS | Dividend | Ratio |

| 2023 | 6.13 | 0.95 | 15.50 |

| 2022 | 6.11 | 0.91 | 14.89 |

| 2021 | 5.61 | 0.86 | 15.33 |

| 2020 | 3.28 | 0.8 | 24.39 |

| 2019 | 2.97 | 0.76 | 25.59 |

Source: https://csimarket.com/stocks/single_dividendpry.php?code=AAPL

From the above table we can see that Apple Inc. has maintained a Dividend payout ratio between 14%-25% for the last 5 years. This means that the company is re-investing the remaining 75%-86% earnings in the company for its future growth of operational activities and investing in new opportunities.

Read more on our LinkedIn page as well:

5 thoughts on “Dividends – Does it affect company value?”

[…] liability and if any further surplus is left shall be available for distribution to shareholders as dividends or retention in the company for future growth of operations. A negative EBITA on the other hand […]

[…] since the stock price rises. Low PE ratio is often found in mature industries that pay out dividends at a steady rate to its […]

Somebody essentially lend a hand to make significantly posts I might state That is the very first time I frequented your web page and up to now I surprised with the research you made to create this particular put up amazing Excellent job

Attractive section of content I just stumbled upon your blog and in accession capital to assert that I get actually enjoyed account your blog posts Anyway I will be subscribing to your augment and even I achievement you access consistently fast

Hi Neat post There is a problem along with your website in internet explorer would test this IE still is the market chief and a good section of other folks will pass over your magnificent writing due to this problem

Comments are closed.