Introduction

Leverage ratios are a set of financial relationships which indicate a business’s debt level against its assets and operations. Analysts have numerous leverage ratios to understand the degree of debt obligations of the company. The most commonly used leverage ratio are the Debt-to-Equity ratio, Debt-to-Capital ratio, Debt-to-EBITDA ratio, Debt to Asset ratio, etc.

Analysts use the debt-to-asset ratio to assess the level of debt used to own assets in the business.

In this article, we will understand what is the debt-to-asset ratio, and its nuances. We will also understand the calculation of the debt-to-asset ratio along with its analysis.

What is Debt to Asset Ratio?

The debt-to-asset ratio is calculated when the total debt is divided by the total assets of a company. The debt-to-asset ratio measures the degree of debt in the business, financing the assets.

| Debt to Asset | = Total Debt/ Total Assets |

Debt is the amount of money owed by a business to other parties. Debt is categorised as financing debt and operating debt. Financing debt is the amount raised by a company for expansion and acquiring assets. Operating debt refers to the funds raised by a business to sustain its ordinary business operations. Therefore, for the debt-to-asset ratio calculation, we take the value of the financing debt of the company.

When calculating the debt-to-asset ratio, total debt includes current and long-term debt. Long-term debt is the outstanding debt with a maturity of more than 12 months or more. It includes bonds, debentures, mortgages, bank loans, etc. Short-term debt is the debt obligations a company has to meet in under 12 months. It includes short-term borrowings, short-term loans, etc. It is important to note that current and non-current liabilities are excluded when calculating total debt.

Assets are any resources owned by a business with economic value. Assets are distinguished as current, non-current, tangible & non-tangible assets. When calculating total assets for the debt-to-asset ratio, we include every asset owned by the business.

The debt-to-asset ratio measures the firm’s degree of leverage. But it does not tell the structure of assets, which assets are debt-financed, and which ones are brought from equity investment.

The debt-to-asset ratio fluctuates from company to company based on the nature of the industry, the stage of the business in the company’s lifecycle or because of management preferences.

Analysis of Debt to Asset Ratio

The debt-to-asset ratio can be calculated in times or percentages by multiplying 100. If the debt-to-asset ratio is higher, that means assets are majorly financed by debt than equity capital.

If the debt-to-asset ratio is 0.5 or 50%, it shows that 50% of the assets are acquired by raising debt and the rest by equity.

If the debt-to-asset ratio is 1, it shows that 100% of the company’s assets are acquired by debt capital. When the debt-to-asset ratio is 1, the business is deemed insolvent because it has more liabilities than assets.

A business also uses the debt-to-asset ratio to understand its capital structure by performing a trend analysis or comparing it with the peer companies or the industry benchmark.

Real Life Example of Debt to Asset ratio

Singapore Airlines operates aircraft for both passenger and freight travel. Singapore Airlines, SilkAir, Budget Aviation, SIAEC, and Others are the segments in which it operates. Let’s calculate the debt-to-asset ratio for Singapore Airlines for the year ending 2023.

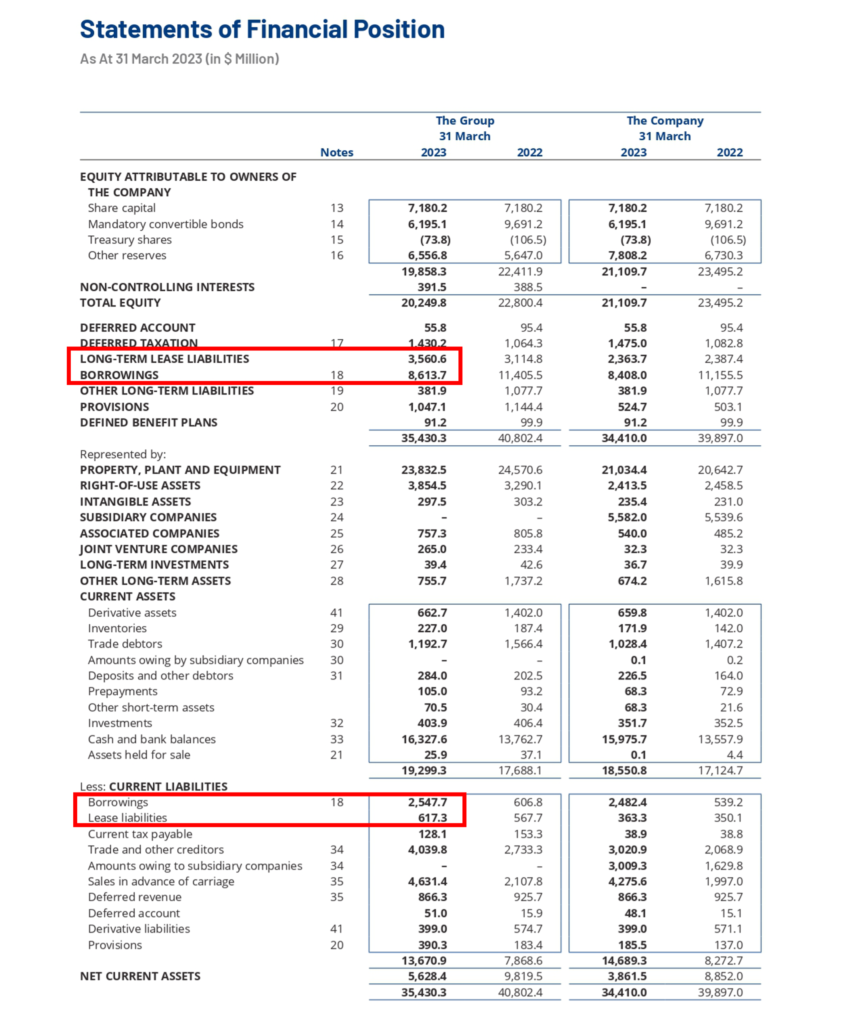

Consolidated Statement of Position for Singapore Airlines:

Source: https://www.singaporeair.com/saar5/pdf/Investor-Relations/Annual-Report/annualreport2223.pdf

The values used for the calculation of Total Debt are highlighted, it included long-term lease liabilities, long-term borrowings, current borrowing and short-term lease liabilities.

Calculation of Total Debt for the year ending 2023:

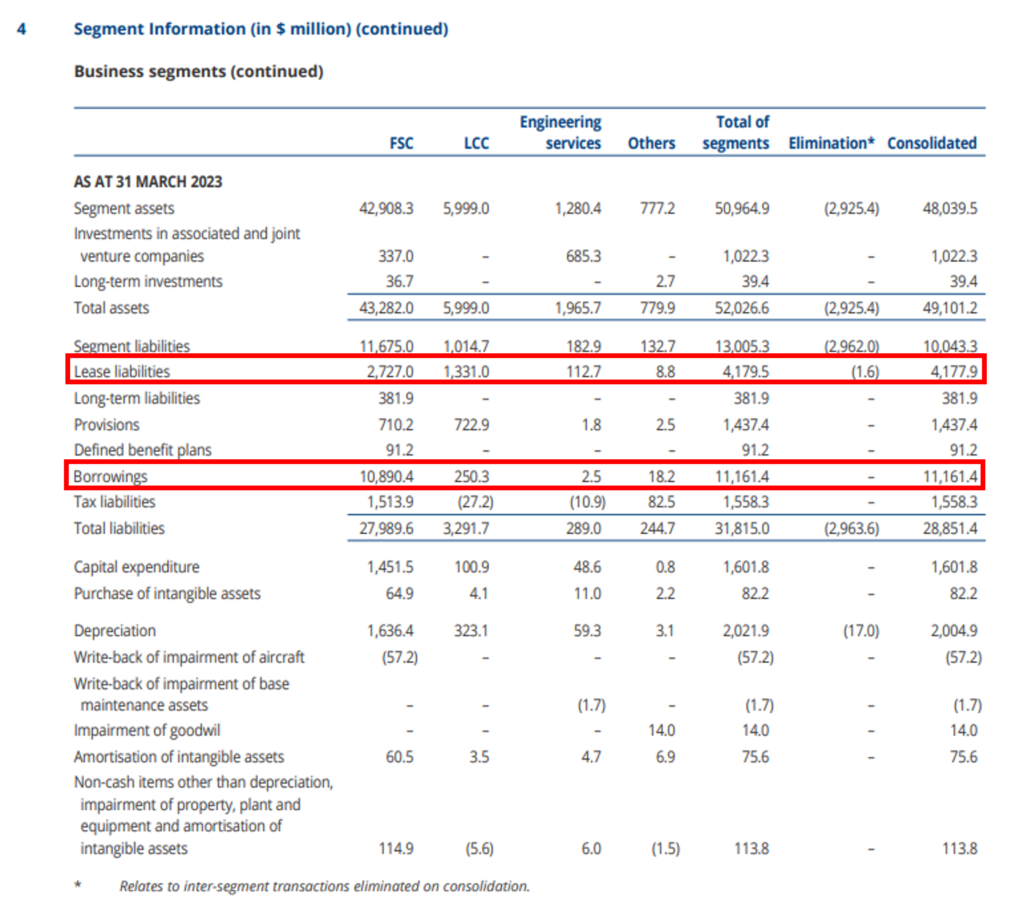

We can also find the consolidated values of lease liabilities and borrowings in the annual report of Singapore Airlines on Notes to Accounts page: 143.

| Total Debt | = Lease Liabilities + Borrowings |

| = 4,177.9 + 11,161.4 | |

| Total Debt | = 15,339.3 |

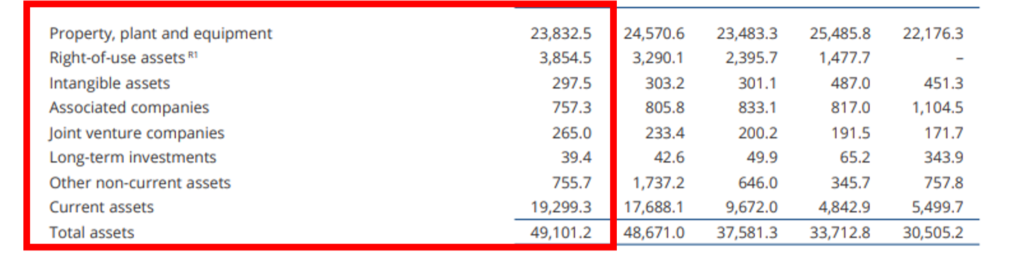

Calculation of Total Assets for the year ending 2023:

The company has shown the total asset calculation for 2023 in its five-year financial summary given on page: 212 of the annual report of Singapore Airlines.

| Total Debt | = 15,339.3 |

| Total Assets | = 49,101.2 |

Calculation of Debt-to-Asset Ratio for Singapore Airlines

| Debt to Asset | = Total Debt/ Total Asset |

| = 15,339.3/ 49,101.2 | |

| Debt to Asset | = 0.31 |

The value calculated for the debt-to-asset ratio of Singapore Airlines for the year ending 31st March 2023 is 0.31 or 31%.

Calculation of the debt to asset ratio for Delta Airlines for the year ending 2023.

Delta Airlines is a US-based company working in passenger and cargo transportation. It provides services in the following areas: holiday packages, training and consultation, aviation solutions, professional security, aircraft management, passenger and freight transport, maintenance, repair, and overhaul (MRO).

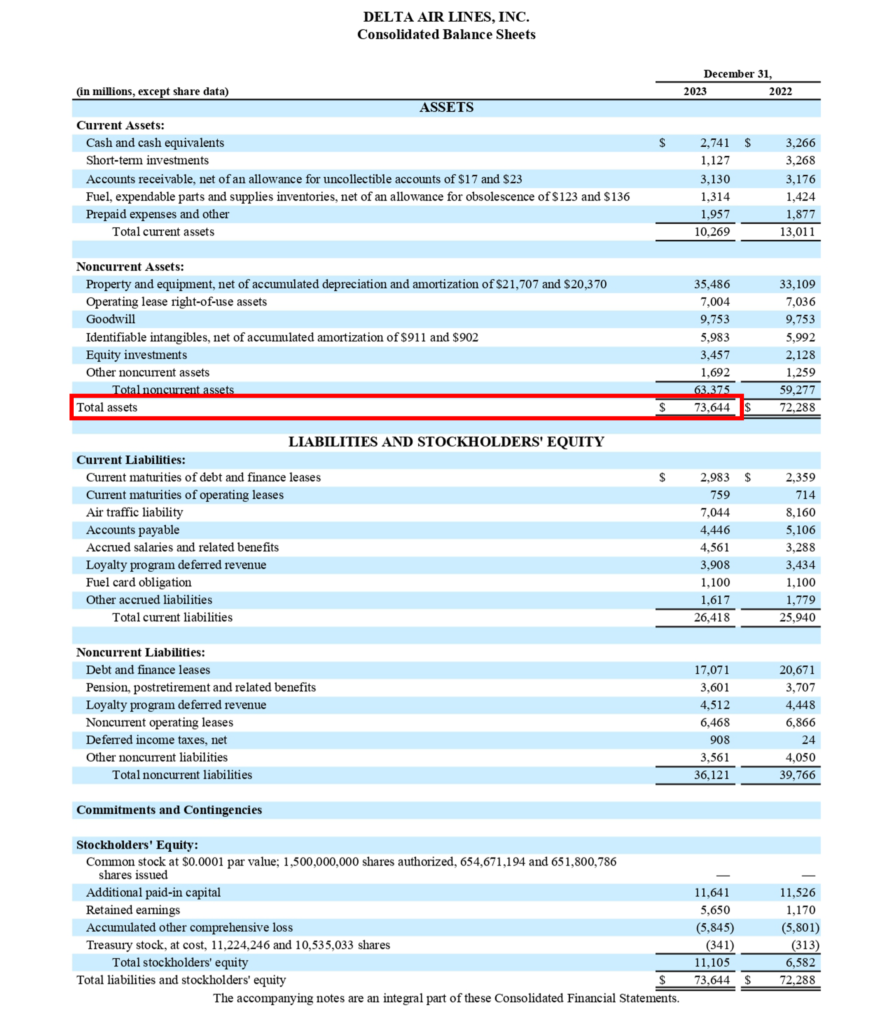

Consolidated Statement of Financial Position of Delta Airlines for the year ending 2023

Source: https://ir.delta.com/financials/sec-filings/sec-filings-details/default.aspx?FilingId=17258941

The value of Total Assets taken for the calculation of the debt-to-asset ratio is highlighted.

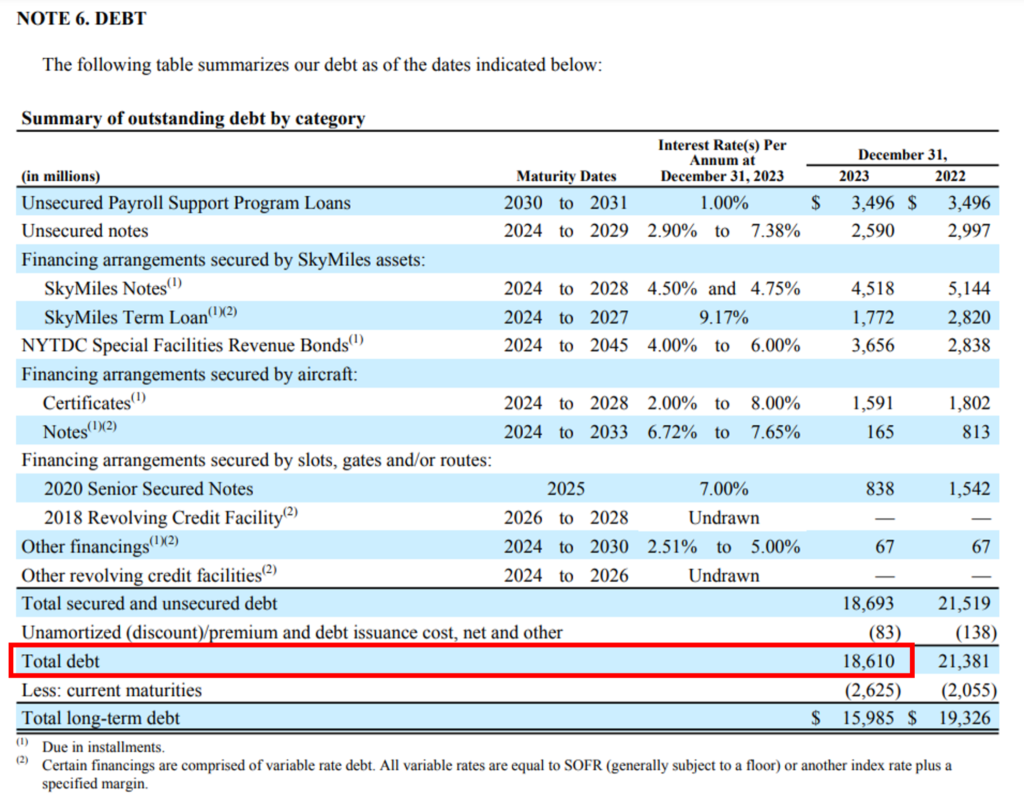

The company has shown the calculation of Total debt in the Notes to Accounts of the annual report on page: 75.

| Total Debt | = 18,610 |

| Total Assets | = 73,644 |

| Debt to Asset | = Total Debt/ Total Asset |

| = 18,610/ 73,644 | |

| Debt to Asset | = 0.25 |

The debt-to-asset ratio of Delta Airlines for the year ending 31st December 2023 is 0.25 or 25%.

When we compare the debt-to-asset ratio of Singapore Airlines and Delta Airlines we conclude that Singapore Airlines has a higher debt-to-asset ratio of 0.31 or 31% than Delta Airlines with 0.25 or 25%.

Use of Debt to Asset Ratio

Investors use the debt-to-asset ratio to pinpoint if the company has apt funds to meet its debt obligations. They also assess whether the company is effectively utilising their funds.

Creditors use the debt-to-asset ratio to see how much debt the company already has, the repayment strategies, and whether it is feasible for the company to take up more loans (short and long-term).

Conclusion

The debt-to-asset ratio is an essential metric used to assess a company’s risk profile and financial leverage. Calculated by dividing total debt by total assets, this financial ratio indicates the extent to which a company’s assets are financed by debt. A higher ratio suggests greater reliance on debt financing, while a lower ratio indicates a healthier balance between debt and equity. However, it’s essential to recognise that the debt-to-asset ratio alone doesn’t provide insight into the composition of assets or the sustainability of debt levels. Trend analysis and comparisons with industry benchmarks are valuable for contextualising the ratio’s significance. Moreover, investors and creditors utilize this ratio to assess a company’s ability to meet its debt obligations and manage its financial resources effectively. By understanding and monitoring the debt-to-asset ratio, stakeholders can make informed decisions regarding investment, lending, and overall risk assessment strategies.